Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Traders have upped their bets that the euro could fall back down to parity with the dollar as stubbornly high inflation and resilient growth in the US raise expectations that the Federal Reserve will only begin cutting interest rates months after the European Central Bank.

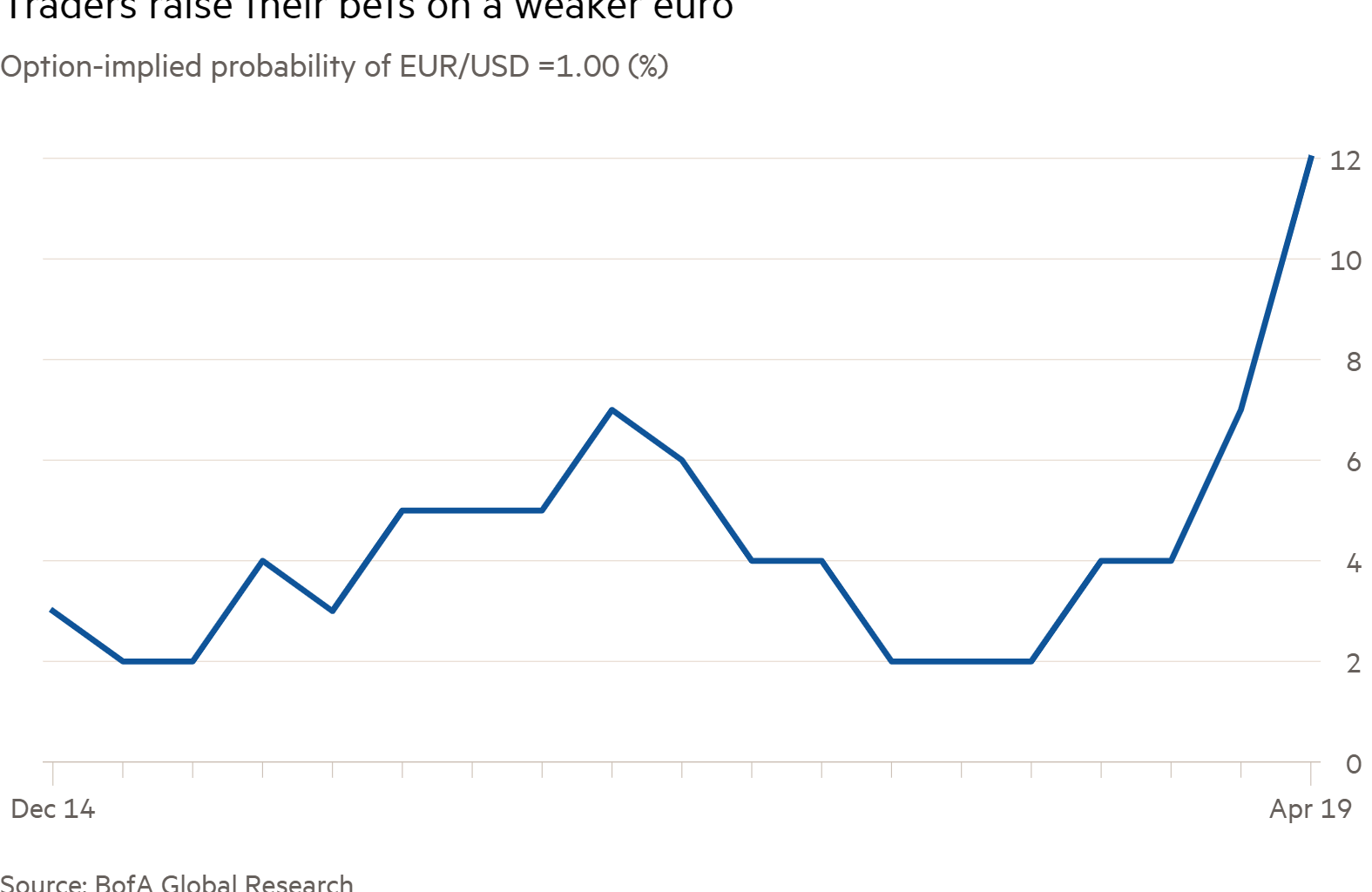

Investors have been buying options that will pay out if the common currency falls to $1 or below. Based on the price of these options, strategists at Bank of America say markets are now pricing in a more than 10 per cent chance of such a scenario within the next six months. At the beginning of January the market saw almost no chance of this happening.

The euro has already slipped 3.5 per cent against the greenback since the start of January. Parity would require a further drop of almost 6.5 per cent.

“It now seems like markets have thrown in the towel on substantial rate cuts in the US, whereas traders are pretty certain the ECB will start easing in June,” said Francesco Pesole, a currency strategist at ING.

The cost of betting on further weakness in the euro in the options market has “increased quite dramatically of late”, he added.

Signs of stubborn inflation and resilient growth in the US have led traders to slash their bets on how fast borrowing costs will fall in the world’s largest economy. Traders are now pricing in less than two quarter-point interest rate cuts this year from the Fed, compared with expectations of more than six at the end of last year.

In contrast, in the eurozone the annual pace of inflation dropped to 2.4 per cent in March, close to the ECB’s 2 per cent target, while growth also remains comparatively sluggish. The IMF said on Tuesday that the US economy was on track to grow 2.7 per cent in 2024 — more than triple the pace of the eurozone.

Fears of a widening conflict in the Middle East, and the potential knock-on effect of higher oil prices, have also triggered warnings about a hit to the common currency, with Europe dependent on energy imports.

The euro last dropped to parity with the dollar in 2022, the first time in two decades, amid the energy price shock triggered by Russia’s full-scale invasion of Ukraine and during a huge bull run on the dollar.

“The US economy is still not landing [weakening] and the risk of higher oil prices has increased. This has dramatically increased the risk for an even weaker euro-dollar, even parity,” said Athanasios Vamvakidis, global head of G10 foreign exchange strategy at Bank of America.

ECB President Christine Lagarde told CNBC on Tuesday that the central bank would monitor oil prices “very closely”, but noted that the market reaction following Iran’s air strikes on Israel last weekend had so far been “relatively moderate”.

Signs of escalation in the Middle East could also push the greenback higher as investors typically gravitate towards the perceived safety of the dollar in times of stress.

Deutsche Bank and JPMorgan have warned that the ECB might have to move more gradually once it starts lowering borrowing costs as interest rate differentials could cause excessive weakness in the common currency and risk a fresh spike in inflation by pushing up the price of imported products.

But Jane Foley, head of FX strategy at Rabobank, said the ECB might not oppose a gradual weakening of the euro as it begins to focus “more on growth risks than inflation risk”.

A softer exchange rate could help exports, said Foley, and the boost to growth would be particularly welcome for countries in the region, such as France and Italy, that are struggling with rising government deficits.

Read More: World News | Entertainment News | Celeb News

FT