Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

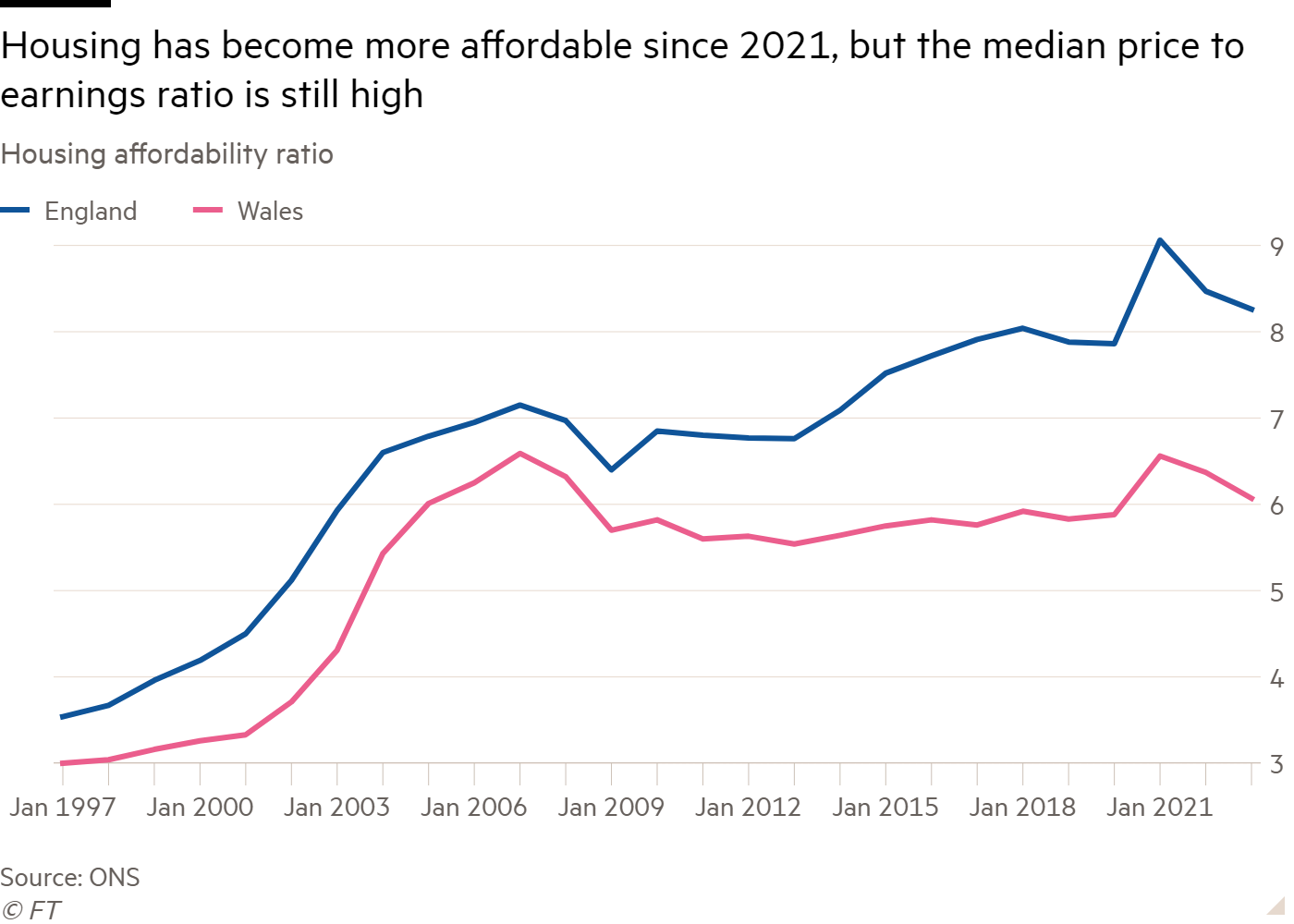

UK housing has become more affordable since a spike in prices during the pandemic, but home ownership is set to remain out of reach for many as house prices remain high.

The housing affordability ratio for England — the ratio of the median house price to median salaries — fell to 8.26 in 2023, down from 8.47 in 2022 and lower than the pandemic peak of 9.06 in 2021, according to data released by ONS on Monday. The ratio also fell to 6.07 in Wales, down from 6.37 in 2022.

But while the numbers point to a rosier picture, housing experts and economists caution that any affordability improvements may only be temporary.

“Even though the ratio has declined, that does not mean that the cost of housing has declined,” said Anthony Breach, associate director at the Centre for Cities think-tank. “Income growth has been faster than house price growth for the last year, but that is not set to remain.”

Since 2022, UK wage growth has been at record highs, with average earnings excluding bonuses increasing at an annualised rate of 3.5 per cent between October 2023 and January 2024. Meanwhile, a recent rise in UK home sales and a fall in mortgage rates have created a more hospitable market for buyers.

Economists caution that the increase in affordability reported by ONS is transient, as structural issues in the UK’s housing supply will continue to lock many out of the market.

“It is more affordable today, yet fewer people can afford it. Prices are down but deposits are up,” said Paul Cheshire, professor emeritus of economic geography at the London School of Economics.

“The housing market has continued with its perennial issue of inelastic supply. There are far too few houses being built, and the number has been falling as local authorities have cut back,” he added.

Data from the Resolution Foundation also released on Monday showed that a lack of new construction and the lagging modernisation of older homes has left the UK with the worst-value housing of any advanced economy.

Despite the improvement in affordability shown in the most recent data, UK housing is still on average less affordable than before the pandemic. In 2020, the housing affordability ratio for England was 7.86 and had increased in three of the preceding five years.

The ONS figures also showed that affordability had decreased in every local authority since data was first collected in 1997, with an especially large differential between median earnings and median list prices in the south east of England, with London boroughs of Kensington and Chelsea ranking as the most unaffordable.

“The planning system, by disconnecting local supply from local demand, has resulted in housing being more unaffordable overtime,” said Breach.

Read More: World News | Entertainment News | Celeb News

FT