Meta founder and CEO Mark Zuckerberg speaks during the Meta Connect event at Meta headquarters in Menlo Park, California, on Sept. 27, 2023.

Josh Edelson | AFP | Getty Images

Mark Zuckerberg is so pleased with his “year of efficiency” that he’s extending it indefinitely.

On Thursday’s earnings call, after Meta reported fourth-quarter financials that sailed past analysts’ estimates, Zuckerberg said he wants to “keep things lean” and has no plans to accelerate hiring.

Headcount, which peaked well above 86,000 in 2022, shrank 22% last year to 67,317, as Meta instituted mass cost cuts to appease an investor base that had lost faith in the company’s ability to adjust to changing market conditions. At the time, Meta was facing a tough digital ad market and the lingering effects of Apple’s 2021 iOS update.

Exactly a year ago, Zuckerberg told analysts on an earnings call that management’s theme for 2023 would be the “year of efficiency,” and that Meta would become a “stronger and more nimble organization.”

Wall Street has rewarded him ever since. The stock almost tripled in value last year, making it the second-best performer in the S&P 500, behind only Nvidia. It reached a record last month, and the continuing rally has pushed Meta’s market cap well past $1 trillion.

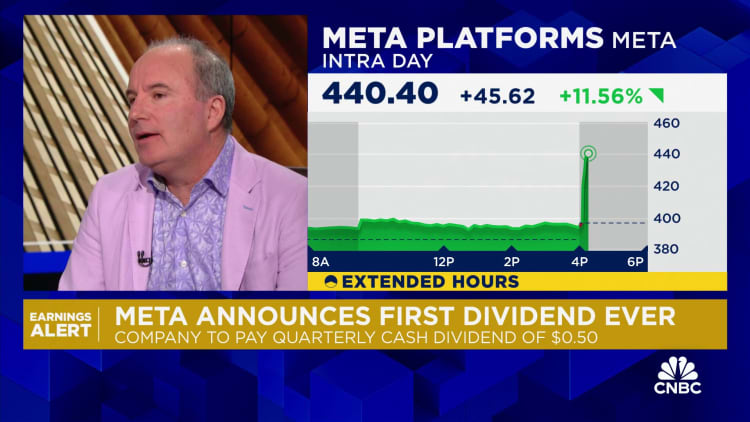

On Thursday, Meta reported fourth-quarter sales growth of 25%, the fastest rate of expansion since mid-2021, to $40.1 billion. Net income soared a whopping 201% to $14 billion, and the company’s operating margin more than doubled to 41%. The stock jumped 15% in extended trading.

Add it all up, and Meta is showing it can grow at a healthy clip while also dramatically cutting costs, which shrank 8% from a year earlier. So confident is the company in its financial health that it authorized a $50 billion share buyback and, for the first time, said it would pay a 50-cent quarterly dividend.

It’s not that Zuckerberg isn’t willing to spend money. He just doesn’t want to do it on people.

Zuckerberg said on the call that his playbook involves building a “world-class compute infrastructure,” which means spending billions of dollars on Nvidia’s artificial intelligence chips needed to train Meta’s AI models.

“We’re playing to win here and I expect us to continue investing aggressively in this area in order to build the most advanced clusters,” Zuckerberg said. “We’re also designing novel data centers and designing our own custom silicon specialized for our workloads.”

‘Even beyond 2024’

Total expenses for the year will be $94 billion to $99 billion, Meta said, up from $88.15 billion in 2023. Finance chief Susan Li said capital expenditures will be between $30 billion to $37 billion, “a $2 billion increase of the high end of our prior range.”

But when it comes to hiring, Zuckerberg said the days of hyper growth are in the rearview mirror. Meta still plans to add people this year for high-paying, technical roles, but increases in headcount will be “relatively minimal compared to what we would have done historically,” Zuckerberg said.

“Until we reach a point where we’re just really underwater on our ability to execute, I kind of want to keep things lean because I think that’s the right thing for us to do culturally,” he added.

And that’s not just a story for this year, if Zuckerberg is to be believed.

“I sort of expect that for the next period of time going forward even beyond 2024,” he said.

Meanwhile, Meta’s Reality Labs unit, tasked with developing virtual reality and augmented reality technologies, continues to bleed cash and doesn’t appear to be slowing down. The division racked up a record operating loss of $4.65 billion in the fourth quarter and has now lost over $42 billion since late 2020. Revenue, driven mostly by Quest VR headsets, climbed past $1 billion for the first time.

Meta said losses at Reality Labs will continue to “increase meaningfully year-over-year,” underscoring Zuckerberg’s ongoing belief that the metaverse is the computing platform of the future.

He’s no longer concerned with scaring off investors, acknowledging that the major cost cuts have enabled Meta to make “different investments where that’s necessary,” Zuckerberg said.

“That was the theme that I laid out at the beginning of the year of efficiency last year, to make us a stronger technology company and give us the flexibility and stability to execute the long-term goals,” he said.

Read More: World News | Entertainment News | Celeb News

CNBC