Logo of Aramco, officially the Saudi Arabian Oil Group, Saudi petroleum and natural gas company, seen on the second day of the 24th World Petroleum Congress at the Big 4 Building at Stampede Park, on September 18, 2023, in Calgary, Canada.

Artur Widak | Nurphoto | Getty Images

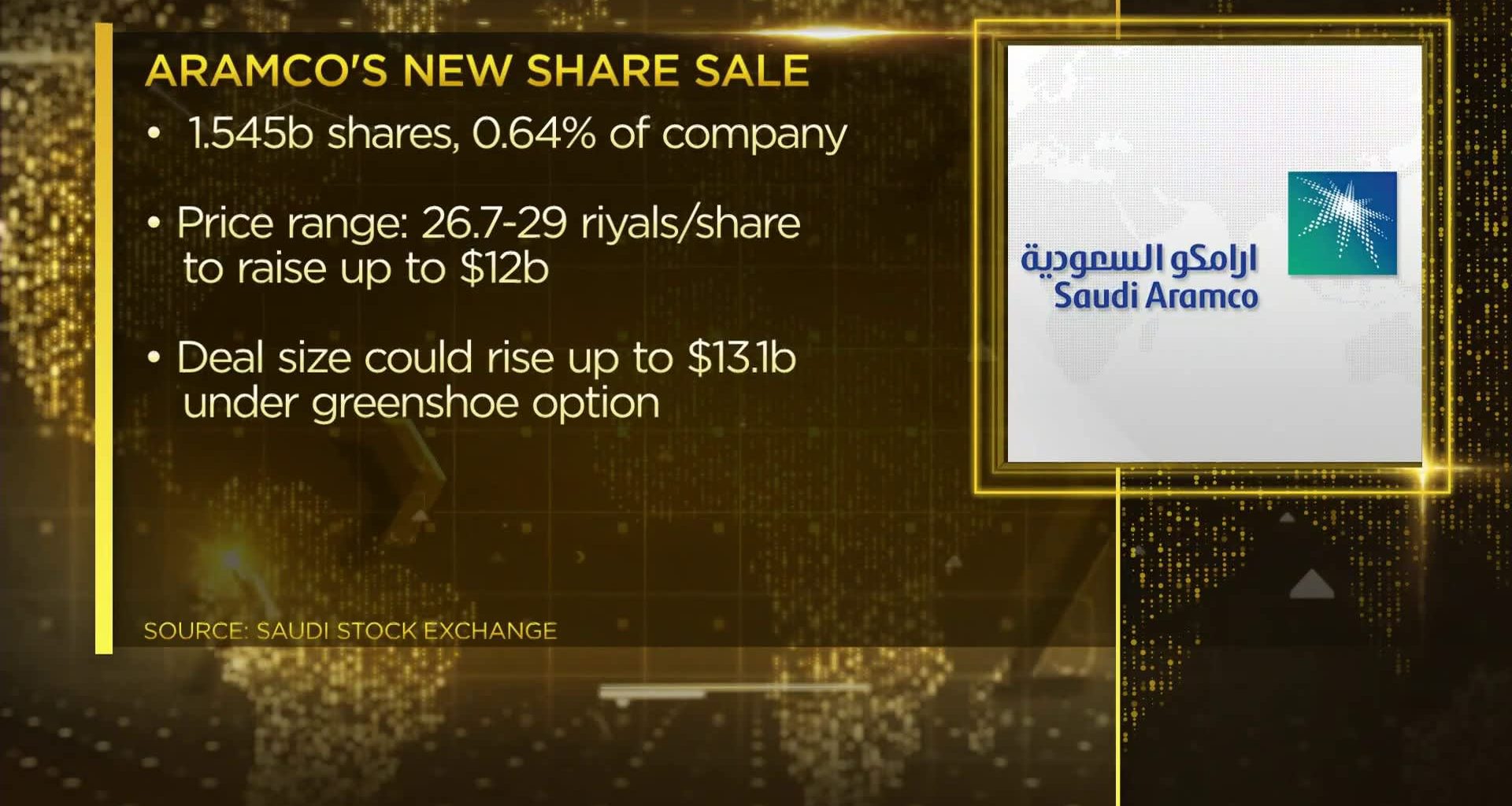

Saudi state oil giant Aramco commenced its secondary public offering on Sunday as the company looks to raise in the region of $12 billion.

Books opened early Sunday morning offering a price range between 26.70 ($7.12) and 29 Saudi riyals per share. Aramco on Thursday announced its plan to sell 1.545 billion shares — a stake of around 0.64%. At the midpoint of that range, the sale would total around $11.5 billion but could eventually reach up to $13.1 billion.

Four more banks were added to the share offering, Reuters reported on Sunday, including Credit Suisse Saudi Arabia and BNP Paribas.

The share sale is the company’s second, after Aramco first entered public markets in 2019 and offered 1.5% of the company to investors. That sale raised a record $29.4 billion, history’s largest IPO to date. Aramco is the world’s largest oil company in terms of both daily crude production and market cap.

The latest offering comes at an opportune time for the kingdom, which in early May chalked its sixth consecutive quarterly budget deficit amid high spending on multitrillion-dollar megaprojects and simultaneous lower oil revenues.

But economists note that even a financial windfall from another Aramco stock sale will barely scratch the surface of the costs of Saudi Arabia’s Vision 2030 diversification plans, which — including giga projects like entirely new cities and all of the infrastructure that entails — are projected to cost more than a trillion dollars.

— CNBC’s Ruxandra Iordache contributed to this report.

Read More: World News | Entertainment News | Celeb News

CNBC