Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

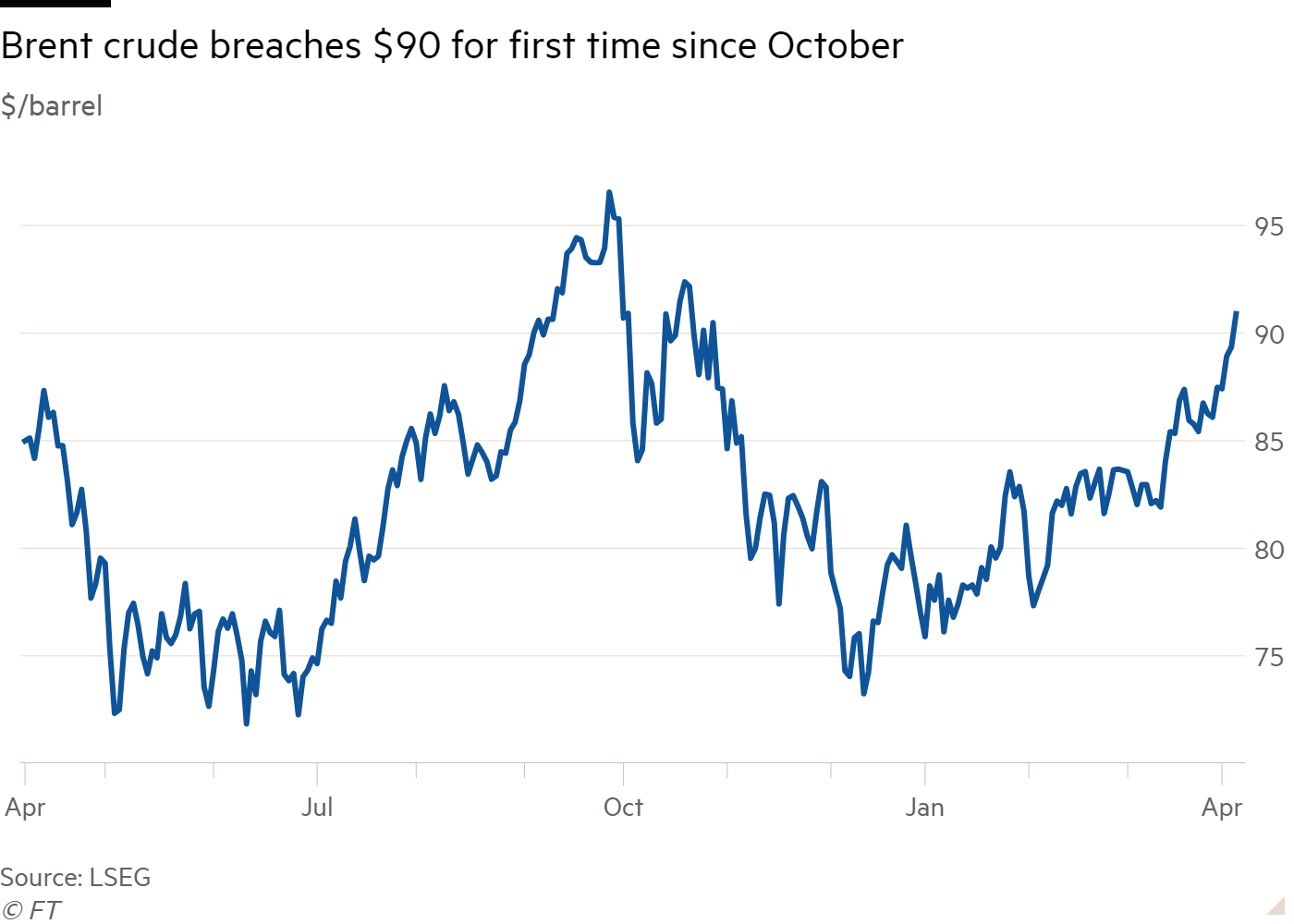

Oil prices rose above $90 a barrel and US stocks tumbled as flaring tensions in the Middle East sent tremors through markets.

Brent crude oil futures rose 1.5 per cent on Thursday to settle at $90.65 a barrel — the highest closing price since October — as traders weighed the potential for Iran’s backlash after a suspected Israeli attack on its consulate in Damascus.

Wall Street’s blue-chip S&P 500 stock index closed 1.2 per cent lower, its sharpest daily decline since the middle of February, while the tech-heavy Nasdaq Composite fell 1.4 per cent.

Fears that the war between Israel and Hamas might descend into a broader conflagration had simultaneously sparked a rush for assets considered less risky than stocks, according to Steve Englander, head of macro strategy at Standard Chartered in New York.

“It’s a classic rush for safe-haven assets,” he said, noting that prices for US Treasuries, which are widely considered risk-free, had climbed as stocks sold off.

“Even the Japanese yen is doing OK, and it takes a lot for the yen to do well these days,” Englander added, referring to the country’s under-pressure currency.

His thoughts were echoed by Peter Tchir, head of macro strategy at Academy Securities. “There was a flight to safety after headlines about an escalation in the Middle East. Crude spiked and investors rushed into Treasury bonds.”

The stock market decline coincided with a speech by Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, who suggested that US interest rates may not fall as widely expected this year. If US inflation continued to move “sideways, then that would make me question whether we need to do those rate cuts at all”, he said.

But analysts were unsure about the influence of Kashkari’s comments on the market given that he does not have a vote on the Fed’s interest rate policy panel this year. The US dollar index, which tends to move with rate expectations, was unchanged on the day.

“[Kashkari’s] comments wouldn’t lead to a rally in bonds,” said Subadra Rajappa, head of US rates strategy at Société Générale, adding that Thursday’s moves “are more to do with geopolitical tensions and caution ahead of tomorrow’s US jobs report”.

Oil prices have blown through analysts’ median forecast of $83 a barrel for this quarter, according to Bloomberg data, as global petroleum demand grows when the Saudi Arabia-led Opec+ alliance is constraining supply.

Giovanni Staunovo, a commodity analyst at Swiss bank UBS, said: “We believe the latest price increase has been driven by renewed geopolitical tensions in the Middle East, but fundamentals like better than expected demand and lower oil production have also helped.”

The surge in oil prices complicates central banks’ efforts to tamp down rising prices. It comes a day after Federal Reserve chair Jay Powell said the bank’s battle with inflation was “not yet done”.

Staunovo said: “Higher energy prices could become a concern for financial markets if it would further delay the start of interest rates cut by key central banks.”

The US Department of Energy on Wednesday said it was cancelling its latest plans to purchase oil to refill the nation’s emergency crude stockpile amid the rise in prices. The Strategic Petroleum Reserve has been drawn down in recent years to offset shortfalls sparked by Russia’s full-scale invasion of Ukraine.

The rise in crude prices has contributed to increasing petrol prices ahead of the summer driving season that begins next month. The uptick has become a mounting source of concern in the White House as November’s presidential election looms. Washington recently warned Ukraine to call off strikes on Russian oil refineries over fears it could fuel the oil price rally.

Read More: World News | Entertainment News | Celeb News

FT