Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. We start with news from the New York market debut of Donald Trump’s social media business yesterday.

Trump Media & Technology Group, the company behind his Truth Social platform, rose as high as $79.38 a share from the previous day’s price of $49.95, before closing up 16 per cent at $57.99. Trading was so volatile that it was halted for several minutes.

Trump, owner of 58 per cent of the shares in the merged company before accounting for dilution, is the biggest beneficiary of the price surge. His stake is now worth $4.6bn.

TMTG is now listed on the Nasdaq stock exchange under the ticker symbol DJT — Trump’s initials — after completing its merger with blank-cheque company Digital World Acquisition Corp on Monday.

The former US president faces a pile-up of legal and financial woes ahead of what is expected to be the most expensive presidential election campaign in US history. But here’s why TMTG’s share price jump is unlikely to help him secure funds.

And here’s what else I’m keeping tabs on today:

-

Economic data: The EU and France report consumer confidence figures for this month.

-

Bank of England: The UK central bank publishes minutes from its most recent policy meeting.

-

Companies: H&M, S4 Capital and Carnival report results. Moderna holds its investor day.

Five more top stories

1. US small-cap stocks are suffering their worst run of performance relative to large companies in more than 20 years, highlighting the extent to which investors have chased megacap technology stocks while smaller groups are weighed down by high interest rates. The Russell 2000 index has risen 24 per cent since the beginning of 2020, lagging the S&P 500’s more than 60 per cent gain over the same period. Read the full story.

2. Exclusive: JPMorgan Chase chief Jamie Dimon had a one-on-one lunch with US vice-president Kamala Harris at the White House last week, according to people familiar with the matter. His private meeting was not disclosed in the vice-president’s public schedule and comes at a testy time in relations between the Biden administration and US business. Joshua Franklin and James Politi have more details.

3. Exclusive: Solid-state battery technology for electric cars is still years away from commercialisation with “a lot of showstoppers” blocking its development, said the head of the Chinese company that dominates the industry. The much-hyped technology does not work well enough, lacks durability and still has safety problems, the founder and chief of CATL told the Financial Times. Read the full interview with Robin Zeng.

-

More EVs: A quarter of electric vehicles sold in the EU this year will be made in China as the country’s new entrants continue to take sales from local rivals, according to new research by a policy group.

4. Cryptocurrency group Copper hosted a party where guests were served sushi off two scantily clad models at the five-star Mandrake hotel in London last week. The company chaired by former UK chancellor Lord Philip Hammond stores digital assets for customers. Here’s more about the event.

-

More crypto: The US Securities and Exchange Commission is seeking $2bn in penalties from Ripple Labs after a court found the company had improperly sold some tokens to investors.

-

Opinion: Crypto is playing dress-up to make itself look grown-up, writes Katie Martin, but its new clothes may not prove a good fit.

5. Rishi Sunak was forced into a mini-reshuffle after two of his ministers resigned yesterday ahead of the Easter recess. The UK prime minister was hoping to send his MPs off for the three-week parliamentary break with an upbeat assessment of the economy, but his attempts to boost morale were waylaid by Robert Halfon’s unexpected decision to quit.

-

More on Sunak: Under pressure from party hawks to take tough action after Beijing’s repeated cyber attacks, the prime minister is planning a new crackdown on Chinese entities operating in the UK.

-

UK trade: Politicians are failing to champion exports and inward investment because of fears over reawakening old divisions on Brexit, the British Chambers of Commerce has warned.

The Easter recess rounds off a difficult first three months of the year for Sunak. For more on what this means for him and his Conservative party, sign up for Stephen Bush’s Inside Politics newsletter.

