Today, the Bank of England governor Andrew Bailey has a golden opportunity to rebuild his tarnished reputation.

He and his group of timid economists who set interest rates at the Bank can help put an end to the doom-laden narrative that bedevils Britain’s economy today.

But only if they are bold — bold enough to start cutting borrowing costs and put real muscle behind the incipient recovery that is evidently in the air.

If, on the other hand, the Bank leaves interest rates where they are — too high for too long, in a mistaken belief that inflation is still the biggest threat to Britain plc — then there is a real danger that it will condemn our nation to an unnecessary recession, which will cause consumers to become cautious, damage thriving businesses and crush everyone’s living standards.

All that’s needed is a small, quarter of a percentage-point reduction of the official bank rate to 5 per cent. This would put the burners under an already reviving housing market, it would make credit more accessible and signal to consumers and businesses that better times lie ahead.

Bank of England governor Andrew Bailey needs to be bold and cut borrowing costs

The tiniest adjustments in the right direction can boost confidence and lead to surprisingly substantial outcomes.

Increasingly, the talk among economists and business leaders is of the need for such a move. They point out that far from being the basket case so much of the broadcast media and so many commentators would have you believe, the UK is not in bad shape at all.

Even the hand-wringing International Monetary Fund — which ill-advisedly told the Chancellor Jeremy Hunt this week that it would be a mistake to cut taxes — predicts that over the next two years Britain’s growth will be stronger than that of most of the richest Group of Seven nations.

Already the signs of improvement are here. House prices in January climbed against all expectations, according to Nationwide, and mortgage approvals are at their highest level in six months. Consumer confidence is at its strongest in two years and optimism about the prospects for the coming 12 months is building.

Output from British car factories, boosted by the production of electric vehicles and unprecedented levels of investment, has climbed to its top rate since before the pandemic, while commercial vehicle output is at its highest level since 2010. Meanwhile, contrary to many predictions both pre- and post-Brexit, the City of London is booming.

The Nissan car plant in Sunderland. British car factory output is its best since before Covid

There is no doubt that Britain’s light-on-its-feet, services-driven economy is, against all odds, showing remarkable signs of life.

Which means, if we play it right, there is every possibility of breaking out of the stagnation that has held us back, every chance of unleashing true business enterprise.

I can’t stress enough how important it is for the Bank of England to read the signs and take the opportunity to lower interest rates today. If the Government then lifted the unconscionable burden of taxation which is hurting every citizen, small business and corporation in the land, we would be in business.

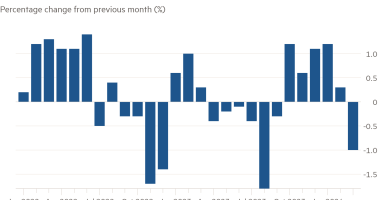

The point is, this is all possible because the rapacious monster of inflation has been slain for the foreseeable future. Anyone listening to BBC news bulletins earlier this month, when the December consumer prices figures were issued, might have believed the pernicious levels of inflation we saw last year and in 2022 were back.

They would have heard presenters seemingly revelling in the fact that the headline rate rose from 3.9 per cent to 4 per cent, and suggesting that the worst cost of living crisis in decades was set to stay.

The reality is quite the opposite. December was a blip caused by an increase in tobacco duty, and prices are coming down like a stone, despite the seismic events in Ukraine and the Middle East.

Barring some kind of terrible further conflagration, the Government’s inflation target of 2 per cent could be achieved as soon as the summer.

Only on Tuesday, figures released by the British Retail Consortium — which collects price information from food, clothing and other shops — showed that shop price inflation came down with a bump in January, from 4.3 per cent to 2.9 per cent. Indeed, inflation on non-food products is running at its lowest level since February 2022.

Shop price inflation came down with a bump in January, from 4.3 per cent to 2.9 per cent

At the same time, new Office for National Statistics figures show that average wage growth — a measure closely followed by the Bank of England — fell from 7.2 per cent in October to 6.6 per cent in November, which was lower than predictions.

Even the most gloomy economists now admit that concerns about a wage-price spiral of the kind seen in the 1970s and early 1980s — where higher wages fuel inflation which, in turn, leads to still higher pay demands — have faded into the background.

Unions such as those representing the railwaymen and the junior doctors now appear to be skating on very thin ice.

What is more, the downward pressure on prices will continue, because the energy price cap — introduced to relieve the pressure on households — is forecast to fall dramatically in the next couple of months.

Analysts at Investec and Deutsche Bank predict that, as a result, the Consumer Prices Index will drop below 2 per cent within four months, while ING Group expects it to plunge to 1.5 per cent in May.

Capital Economics, in the meantime, thinks inflation will hit 1.8 per cent in April and 0.9 per cent by September.

An article in MoneyWeek magazine this week actually warns of the risks of deflation later in the year, with one economist warning the inflation rate could be as low as 0.3 per cent by September.

The Bank of England should take note of the evidence that inflation has been nipped in the bud

So you would surely expect the economic sages at the Bank of England to take note of the mounting evidence that inflation has been stayed, and there is both the need, and the room, for a bank rate cut.

I do hope so. But my fear is that Andrew Bailey and his band are so inhibited by past mistakes — they were too slow to see inflation coming and foolishly pressed on with printing money and artificially low interest rates for too long — that he lacks the confidence to take the necessary steps.

Bailey and his colleagues were the subject of an excoriating report by a House of Lords committee that included former Bank governor Lord (Mervyn) King, which accused the Bank of losing focus on its main job of enforcing price stability. And in an attempt to appease its many critics over its poor forecasting, the Bank appointed the distinguished former chairman of the U.S. Federal Reserve bank to review its methodology.

Decision-making in the Bank’s grand building on Threadneedle Street, in the heart of the City of London, is based on often flawed internal projections and historic data.

One cannot but feel that if the interest-rate setters spent more time out and about in the real world of industry, services and construction, they might act differently.

Many of our biggest corporations, whose senior executives I speak to regularly as the Mail’s City Editor, are full of optimism. We have heard much of the hardship in the steel industry at Port Talbot, where jobs have been lost as blast furnaces are to be displaced by a modern electric arc production, but little of Barrow-in-Furness, where BAE Systems, the UK’s cutting-edge aerospace and defence company, is gearing up to build a new submarine fleet for Australia.

We are told, too, that the London Stock Exchange is losing ground to New York. Yet in terms of raising capital, making deals and overseas banking, the City outpaces New York and has regained its title as the world’s top financial centre ahead of the Big Apple and Singapore.

Now is the time to capitalise on Britain’s formidable economic potential and release us from the doldrums.

A dramatic first step would be for the Bank to lower interest rates today.

Read More: World News | Entertainment News | Celeb News

Mail Online