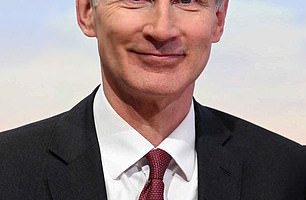

David Solomon, Chairman and CEO, Goldman Sachs, participates in a panel discussion during the annual Milken Institute Global Conference at The Beverly Hilton Hotel on April 29, 2019 in Beverly Hills, California.

Michael Kovac | Getty Images Entertainment | Getty Images

Goldman Sachs on Tuesday posted fourth-quarter results that topped analysts’ expectations on better-than-expected asset and wealth management revenue.

Here’s what the company reported versus what Wall Street analysts surveyed by LSEG, formerly known as Refinitiv, expected:

- Earnings: $5.48 per share; it wasn’t immediately clear if that was comparable to the $3.51 estimate of analysts surveyed by LSEG.

- Revenue: $11.32 billion vs. $10.80 billion expected, according to LSEG

Goldman said earnings for the quarter jumped 51% to $2.01 billion, or $5.48 per share, from a year ago, when the bank was weighed down by loan-loss provisions and surging expenses. Companywide revenues rose 7% to $11.32 billion from a year ago on growth from the bank’s asset and wealth management and platform solutions divisions.

Asset and wealth management revenue jumped 23% from a year earlier to $4.39 billion, topping the StreetAccount estimate by nearly $550 million, on higher revenue from equity and debt investments and rising management fees. Helped by rising markets in the fourth quarter, Goldman said it booked gains on public equities and markups in debt investments.

Other Goldman operations met or slightly missed expectations. For instance, while platform solutions revenue jumped 12% to $577 million, that was below the $612 million estimate.

In the company’s trading division, stronger-than-expected results in equities mostly offset a miss in fixed income revenue.

Equities trading jumped 26% to $2.61 billion in revenue, thanks to derivatives activity and equities financing, topping the $2.22 billion StreetAccount estimate. Fixed income posted $2.03 billion in revenue, a 24% decline from a year earlier on weakness in interest rate and currencies trading, and well below the $2.53 billion estimate.

Goldman CEO David Solomon has endured a tough year, thanks to dormant capital markets and strategic missteps.

But hope is building that Goldman can turn a corner after pivoting away from Solomon’s failed consumer banking efforts.

Goldman’s core activities of investment banking and trading may not recover in the fourth quarter, but analysts will want to hear about the possibility of a rebound in 2024. Early signs are that corporations that have waited on the sidelines to acquire competitors or raise funds may finally be ready to act this year.

Unlike more diversified rivals, Goldman gets most of its revenue from Wall Street. That can lead to outsized returns during boom times and underperformance when markets don’t cooperate.

On Friday, JPMorgan Chase, Bank of America, Citigroup and Wells Fargo each posted results that were marred by a litany of one-time items.

This story is developing. Please check back for updates.

Read More: World News | Entertainment News | Celeb News

CNBC