There was a time not long ago when central bankers liked to say it was too early even to think about cutting rates. Now financial markets have responded and no longer expect a huge monetary easing in 2024, their language has changed.

The most important revision, common to all the leading central banks, is to acknowledge that the level of interest rates will still be restrictive even if they are reduced a little. Or, to use the inevitable motoring analogy, their feet are still pressing on the car’s brakes, but not so hard.

Jay Powell, chair of the Federal Reserve, likes to say:

“It will likely be appropriate to begin dialling back policy restraint at some point this year.”

European Central Bank president Christine Lagarde has adopted the same language:

“What we have done is that we have just begun discussing the dialling back of our restrictive stance.”

In its new mood for effective communication, the Bank of England’s Monetary Policy Committee was even more explicit in the minutes of its March meeting:

“The committee recognised that the stance of monetary policy could remain restrictive even if Bank Rate were to be reduced, given that it was starting from an already restrictive level.”

However they like to phrase it, there is no doubt that this lowers the bar to rate cuts. Correctly so. If policy committees kept slowing economic activity until they were 100 per cent sure rate cuts were warranted and inflation was definitively beaten, they would also know they had made a mistake, since monetary policy takes time to have an effect.

A concern that the Swiss National Bank had waited too long was evident in its statement after cutting rates to 1.5 per cent last month. Although the SNB said all the expected things about having fought an “effective” battle against inflation, its latest inflation forecast was “significantly lower than that of December” and it said unemployment was likely to rise further. That is not the ideal forecast.

In addition to the common theme of easing pressure on the economic brakes, there are area-specific additional reasons given for lowering rates soon.

Powell last week articulated the US reason that supply capacity might be rising even faster than demand. In a characteristically optimistic US take, the Fed chair said rapid growth and employment creation “reflects significant improvements in supply that offset to some extent the effects on demand of tighter financial conditions”. It is likely that this sunny outlook will survive the latest strong US jobs figures, but would be challenged by further bad consumer price index inflation figures tomorrow.

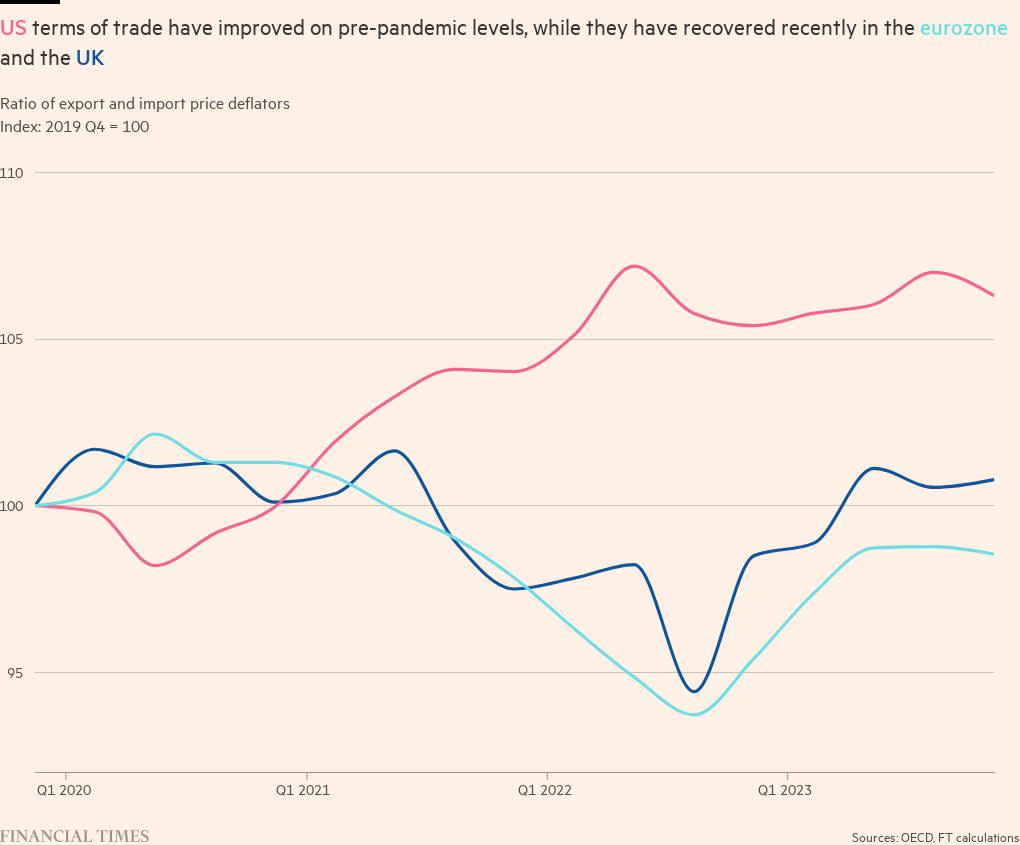

In Europe, there are more voices recognising that the terms of trade shock of 2022, which raised import prices making people poorer, reversed and this will allow real wages to grow without being inflationary. As the new ECB executive board member Piero Cipollone said last month, “there is scope for wages to rebound in the short term” with the European economy “switch[ing] to a faster lane without endangering the disinflation process”.

