Macy’s hasn’t yet shut the approximately 150 stores it plans to close. But retail competitors already smell opportunity.

In recent interviews with CNBC, Target CEO Brian Cornell and Kohl’s CEO Tom Kingsbury said the department store’s decision to shrink its footprint gives them a chance to increase their own sales.

Off-price chain T.J. Maxx could pick up more business, too, since it carries similar merchandise and has stores near Macy’s locations that might shut, according to Jefferies.

And many other retail names, including off-price chain Ross and department store rivals like Nordstrom could benefit from the closures, too. Those companies already count many of Macy’s shoppers as their customers, according to an analysis of credit card data by Earnest Analytics.

Facing lackluster sales and pressure to improve its business, Macy’s announced in late February that it would close more than a quarter of its an approximately 500 namesake stores. With the wave of closures, the department store will join a list of retailers that have shrunk in size and created a void for other brands to swoop in. Those include Bed Bath & Beyond, which closed all of its stores after filing for bankruptcy, or others like J.C. Penney, a department store that is a fraction of its former size.

Macy’s closures could put as much as $2 billion of market share up for grabs. The department store’s net sales were $23.1 billion in the most recent fiscal year, and it said the 150 stores that it’s closing account for less than 10% of sales.

Yet Macy’s, for its part, has said closing the underperforming stores will help it focus on driving higher sales at other locations. Macy’s CEO Tony Spring said the company will open more locations of its higher-end department store Bloomingdale’s and beauty chain Bluemercury, which have both outperformed the company’s namesake chain. The closures will also free up capital to invest in its better-performing namesake stores.

Macy’s has not yet said which locations will close and when exactly they will shutter, but said 50 stores will close by early 2025. The move will have implications for shopping malls, too, since Macy’s will close giant stores that are mall anchors.

An opportunity for off-price chains

Department stores have been losing market share for years as shoppers have chosen to shop at strip malls or online instead, said Corey Tarlowe, a retail analyst at equity research firm Jefferies. Beneficiaries have ranged widely from big-box stores like Target to specialty players like Abercrombie & Fitch, which has opened stores in major cities like New York.

In an interview with CNBC in March, Target CEO Cornell said the retailer has gotten a leg up from other closures before. For example, he said, some of its stores are in former Toys R Us locations.

Off-price retailers, in particular, have posed a major competitive threat to department stores — and been the big winners from their struggles, Tarlowe said. They sell a lot of discretionary merchandise like clothes, handbags and shoes, too, but often in more convenient locations and for a better price.

“It’s kind of like the new department store in effect, but it’s much smaller,” he said. “They sell similar brands and similar products, but for 40% to 70% of the cost.”

Signs are posted at the entrance to a Macy’s store that is set to close at Bay Fair Mall on February 27, 2024 in San Leandro, California. Macy’s announced plans to shutter 150 underperforming stores across the United States.

