Stay informed with free updates

Simply sign up to the US equities myFT Digest — delivered directly to your inbox.

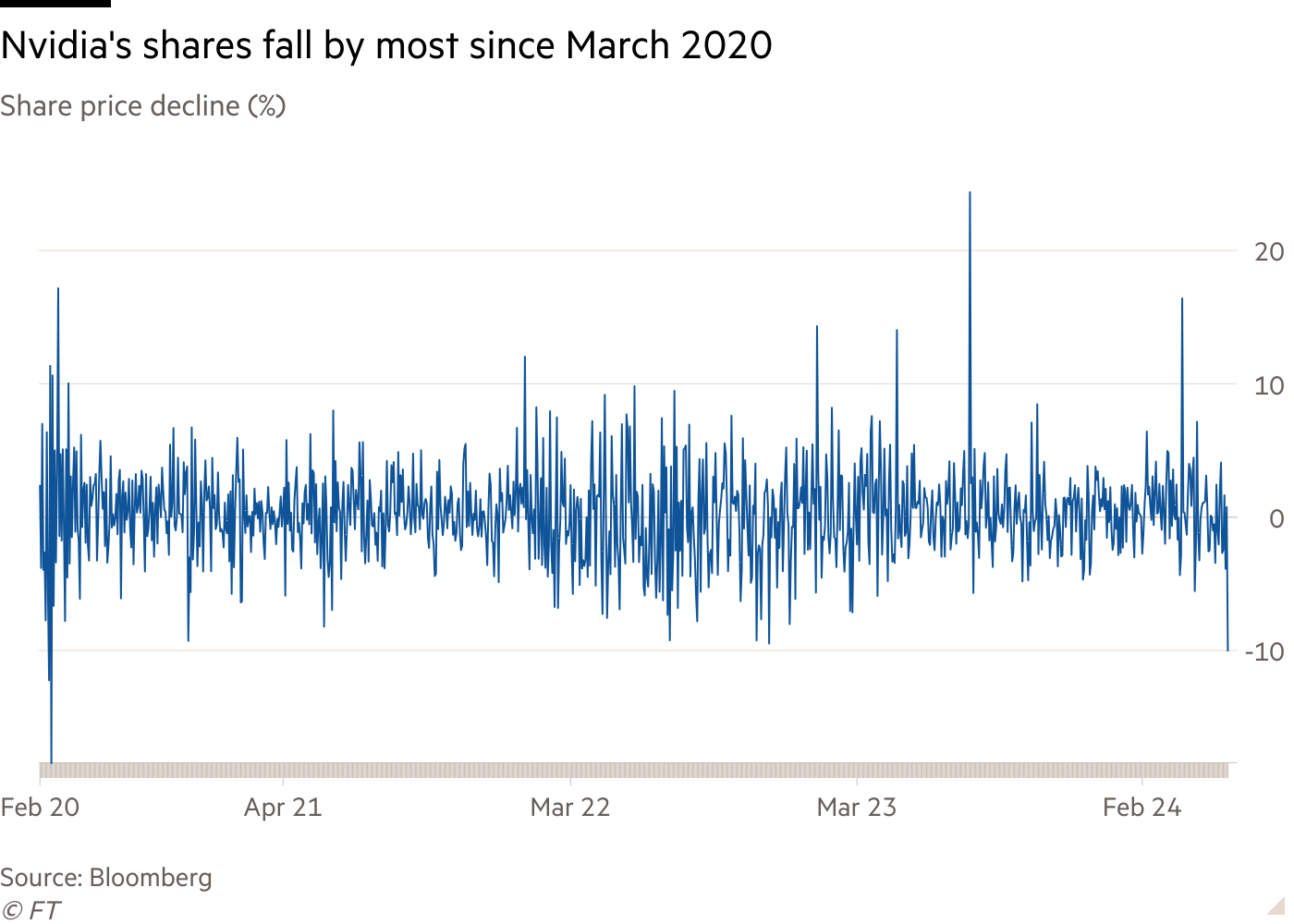

Nvidia’s share price plunged by 10 per cent on Friday, helping to seal the worst run for US stock markets since October 2022, as investors shunned risky assets ahead of a flurry of Big Tech earnings next week.

The chipmaker endured its worst session since March 2020, losing more than $200bn of its market value on the day. The decline accounted for roughly half of the 0.9 per cent fall in Wall Street’s S&P 500, according to Bloomberg data.

Netflix, meanwhile, shed about 9 per cent a day after the streaming service’s announcement that it would stop regularly disclosing its subscriber numbers overshadowed stronger than expected earnings. The tech-heavy Nasdaq Composite ended the session down 2.1 per cent.

Stocks that have been powered higher by investor enthusiasm for artificial intelligence also suffered, with Advanced Micro Devices, Micron Technology and Meta closing 5.4 per cent, 4.6 per cent and 4.1 per cent lower, respectively. Super Micro Computer, a server equipment group seen as a beneficiary of the AI boom, closed down 23 per cent.

“It’s a rough day for tech stocks,” said Kevin Gordon, a senior investment strategist at Charles Schwab. “Anything that was doing well earlier this year is unwinding, but banks and energy are doing well with [defensive] staples.”

Friday’s moves come as investors have begun to take seriously the possibility that the US Federal Reserve could make just one quarter-point cut to interest rates this year, or perhaps none at all. Retaliatory strikes between Iran and Israel have also ratcheted up investor anxiety, denting the market rally.

But analysts said Friday’s sell-off was instead being driven by investors hurriedly repositioning their portfolios ahead of a flurry of Big Tech earnings next week.

“The stock pullback has very little to do with [interest] rates,” said Parag Thatte, a strategist at Deutsche Bank. “It’s more to do with investors pricing in slower earnings growth [for Big Tech].”

Andrew Brenner, head of international fixed income at NatAlliance Securities, said “there is no relative pressure on rates” in the absence of fresh announcements from the Fed. “But equities are getting crushed.”

Microsoft, Alphabet and Meta all report results for the first quarter next week, while Nvidia’s results are due in late May. Although all are expected to have performed well, they face tough quarter-on-quarter comparisons.

Year-on-year earnings per share growth for Nvidia, Meta, Microsoft, Amazon, Alphabet and Apple peaked at 68.2 per cent in the fourth quarter of 2023. UBS analysts expect the so-called Big 6 to report EPS growth of 42.1 per cent for the first three months of this year.

Wall Street’s benchmark S&P 500 index shed 0.9 per cent on Friday, capping its worst week in more than five months in percentage terms. The index has declined every day since last Friday, its worst run in a year and a half.

All of a sudden, “the dip-buyers are not dip-buying . . . or if they are, they are getting swamped”, said Mike Zigmont, head of trading at Harvest Volatility Management.

The dollar index was steady on the day while oil prices rose modestly.

Read More: World News | Entertainment News | Celeb News

FT