Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Good morning. We have new data today signalling an end to the lengthy drought in global dealmaking, with blockbuster takeovers more than doubling in the first quarter of this year.

The number of deals worth at least $10bn jumped in the first three months of 2024 compared with the same period last year, driven by large US deals in the energy, tech and financial sectors, according to data from the London Stock Exchange Group.

Eleven such transactions, with a total value of $215bn, were struck during the quarter, up from five takeovers worth a combined $100bn in the first three months of 2023. The overall value of global mergers and acquisitions climbed 30 per cent to $690bn even as the total number of deals announced fell 31 per cent.

The rebound in dealmaking comes after M&A activity plunged to a decade-long low last year, as a frenzy of activity fuelled by low interest rates during the Covid-19 pandemic was followed by a sharp decline in takeovers. Here’s more on the regions driving a nascent recovery in the M&A market.

And here’s what else I’m keeping tabs on today:

-

Sam Bankman-Fried: Prosecutors are seeking up to 50 years of prison time for the FTX founder at his sentencing today, after he was convicted on multiple counts of fraud and money laundering.

-

Results: The pharmacy chain Walgreens Boots Alliance is expected to report that revenues increased about 3 per cent in the three months that ended February, but earnings are forecast to decline by 59 per cent to 32 cents a share, according to analysts polled by LSEG.

-

Economic data: Economists expect the final estimate for fourth quarter economic growth to remain unchanged at 3.2 per cent. Pending home sales in the US are expected to have increased 1.5 per cent in February from the previous month. The University of Michigan’s final consumer sentiment reading is expected to remain unchanged at 76.5.

Five more top stories

1. Zhao Leji, a senior official in President Xi Jinping’s administration, has called for Asia to ‘jointly’ manage its own security, in a veiled rebuke of US efforts to strengthen alliances in the region. Zhao’s comments align with China’s Global Security Initiative, a manifesto which analysts think ultimately aims to reduce America’s role in global defence. This comes as China seeks a more integrated regional market in response to European and US companies’ de-risking of supply chains and denying China access to chipmaking technologies.

-

More US-China relations: US Treasury secretary Janet Yellen has warned China not to flood the world with cheap clean energy exports, saying they would distort global markets and harm workers.

2. Stock traders have begun placing bets on an upsurge of volatility around November’s US election, which is shaping up to be a tense rematch between President Joe Biden and his predecessor Donald Trump. Futures contracts tied to the value of the Vix index — the so-called fear gauge that measures expectations of near-term swings in the S&P 500 — are pricing in a rise in market stress in the weeks before and after voters head to the polls. Here’s how this compares with previous election years.

3. Chatbots that claim to predict share prices and evade plagiarism detectors are among the most popular on OpenAI’s new app store, according to data from analytics group SimilarWeb. The Microsoft-backed start-up has allowed paying users to create custom versions of ChatGPT since November, with other subscribers then able to access these so-called “GPTs” through an online store. But a Financial Times analysis shows some of them could be in breach of OpenAI’s usage policies.

-

More AI: Amazon has committed a further $2.75bn to Anthropic in the tech giant’s largest venture investment, bringing its total commitment to the AI start-up to $4bn.

4. UBS has made Sergio Ermotti Europe’s best-paid bank head less than a year after he returned to the lender. Ermotti was paid a total of SFr14.4mn ($15.9mn) last year, with the UBS board crediting the Swiss executive for successfully steered the integration of rival Credit Suisse. This follows calls for increased scrutiny of the lender by the Swiss central bank in light of its increased “systemic importance”. The size of the combined group’s balance sheet is now roughly twice the size of Switzerland’s gross domestic product.

5. A top Federal Reserve official has said the US central bank should “push back” the timing of cutting interest rates after “disappointing” inflation data. Christopher Waller, a Fed governor and one of the most influential US rate-setters, said yesterday that the recent rise in month on month measures of prices reinforced his view that there was “no rush” to lower the central bank’s 5.25 per cent to 5.5 per cent target range. Here’s more from his remarks.

