Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

It’s time to look at Greece’s strong post-pandemic economic recovery in a historical context. Tl;dr: the country is indeed among the best recent performers in the eurozone, but it has also become the poorest.

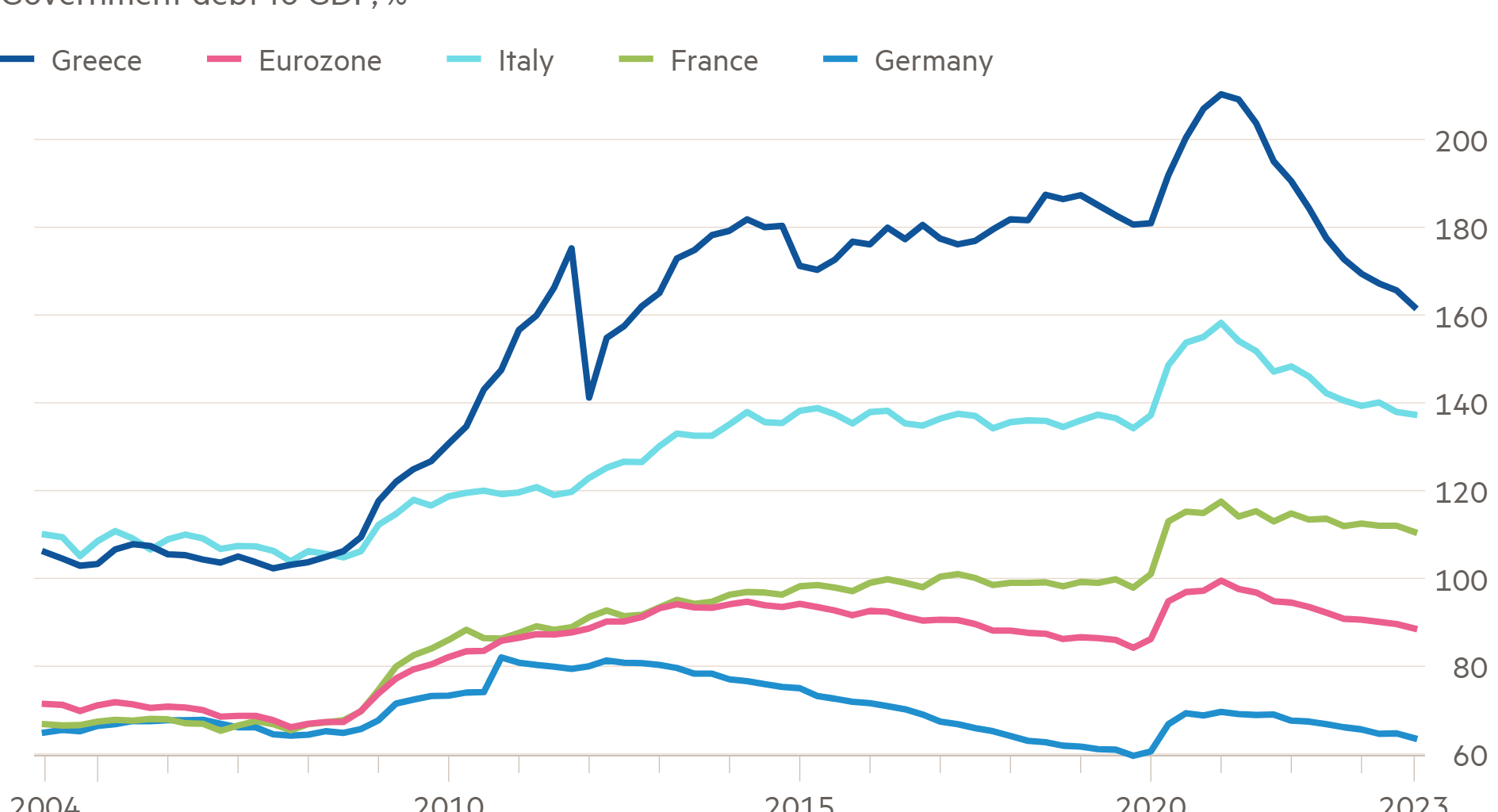

Last week, rating agency S&P was the latest to sing the country’s well-deserved praise as it revised the country’s outlook to “positive”. This was on the back of Greek authorities undertaking “a broad ranging structural reform agenda and tackling long-standing bottlenecks” boosting growth above the eurozone average and resulting in a falling debt-to-GDP ratio.