Of course, there are also reasons to wait, especially in the US where the economic conditions remain strong. Fed governor Chris Waller was clear last month that he would need to see “at least a couple [of] months of better inflation data before I have enough confidence that beginning to cut rates will keep the economy on a path to 2 per cent inflation”. Other Fed governors have been making similar noises.

These caveats are important. But they do not alter the big picture. The bar to cutting rates is now lower. Feet will still be pressing on the brakes. And preparations are in place for rate cuts this quarter as long as the data behaves itself.

A troubling reason for caution

Back in December, I examined a lot of research on public attitudes to inflation. People overestimate inflation, do not think in neat annual chunks of time, worry when prices rise above quite low thresholds, overestimate their knowledge, want prices to come down but wages to stay high and blame others for a rising cost of living, I said. Much of the research evidence was quite old, but I concluded that the public was objectively clueless about inflation.

I was delighted, therefore, that Harvard professor Stephanie Stantcheva has produced a new paper on public attitudes to inflation in the US. It strongly confirms the old research evidence and you should read it here, or watch her presenting the paper here.

Again, the naivety among the public is both important and relatively shocking for economists and policymakers. Most important is that even though almost half the people she surveyed could not even articulate a reasonably accurate definition of inflation, they knew they hated it.

Asked what the positive benefits of rising prices were, people did not respond that it was an appropriately hot-running economy with real wage rises or the ability to allow smooth price changes without nominal wage or price reductions. Instead, 51 per cent said there were no benefits of rising prices at all. As Stantcheva told me: “One single reason [people hate inflation] is that [they perceive] it decreases their purchasing power and don’t believe that wages keep up with prices.”

For people in power the results are almost all bad. As the chart below shows, most blamed “[Joe] Biden and the administration” for high inflation and even with a partisan response from Republican voters, the president was seen as the main culprit by almost as many Democrat voters as those wanting to blame corporate greed. Certainly, inflation was a burden imposed on them from the outside, they thought.

The most difficult finding for economists was that the public could not tie together subjects that were clearly linked. Of those who received an increase in their wages, around 80 per cent thought this was a result of their job performance or a mix of that and inflation. This was especially true of those who moved jobs and those on high incomes. We really are a narcissistic species.

Economic reasoning, for example that pay rose because companies needed to remain competitive with their rivals, was rejected.

You might reasonably ask why people were not happier with inflation if it gave them reasons to pat themselves on the back. Of course, this comes back to their view that wage rises did not compensate them for price rises. Also, don’t ask for consistency from the public.

So, what does this mean for the Fed? I do not like word cloud analysis and think it’s a bit of a gimmick, but want to show this one from the Stantcheva paper because you struggle to see the Fed mentioned as an institution to be angry with. People might well be lumping the Fed in with “government”, but at face value, the Fed truly has power without responsibility.

Luckily, officials do not see it this way and are constantly worried about their legitimacy. The paper gives them reason to be cautious about cutting rates given how much the public hate inflation, but does not shed much more light on policy than that. People also hate deflation and any other bad macroeconomic situations.

As Stantcheva said, it is “tricky to extrapolate” the survey results into actions for the Fed, but still vital to understand the way that people really think.

What I’ve been reading and watching

-

Although Powell was still seeing the sunny side of things, and is by far the most important official, regional Fed presidents are beginning to worry about the persistence of inflation. In Chicago, Austan Goolsbee worried that housing inflation was remaining too strong; in Dallas, Lorie Logan was “increasingly concerned about upside risk to the inflation outlook”; and Atlanta’s Fed president Raphael Bostic maintained his view that only one interest rate cut was warranted this year because inflation’s decline would be bumpy

-

If the short term is vexing regional Fed presidents, so is the longer term. Loretta Mester argues that the Fed’s median estimate of neutral long-term interest rates is too low at 2.6 per cent and has raised her estimate to 3 per cent. Many other Fed officials are with her on that but are shy about changing their inputs into the quarterly summary of economic projections so far, although in a speech on Friday, Logan indicated she would soon alter hers

-

In a lovely piece of reporting, Martin Arnold tells the story of how the southern Europe former laggards, Portugal, Italy, Greece and Spain, are eclipsing the economies of Germany and France. Time to put the rude Pigs acronym — which has been banned by the FT style guide for years — to bed.

-

The BoE is preparing to ditch its forecast fan charts, says Sam Fleming. In my view this is at least a decade too late. But the issue is not the charts, it is making the UK’s forecasting process clear, consistent, accountable and humble. This requires more than a new central forecast and some scenarios as I have laid out here and here.

A chart that matters

Eurozone flash inflation figures came out last Wednesday and were better than expected, meeting one of the three criteria for rate cuts set out by the ECB’s governing council. The data was not perfect, however, with the annual rise in services prices stuck at 4 per cent.

More evidence is therefore needed that hefty start-of-year price rises will not continue and that the (rising) six-month and three-month annualised rates are reversing again. Nothing to get worried about in the latest figures, but still disinflation is not quite in the bag.

Read More: World News | Entertainment News | Celeb News

FT