News in-depth

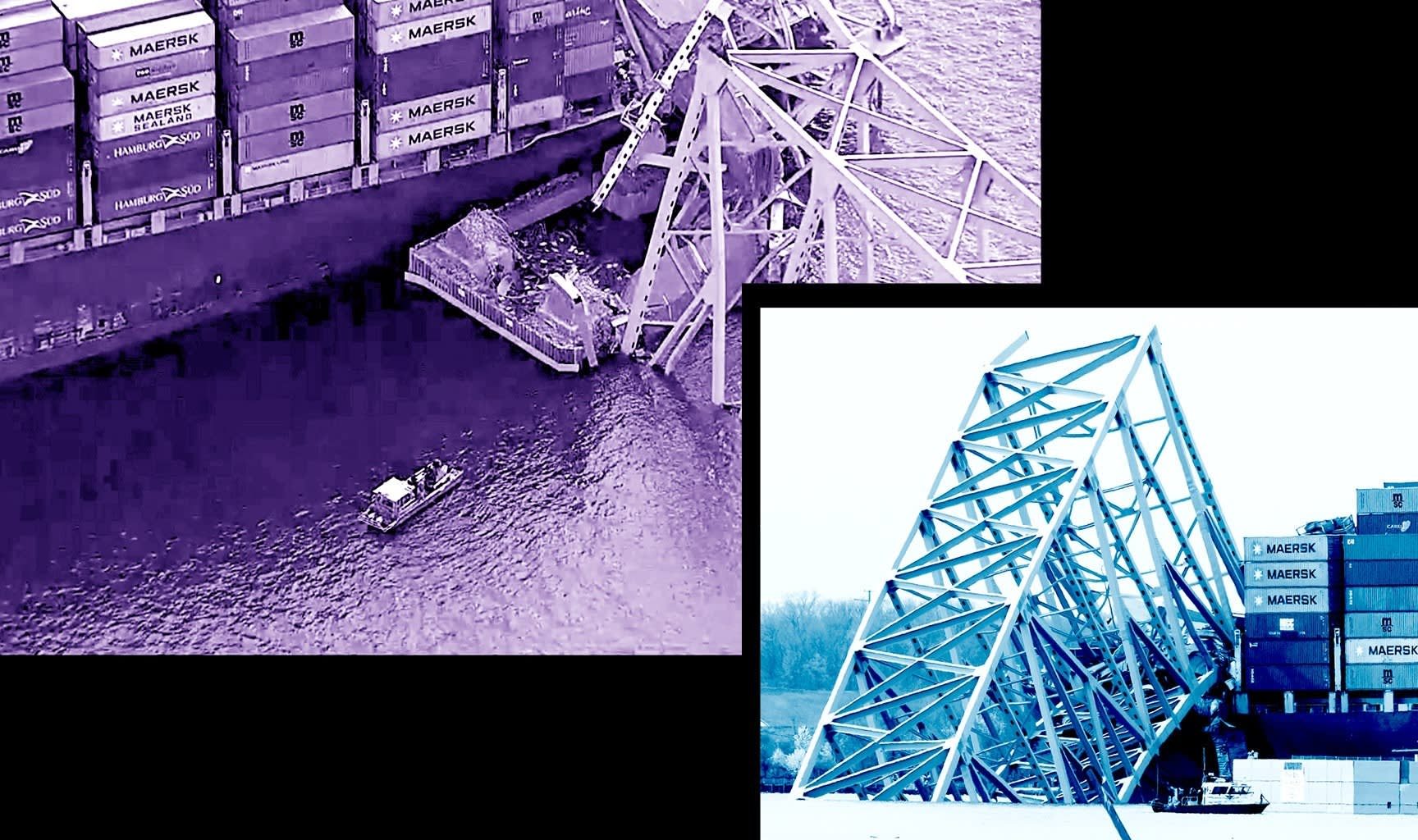

The collapse of the Francis Scott Key Bridge in Baltimore after a container ship collided with it yesterday has triggered urgent questions. Wes Moore, the governor of the state of Maryland, has declared a state of emergency after the elevated roadway’s disintegration into the Patapsco river. Six people are presumed dead, according to state police. What happened, and who will pay?

We’re also reading . . .

-

Fortnox’s rise: The $4.6bn Swedish software company’s stock has boomed under chief executive Tommy Eklund, but how much further can its niche business expand?

-

Chinese economy: President Xi Jinping’s pivot towards high-technology manufacturing, rather than boosting consumer-led growth, is drawing scrutiny at home and abroad.

-

Fascism is not dead: The 1920s and 1930s were different times, writes Martin Wolf, but do not be complacent: history may not repeat itself, but it rhymes and is rhyming now.

-

Israel-Hamas war: Israel’s second raid on Gaza’s al-Shifa hospital is stretching into its ninth day and shaping into the biggest battle of the nearly six-month war.

Chart of the day

The price of cocoa surged past $10,000 a tonne for the first time yesterday, as a dizzying rise in prices caused by poor harvests in Africa continued to accelerate. The market was “out of control”, said Andrew Moriarty, price reporting manager at Mintec, a commodities data group. “Everyone is just bracing for impact.”

Take a break from the news

Are we really ready to live forever? In an age of remarkable scientific advances, Stephen Cave reviews three new books that explore the prospects for living longer — and the challenges for human society.

Additional contributions from Benjamin Wilhelm and Gordon Smith

Read More: World News | Entertainment News | Celeb News

FT