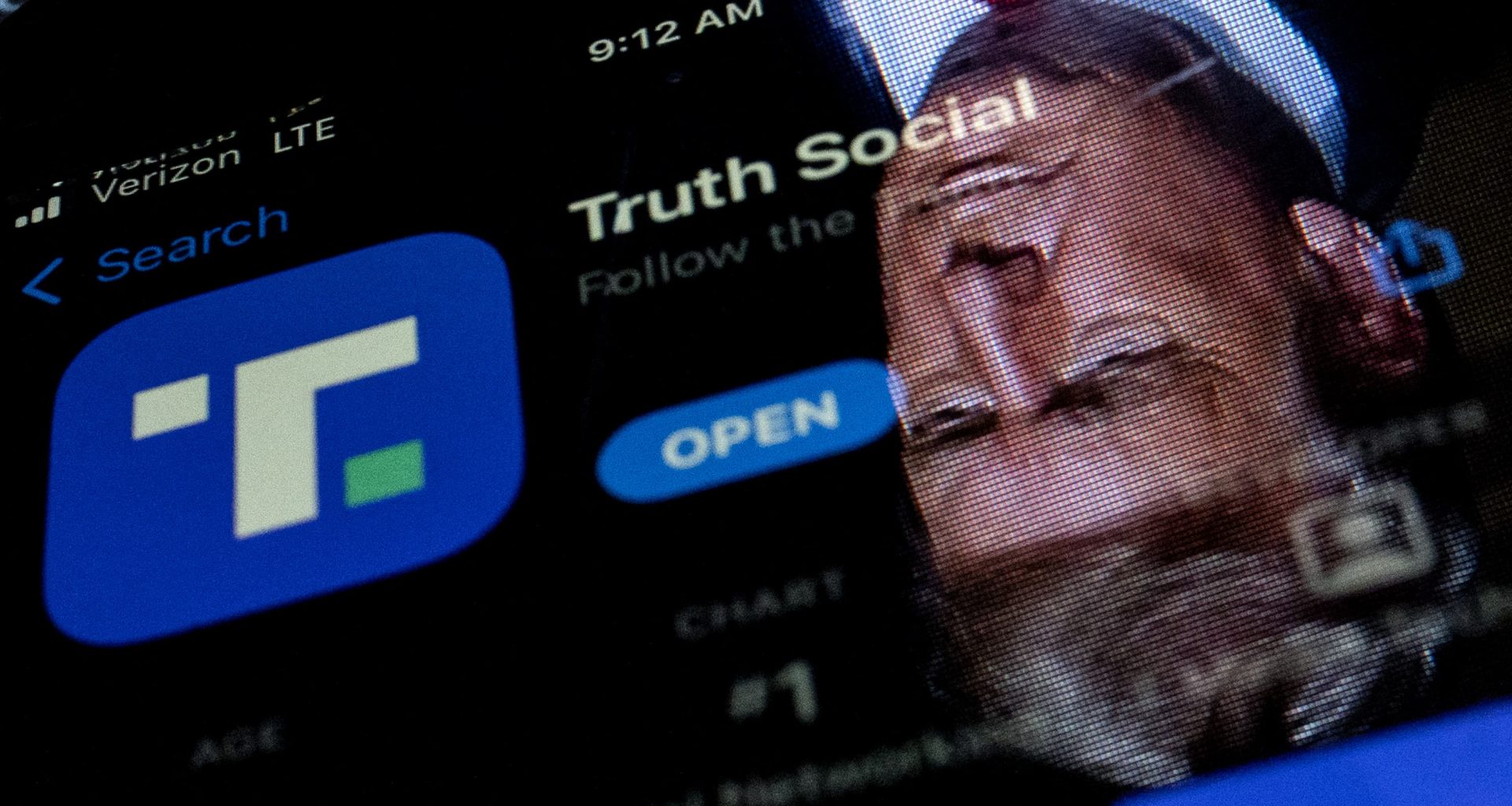

This photo illustration shows an image of former President Donald Trump reflected in a phone screen that is displaying the Truth Social app, in Washington, DC, on February 21, 2022.

Stefani Reynolds | AFP | Getty Images

A weekslong sell-off of Trump Media picked up speed Thursday afternoon, with shares of former President Donald Trump‘s company falling around 13% in another volatile trading session.

The company behind the conservative social media app Truth Social, which appears on the Nasdaq as DJT, was trading at around $27.50 per share at midday.

That price is more than 40% lower than it stood at the start of June, when Trump Media stock cost just over $49 a share.

The company’s declining price comes during a period of massive trading activity. More than 8.3 million shares of Trump Media had already changed hands as of noon ET on Thursday, a figure that is more than double its average volume and highly unusual for a company that generates very little revenue.

The stock’s slide also represents a massive on-paper loss for Trump, the majority owner of Trump Media.

Trump’s 114,750,000 shares in the company, worth more than $5.6 billion at the beginning of the month, would be worth around $3.2 billion based on Thursday’s stock moves.

Trump Media has been in a slump since May 30, when a New York jury convicted the former president and presumptive Republican presidential nominee on 34 felony counts of falsifying business records.

That downward trend accelerated Tuesday, dovetailing with a company deadline related to the Securities and Exchange Commission’s expected approval of its registration statement.

The stock fell nearly 10% in Tuesday’s session, on more than double the average trading volume. After the bell, Trump Media revealed that the SEC had declared its registration statement effective. The stock plunged more than 17% in post-market trading following the announcement.

The development authorized early investors in Trump Media to exercise warrants they hold in the company, and it allowed stockholders to publicly resell securities covered by the registration statement.

Markets were closed Wednesday.

This is developing news. Please check back for updates.

Read More: World News | Entertainment News | Celeb News

CNBC