Justin Sullivan | Getty Images News | Getty Images

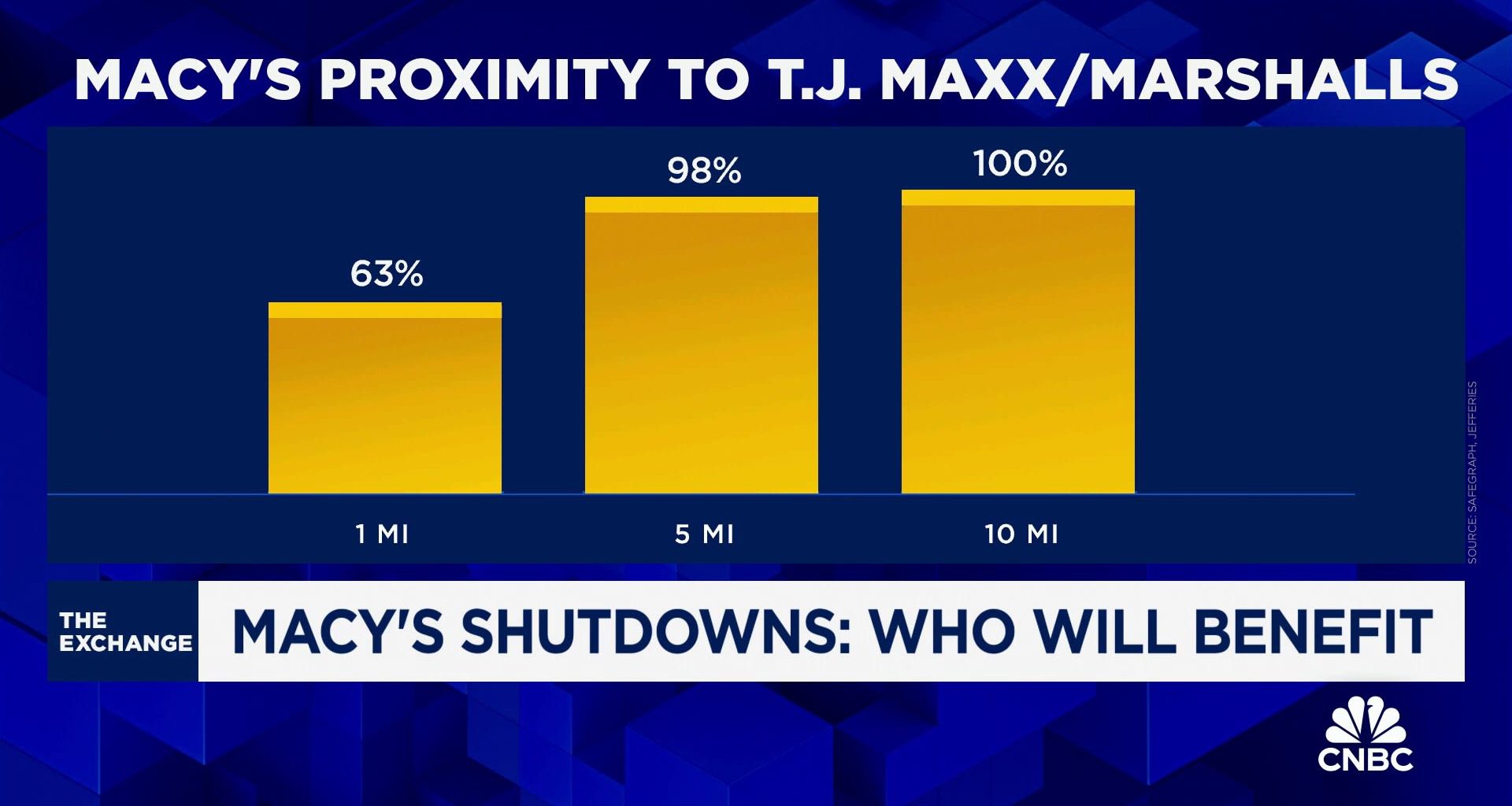

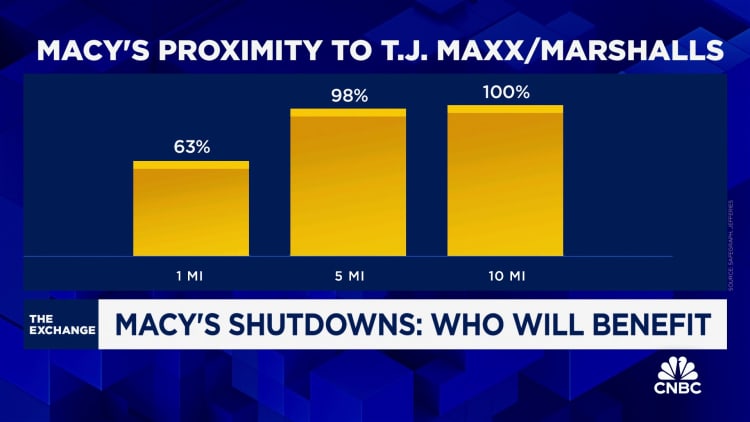

With Macy’s broad closures, TJX Cos.-owned T.J. Maxx, which includes its namesake stores, Marshalls and Home Goods, is especially well positioned. About 63% of Macy’s stores have a T.J. Maxx or Marshalls within a one-mile radius, according to an analysis by Jefferies.

Off-price stores also draw a similar customer, which tends to be more affluent. About 47% of Macy’s shoppers have an annual household income of more than $100,000, compared with about 50% of shoppers who go to TJX-owned stores, Jefferies found. Only about 30% of Burlington shoppers and about 34% of Ross customers have an annual household income of more than $100,000, which may mean they have less overlap with Macy’s shoppers.

“I used to see Toyota Camrys in parking lots at a T.J. Maxx and now I see BMWs, I see Mercedes, I’ll see Porsches,” Tarlowe said.

He added that TJX stores are easier for shoppers to get to, with roughly 2,500 locations in the U.S. That is a much larger footprint than Macy’s, which will have approximately 350 namesake stores after the closures.

Department store, big-box rivals see an opening

Other rivals also have a high overlap with Macy’s customer base, which could position them well.

About a third of Macy’s customers also shopped at Kohl’s during the prior 12 months, according to a late March credit card data analysis by Earnest Analytics. That was only surpassed by T.J. Maxx, which had 37% of Macy’s customers shop at its brands over the same period.

In a recent interview with CNBC, Kohl’s CEO Kingsbury described Macy’s closures as a chance for the company to grow. He also said Kohl’s is the largest department store in the country with 1,174 stores, but has quality locations.

“The beauty of Kohl’s is the fact that our stores are located in strip centers,” he said in an interview at Shoptalk, a retail conference in Las Vegas, in March. “It’s really a big deal. So we can bring the department store concept to the strip centers where you know a lot of the successful companies are located overall.”

Yet Kohl’s faces similar struggles as Macy’s, as it grapples with softer discretionary spending and challenges with attracting a younger customer. Like Macy’s, it also projected that comparable sales, which takes out the impact of stores openings and closures, may not grow or will only rise modestly in the year ahead.

Macy’s has also been trying to take a page from its competitors’ books. It’s opening up to 30 smaller stores in strip centers. And at many of its department store locations, it has added Backstage, an off-price shop inside of the bigger store.

But in the places where Macy’s is leaving a void, Target may also be poised to open stores or gain customers. The Minneapolis-based company said last month that it plans to build more than 300 new stores over the next decade. It already has more than 1,950 stores across the U.S.

Speaking to CNBC, Cornell did not say if the big-box retailer will open more stores near shuttered Macy’s. But, he added, it’s watching closely.

“We’re always looking at the local market, the opportunities and we think there’s still going to be displacement within retail for years to come,” he said. “And with our capability and financial position, we can be one of the players that continues to lean in and take share and growth.”

Read More: World News | Entertainment News | Celeb News

CNBC