Stay informed with free updates

Simply sign up to the US interest rates myFT Digest — delivered directly to your inbox.

Traders have built up bets that the Federal Reserve could raise interest rates again, a once-unthinkable prospect that highlights a shift in market expectations after stronger than expected US economic data and hawkish comments from policymakers.

Options markets now suggest a roughly one in five chance of a US rate increase within the next 12 months, up sharply from the start of the year, according to analysts.

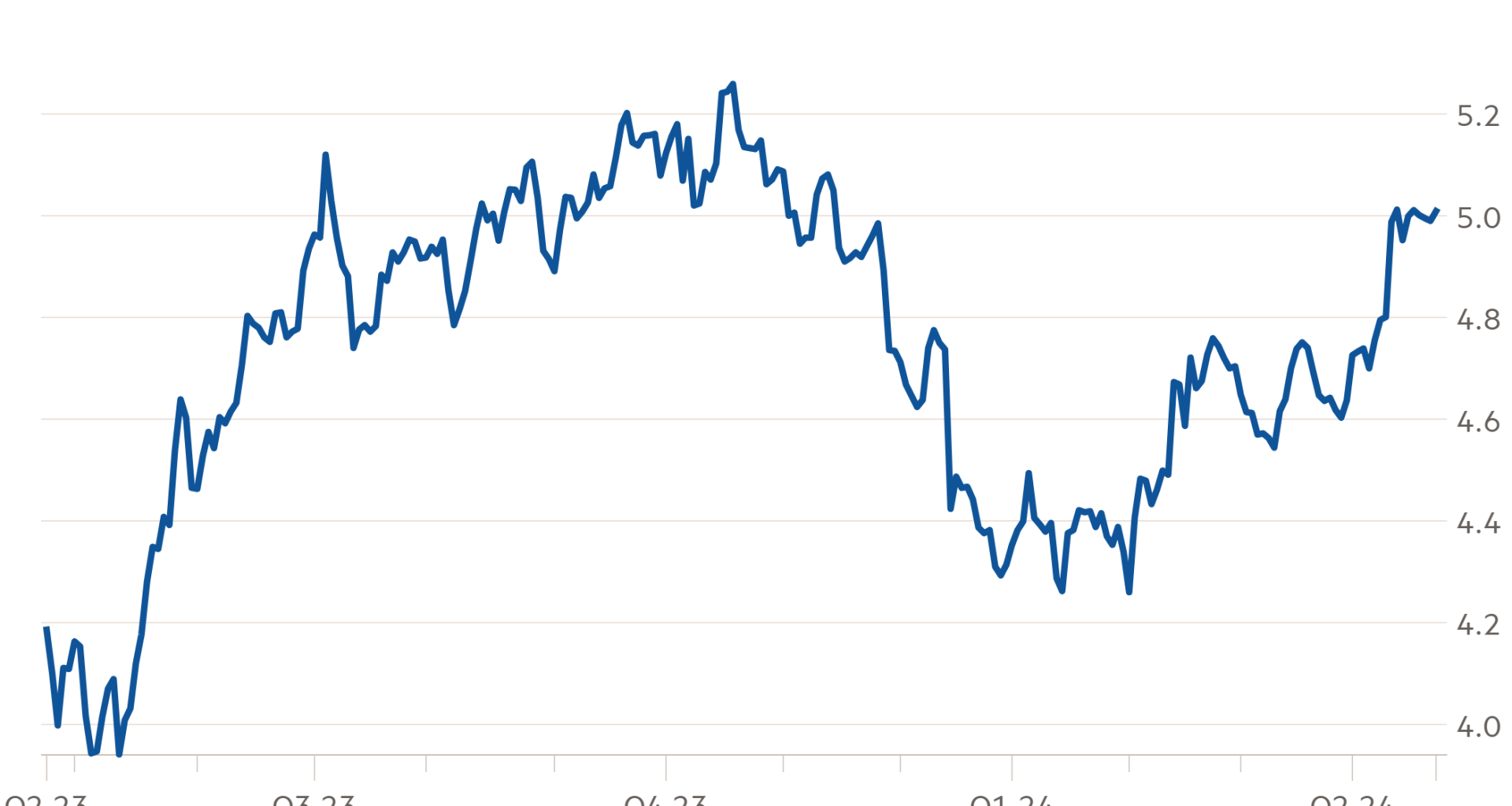

The shift in expectations has hit bond markets, with interest rate-sensitive two-year Treasury yields — which move inversely to prices — reaching a five-month high of 5.01 per cent. Wall Street stocks incurred their longest losing streak in 18 months before jumping on Monday.

Traders’ central expectation is for one or two rate cuts of a quarter of a percentage point each this year, down from six or seven in January, according to pricing in the futures market.

But following three months of higher than expected US inflation data, investors in a corner of the options market are beginning to take seriously the possibility — suggested earlier this month by former US Treasury secretary Lawrence Summers — that the Fed’s next rate move could instead be higher.

“At some point, if the data continues to disappoint, then I think the Fed will have to start re-engaging on hikes,” said Richard Clarida, an economic adviser at Pimco, who was previously vice-chair of the US central bank. Clarida added a rate rise was not his base case, but was a possibility if core inflation climbs back above 3 per cent.

Economists expect core personal consumption expenditures — an inflation metric followed inside the Fed — will come in at 2.7 per cent when data for March are released on Friday.

“I think it’s completely appropriate to factor [a rate increase] in,” said Greg Peters, co-chief investment officer of PGIM. “I feel much better about the market pricing that in, versus the start of this year when it was just cuts in extremis.”

The Fed aggressively raised interest rates between March 2022 and July 2023 in an effort to tame inflation. Rates since then have hovered at 5.25 per cent to 5.5 per cent.

Last week John Williams, president of the New York Fed, said the current state of the US economy means he does not “feel urgency to cut interest rates”. While it is not his base case, he added that “if the data are telling us that we would need higher interest rates to achieve our goals, then we would obviously want to do that”.

Options pricing reflects a roughly 20 per cent chance of a rate rise this year, according to Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investments. His analysis was based on options that will pay out in the event of a rise in the Secured Overnight Financing Rate, a money-market benchmark which closely tracks Fed borrowing costs.

Benson Durham, head of global policy and asset allocation at Piper Sandler, said his analysis suggests an almost 25 per cent chance of a move higher in rates over the next 12 months, while a PGIM analysis of options data from Barclays indicates a 29 per cent probability of such an increase over the same timeframe.

At the start of 2024 the probability was less than 10 per cent.

However, while investors are using options to hedge against — or profit from — the possibility of rate rises, a swift series of cuts also remains a possibility.

The options market suggests a roughly 20 per cent chance the Fed lowers borrowing costs by as much as 2 percentage points — or eight cuts — in the next 12 months, according to Durham.

“There is loads and loads of uncertainty,” Durham said. “My base case has been similar to the Fed’s base case for the last 18 months, but I can also see them cutting a lot faster under certain scenarios. I can also see them, for various reasons, adding another dollop.”

Read More: World News | Entertainment News | Celeb News

FT