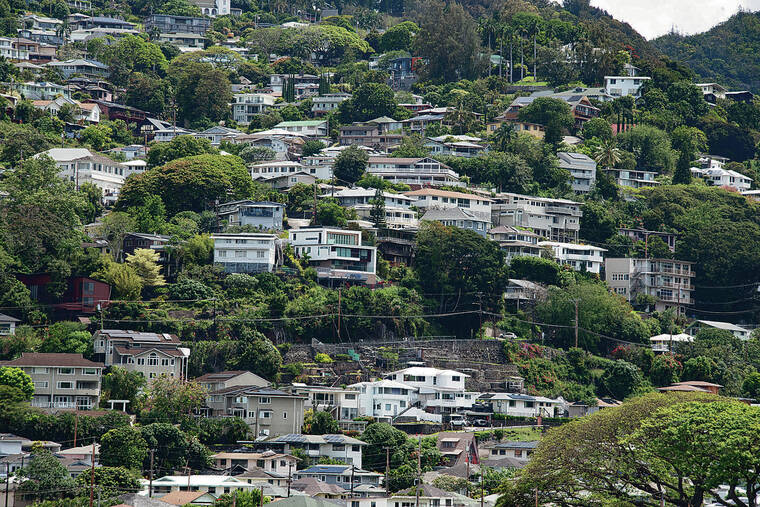

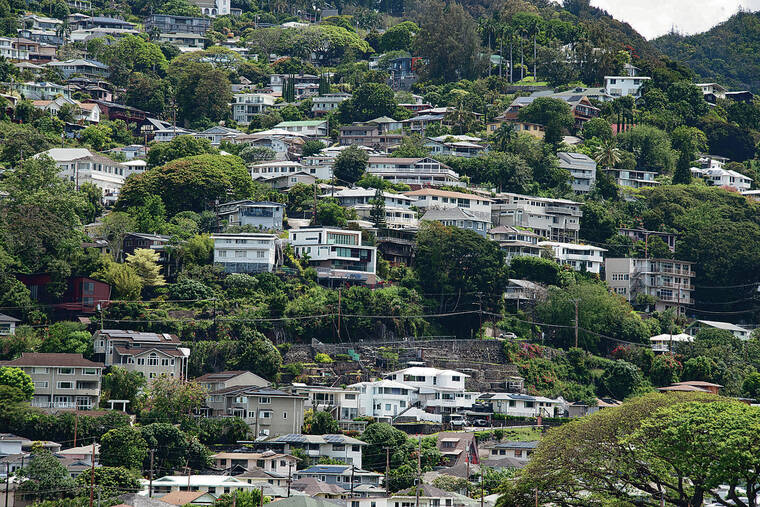

Hawaii’s housing market was pretty bleak in terms of supply and affordability for most residents in 2023, according to a new report.

The assessment from the University of Hawaii Economic Research Organization released Monday said that 1 in 5 Hawaii households, or 20%, had enough income to afford a median-priced single-family house in 2023, down from 30% in 2022 and 44% in 2021.

“Over the past three years, the share of households who can afford the median single-family home has continuously declined,” said the report, which defined affordable as spending less than 30% of household income on mortgage payments. “This downward trajectory is the result of both high home prices and the surge in interest rates during this period.”

UHERO’s report, dubbed the Hawai‘i Housing Factbook 2024, said other influences on dire market conditions include anemic home construction in recent years, out-of-state buyers, vacation rental use and the loss of roughly 3,000 Maui homes from the Aug. 8 wildfires.

The median sale price statewide for single-family homes in 2023 was $875,000, unchanged from 2022, according to the report.

Condominiums in Hawaii sold for a median $600,000 in 2023, up 3% from a year earlier.

To afford a median-priced single- family home, which is a price at which half the homes are more expensive and half are less expensive, a household would need to earn 183% of the median income.

“So really, only a small minority of people in the state have the income necessary to purchase the typical house in the state,” Justin Tyndall, UHERO assistant professor and lead author of the report, said during a news briefing.

This affordability issue in part contributed to the sale volume for Hawaii single-family homes in 2023 falling to a 25-year low, according to the report.

There were 5,600 single-family home sales and 7,300 condo sales statewide in 2023, down 37% and 36%, respectively, from 2022 and about 50% of the level in 2021.

UHERO also found that home rental rates rose in 2023 more than sale prices. The report said that based on Craigslist ads, the median asking rent in 2023 for housing in Hawaii was $2,000, which was 7% higher than actual median rent of $1,868 in 2022 reported in the U.S. Census Bureau’s American Community Survey.