For more on rate-setters’ battle against inflation, sign up for our Central Banks newsletter by Chris Giles if you are a premium subscriber, or upgrade your subscription here.

The Big Read

Medicine shortages recently reached record highs across Europe and hit a 10-year peak in the US last year, forcing countries to scramble for alternatives and patients to skip treatments. Off-patent generic medicines make up the backbone of pharmaceutical care, but manufacturing issues, weak supply chains and low pricing have combined to create a “broken market” that makes these treatments unattractive to produce and vulnerable to supply shocks, quality defects or surges in demand, say industry leaders and analysts.

We’re also reading . . .

-

Climate change: Plans to put all clocks back a second may have to be delayed as water flowing into the oceans from the polar ice caps slows Earth’s rotation.

-

Narendra Modi: Investors bet an election win by Narendra Modi will extend India’s stock market boom, but after years of gains some analysts are growing cautious about the lofty valuations.

-

War in Ukraine: As Russia advances, Kyiv is building 2,000km of fortifications to hold territory in anticipation of another offensive.

-

Daniel Kahneman: The Nobel Prize-winning psychologist who wrote the bestselling book Thinking, Fast and Slow has died at 90.

Chart of the day

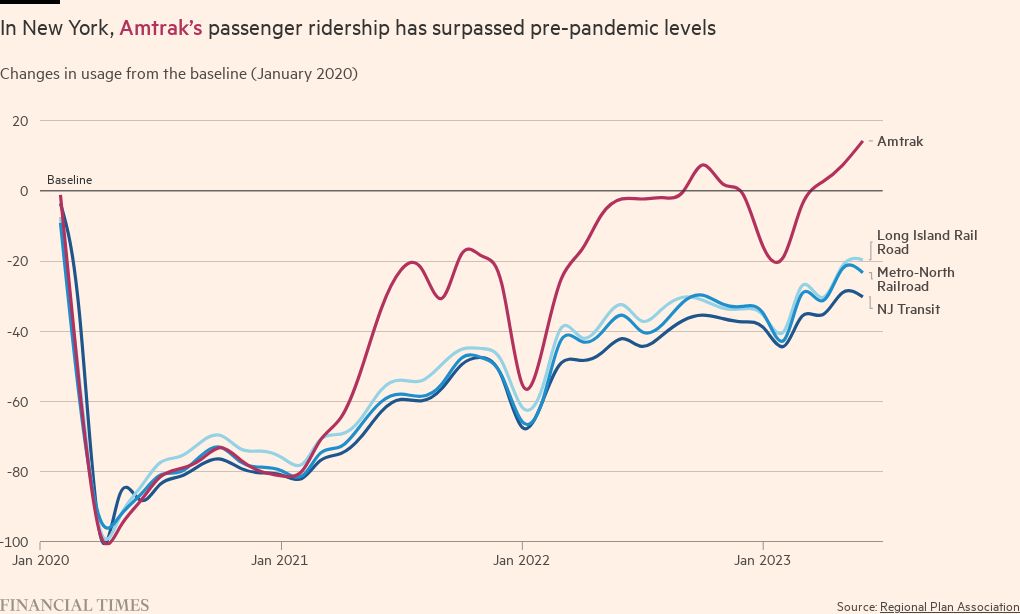

Despite predictions of its demise, commuting has made a comeback — but not as we know it. Hybrid models have altered the traditional rush hour dynamic and posed new challenges for urban planning and corporate culture. New York is seeing a blend of longer but less frequent commutes — the longer distance Amtrack rail usage has surpassed pre-pandemic levels, while other metro systems have not.

Take a break from the news

As spring dawns on us, Harriet Baker’s book Rural Hours examines how back-to-basics living in the countryside fuelled creativity for three literary greats.

Additional contributions from Tee Zhuo and Gordon Smith

Read More: World News | Entertainment News | Celeb News

FT