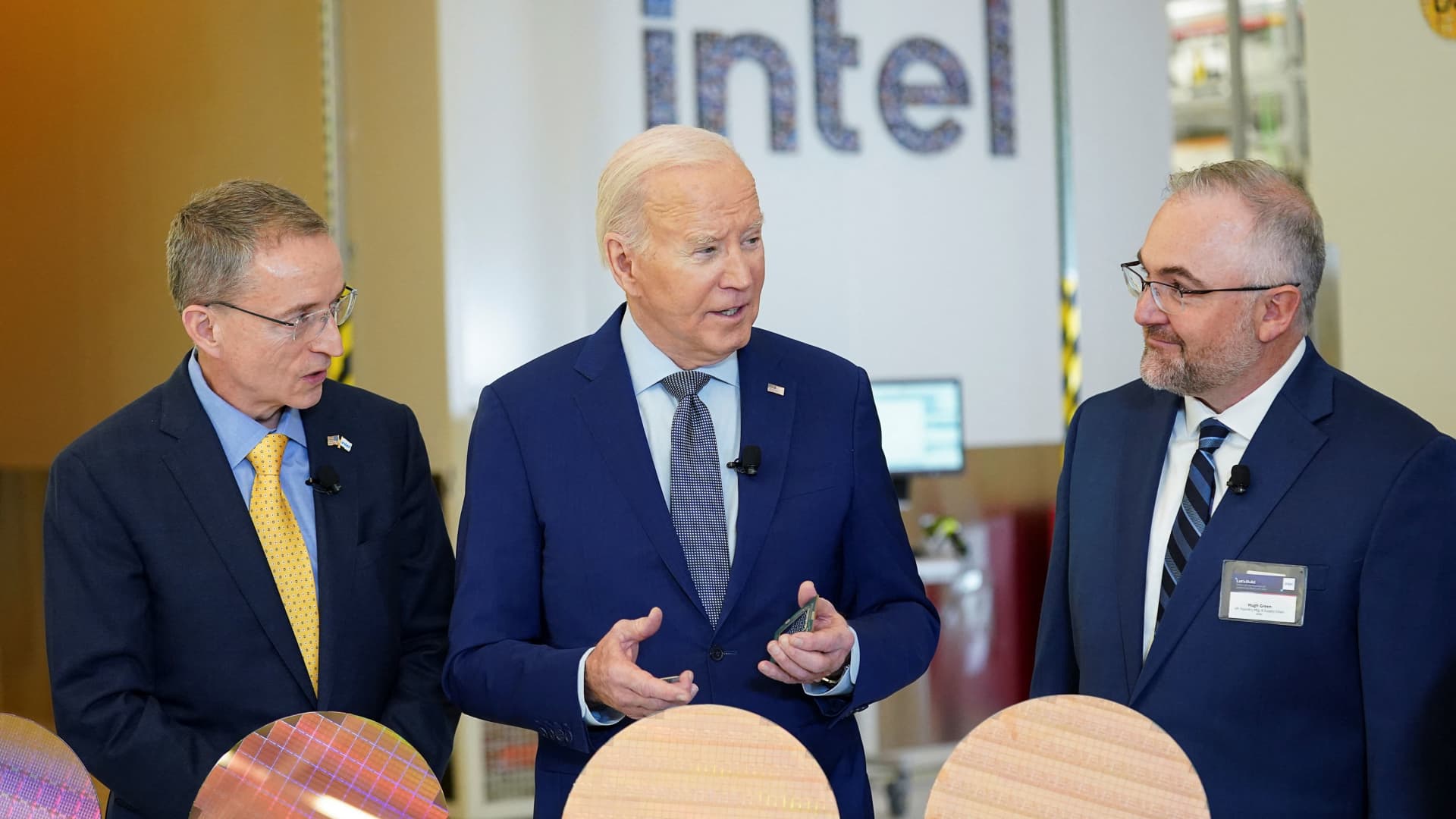

U.S. President Joe Biden tours the Intel Ocotillo Campus, in Chandler, Arizona, U.S., March 20, 2024.

Kevin Lamarque | Reuters

Intel shares fell 4% at one point in extended trading on Tuesday after the company revealed long-awaited financials for its semiconductor manufacturing business, commonly called the foundry business, in a SEC filing.

Intel said its foundry business recorded an operating loss of $7 billion in 2023 on sales of $18.9 billion. That’s a wider loss than the $5.2 billion Intel reported in its foundry business in 2022 on $25.7 billion in sales.

This is the first time that Intel has disclosed revenue totals for its foundry business alone. Historically, Intel has both designed its own chips as well as done its own manufacturing, and reported final chip sales to investors. Other American semiconductor companies such as Nvidia and AMD design their chips but send them off to Asian foundries — often Taiwan’s TSMC — for manufacturing.

Intel has been pitching investors under CEO Patrick Gelsinger on a plan where it would continue to make its own processors, but would also start an external foundry business to make chips for other companies. Intel’s role as one of the only U.S. companies doing cutting-edge semiconductor manufacturing on American soil was a big reason why it secured nearly $20 billion in CHIPS and Science Act funding last month.

Much of Intel’s foundry revenue currently comes from its own operations, the chipmaker said on Tuesday. Intel also restated its products divisions to report its costs as if it were a so-called “fabless” company that has to account for foundry as a cost.

Intel said the newly organized Products division, which mainly consists of processors for PCs and servers, reported $11.3 billion in operating income on $47.7 in sales in 2023.

Intel said on Tuesday that it expected its foundry’s losses to peak in 2024 and eventually break-even “midway” between this quarter and the end of 2030. The company previously said that Microsoft would use its foundry services, and that it has $15 billion of revenue for foundry already booked.

“Intel Foundry is going to drive considerable earnings growth for Intel over time. 2024 is the trough for foundry operating losses,” Gelsinger said on a call with investors on Tuesday.

Intel said in a promo video that much of the lack of profitability for its foundry business was due to the “weight of past decisions,” and separately, Gelsinger cited the company’s past “slow” adoption of a technology called EUV, which is used to make the most advanced chips.

Read More: World News | Entertainment News | Celeb News

CNBC