Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

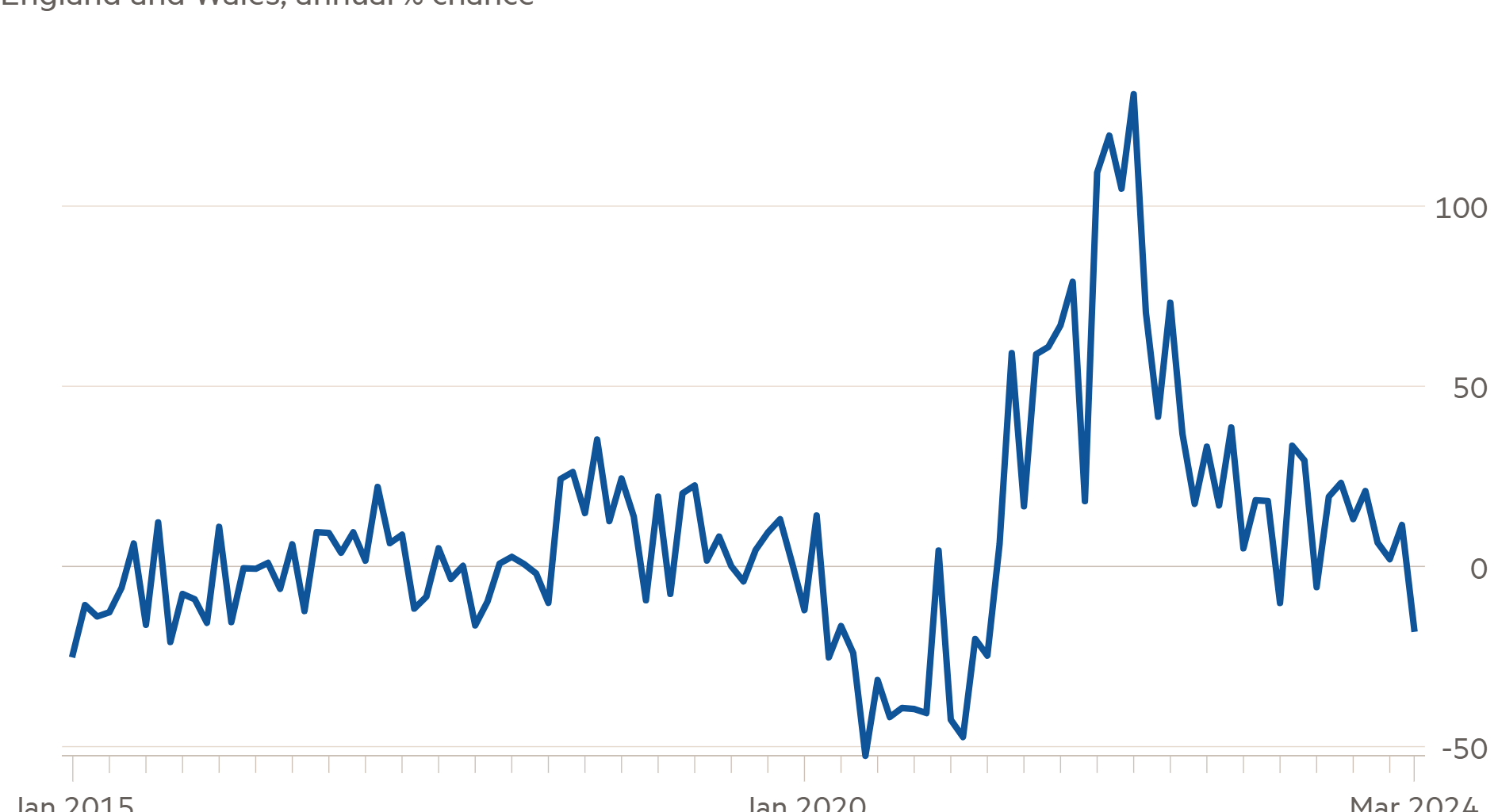

Corporate insolvencies in England and Wales fell sharply in March, registering the first annual decline since July last year.

The number of companies filing for insolvency fell to 1,815 last month, a 17 per cent drop on March 2023, according to official data released on Friday.

Corporate insolvency data is volatile but the numbers have been rising at double-digit rates for most months since mid-2021, hitting a 30-year high last year, as companies struggled with higher costs and sluggish demand.

Despite the decline, the number of insolvencies in March was still much higher than the pre-pandemic monthly average of 1,300 between 2014 and 2019

The figures suggested “that businesses and investors have managed to adjust, cutting their cloth successfully to match the economic climate”, said Trevor Wood, partner and restructuring specialist at international law firm Vedder Price.

However, he also cautioned that the fall might be “just a blip,” as it remained a “difficult environment” for many businesses.

The consultancy Begbies Traynor warned on Friday that more than 40,000 companies were on the brink of insolvency.

The Insolvency Services said construction was the most affected sector, accounting for 18 per cent of insolvencies in the 12 months to February. Construction has been hit by the rise in UK interest rates from a record low in 2021 to the current 16-year high of 5.25 per cent, dampening housing demand.

Expectations of a rate cut by the Bank of England later this year have helped the residential property market recover from the lows of 2023, but transaction levels are still low.

The retail and hospitality sectors were also badly hit, accounting for 16 per cent and 15 per cent of insolvencies respectively over the same 12-month period, reflecting weak consumer demand.

Lindsay Hallam, senior managing director in the corporate finance and restructuring team at FTI Consulting, said she hoped slowing inflation and the rise in the national living wage from April would “generate a positive response from consumers”.

But she warned that after a period of sustained inflation and stagnant demand, many businesses would find it “challenging” to absorb the higher wage costs given their margins were already tight.

The March data showed that the number of voluntary liquidations, the most common type of insolvency filing, fell 19 per cent year on year. Administration filings fell 14 per cent and compulsory liquidations were down 9 per cent.

Read More: World News | Entertainment News | Celeb News

FT