Households are considered rent-burdened if they spend more than 30% of their income on rent, or severely rent-burdened if the cost is over 50%. UHERO said in the report that statewide 56% of households were burdened, including 28% severely.

The UHERO report said interest rates, which peaked at 7.6% in October, had a multifaceted impact on the housing market. They not only reduce the purchasing power of buyers, they also dissuade homeowners from selling if they have an existing low- interest mortgage and make it more challenging for developers to finance new construction.

Yet even in recent years when interest rates were low, relatively little new housing was developed around the state.

UHERO’s report said Hawaii’s housing stock grew by 25,000 units, or 1.8%, from 2018 to 2022. Almost all of this growth, or 23,000 homes, was on Oahu, while 2,600 units were added on Hawaii island, according to the report, which also said that for Maui County and Kauai there were net losses due to vacation rental conversions.

Maui’s loss was made much worse in 2023 with the destruction of about 3,000 homes in Lahaina in the disaster that killed 101 people.

There are major efforts to build temporary housing for fire survivors, including 450 modular units planned by the state, 169 planned by the Federal Emergency Management Agency, 88 developed by a Maui nonprofit and a state conversion of a former 175-unit hotel. Still, UHERO said in its report that this effort won’t come close to meeting demand.

Meanwhile, Maui housing rental rates have soared in part due to FEMA paying above-market rent for 1,300 existing homes on the island to house fire survivors, including about 500 that the UHERO report said remain empty.

The report said a typical three-bedroom home on Maui in 2023 commanded monthly rent of $3,800, while median monthly rent on a four-bedroom unit was $5,200, and that these rates have gone up more than 20% based on first-quarter data from Zillow.

“Even for a family that could afford these prices, there is almost no rental inventory available,” the report said. “Since the fires on Maui, the availability of rentals have plummeted and rents have surged higher.”

The report also noted that short-term vacation rental inventory on Maui is 2% higher now than a year ago despite many such units being destroyed by the Aug. 8 fire.

UHERO said vacation rental inventory fell by 380 units in or near Lahaina, most of which were lost to the fire, but that this drop has been more than offset by new listings in areas mostly from Kaanapali to Kapalua and Kihei to Wailea-Makena.

Maui County aims to ban short-term vacation rental use for 7,000 homes in West Maui under a recently enacted state law, but the county action is subject to regulatory proceedings and likely faces litigation that could affect whether or when the county succeeds with its goal.

Tyndall said converting 7,000 vacation units to residential use would be a huge benefit for Maui’s housing market, representing an 8% to 9% supply gain.

“If this did come to fruition, and we poured all these units back onto the market, this would be an enormous shock to supply, and I would be almost certain this would show up in lower prices and rents, at least in the neighborhoods that are affected by the new regulations,” he said.

Tyndall also said Maui should have more housing inventory after landowners rebuild what they lost in Lahaina, given that emergency housing units will remain.

Rebuilding could, however, take several years, and it’s hard to predict how other things that affect the market will unfold.

One such factor is demand from out-of-state buyers. UHERO’s report noted that more than half of all property owners in Lahaina appear to be nonresidents, based on property tax bill addresses.

Maui County had the highest share of nonresident property owners at 32%, followed by 29% on Kauai, 23% on Hawaii island and 13% on Oahu, the report said.

In terms of housing bought in 2023, nonresidents represented 21% of buyers for single-family homes and 27% for condos statewide, based on addresses for deed transfer documents, according to the report.

By county the highest share of nonresident home-buying in 2023 was Kauai at 37% for single-family homes and 60% for condos, followed by Hawaii island at 30% and 52%, respectively. For Maui County the respective figures were 25% and 53%, and on Oahu they were 10% and 17%.

Tyndall said there is a lot of interest to expand supply and improve Hawaii’s housing woes through policy, which includes a bill passed by the Legislature earlier this month to allow at least two dwelling units in addition to a main home on lots zoned primarily for single- family use. That bill awaits a decision by Gov. Josh Green, who supports the bill’s intent.

“I think there’s a huge amount of policy interest in correcting the problem, so I don’t think it’s hopeless,” Tyndall said. “We’re just in a bad place where we are right now. … Up to the point where we have data, which is really the end of 2023, I think the picture is very bleak.”

HAWAI‘I HOUSING FACTBOOK 2024 LOWLIGHTS

183%

Factor of median income needed to buy median-priced single-family home

56%

Households burdened by rent

21%

Single-family homes bought by nonresidents

20%

Local households earning enough to afford median-priced single-family home

1.8%

Housing supply growth 2018-2022

Source: University of Hawaii Economic Research Organization

READ THE REPORT ONLINE

Read More: World News | Entertainment News | Celeb News

Star Ads