The positive outlook reflects our expectation that the tight fiscal regime will continue to spur a reduction in the government debt ratio, while growth should continue to outperform that of Greece’s eurozone peers.

Indeed, new data published by Eurostat on Monday showed that Greek government debt relative to GDP fell by 10.8 percentage points to 162 per cent in 2023.

The Greek economy grew by 2 per cent in 2023, outshining the 0.3 per cent contraction in Germany. Since 2019, before the pandemic, the country has grown at nearly double the eurozone’s rate. Last week the IMF said the Greek economy will expand by 2 per cent again this year, and continue to outperform the currency union’s average growth rate for the next two years.

Strong tourism numbers — which go hand in hand with improvement in the labour market and the recovery in consumption — are helping. So too are structural reforms aimed at removing obstacles to growth, such as increasing digital access to public services, accelerating judicial decisions, and improving transparency and public finances.

As BNP Paribas economist Guillaume Derrien told FTAV:

Renewed political stability and sharp fiscal consolidation is making Greece a much more attractive country for investment than in the past.

However . . .

The latest rebound has only just slightly lifted Greek living standards relative to the EU average in the last couple of years — and not enough to lift them from their place as the poorest people in the eurozone.

This is a relatively new thing for Greece, as per-capita GDP was similar to that of the EU average until 2009. Since then, 10 countries have seen living standards rise above those in Greece, leaving it the second poorest in the EU after Bulgaria, and the poorest in the common currency bloc

With the gap with Bulgaria narrowing sharply, it’s not unreasonable to expect that Greece will soon become the EU’s poorest country.

How do these opposite stories of strong rebound and poverty reconcile?

The answer lies in the aftermath of the financial crisis and the austerity that followed the 2010 crisis. Greek spending was cut and taxes increased to secure a bailout from the IMF and the EU, squeezing businesses and households and demolishing the economy. The extent of the economic damage was exceptional for peacetime.

The Greek economy shrank by nearly 30 per cent peak-to-through. In 2016, consumer spending was down 24 per cent from 2007, government spending was down 20 per cent and investment plummeted by 65 per cent. Over the same period, manufacturing activity nearly halved, retail trade and professional activity shrank by nearly one-third. Unemployment shot to an all-time high of nearly 30 per cent.

As a result, the Greek economy is today about 19 per cent smaller than in 2007 — despite the country’s strong post-pandemic rebound — while the EU economy as a whole has risen by 17 per cent.

The economic hit is nearly unprecedented in modern times, only comparable to the US Great Depression in the 1930s, notes George Lagarias chief economist at Mazars Wealth Management.

Real wages have been steadily declining until 2022, the latest available in the OECD database, and are down 30 per cent from their pre-financial crisis levels, leaving the country with one of the lowest average salaries among developed economies.

The construction sector — an important driver of growth before the crisis — has been nearly wiped out. Residential investment, which represented over 10 per cent of GDP at the height of the 2008 bubble, has since plunged to 2 per cent of GDP, the lowest share among eurozone countries. As BNP’s Derrien says:

Greece has now a less unbalanced economic development model — which is a positive — but the drop in construction activity has yet to be fully rebalanced by the expansion in new sectors.

There are also concerns about the country’s longer-term economic outlook.

Lagarias argues that growth with limited leverage — which is the case of Greece — will remain sluggish, and predicts that it will take many years of “persistent reforms” for Greece to get back to where it was in 2007. Low investment and sluggish productivity also continue to hamstring Greece’s economic potential, according to Derrien.

In its latest country report, the IMF also mentioned climate change as a danger — as 90 per cent of the country’s tourism infrastructure and 80 per cent of industrial activities are in areas exposed to high climate risks — and the increasingly dour demographics.

Greek births fell to a nine-decade low in 2022, aggravating the country’s ageing and shrinking population as many young people leave the country every year.

Overall, Greece’s economic rebound should be celebrated, but it needs to be seen in the context of a remarkable economic crisis that has left it in a hole that might take a generation to climb out of.

Read More: World News | Entertainment News | Celeb News

FT