Stay informed with free updates

Simply sign up to the Chinese economy myFT Digest — delivered directly to your inbox.

China’s industrial activity picked up at the start of the year in a boost for policymakers as they struggle to counter a two-year property slowdown that continues to weigh on the world’s second-largest economy.

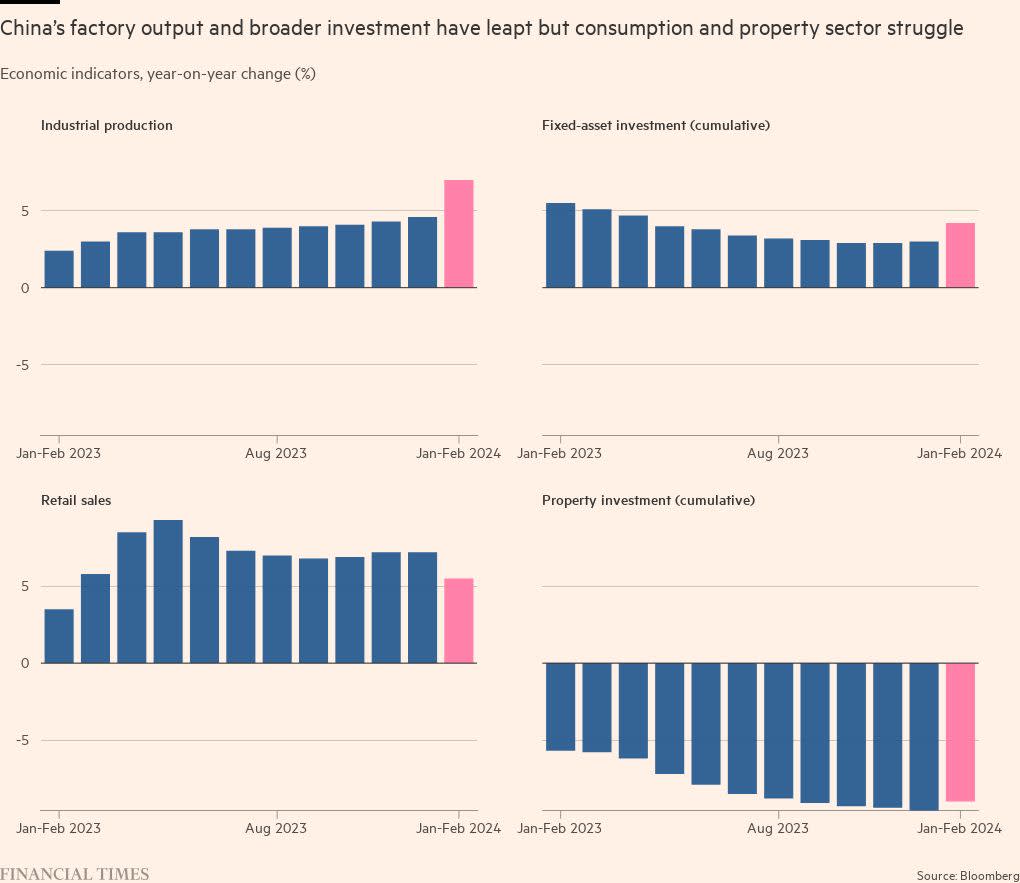

Industrial production leapt 7 per cent year on year in January and February, combined data from the National Bureau of Statistics showed, the fastest rate of growth in almost two years and above an anticipated 5 per cent rise from economists polled by Reuters. Retail sales added 5.5 per cent, in line with expectations.

China’s economic data is being closely watched for any signs of improved momentum after a period marked by deflation, low consumer confidence and a property cash crunch that has spread to some of the country’s most trusted developers in the past year.

The real estate sector remained under pressure in January and February, official figures showed on Monday. Property investment fell 9 per cent year on year in January and February, although at an improved rate of decline than December, when it fell 24 per cent. New construction starts plummeted 30 per cent, the worst fall in more than a year.

Zichun Huang, China economist at Capital Economics, said the overall data marked an improvement, with economic momentum expected to “improve further in the near term” and benefit from support measures.

But she pointed to the economy’s “underlying structural challenges”, a reference to the reliance on the property sector for economic activity. “The correction in property construction is still in its early stages,” she noted.

Beijing has set a growth target for the year of 5 per cent, similar to last year and the lowest in decades. China’s leadership this month emphasised the need for stability during an annual meeting of the country’s rubber-stamp legislature. Gross domestic product increased 5.2 per cent in 2023.

Xi Jinping’s administration has stopped short of providing any major stimulus to counter the property sector’s woes, which was triggered by the failure of Evergrande in late 2021, and has prioritised the completion of unfinished projects. Property sales by floor area dropped 20.5 per cent year on year in the first two months of 2024.

This month China Vanke, partly owned by the state-owned metro in the southern tech hub of Shenzhen, became the latest developer to face consumer and market scrutiny amid concerns over its sales and the viability of private-sector property development. Overall, funds raised by developers dropped 24.1 per cent in January and February, when China’s statistics bureau combines two months of data to avoid distortions from the lunar new year holiday.

Fixed-asset investment rose 4.2 per cent, which analysts at Oxford Economics suggested was “likely supported by a state-driven push early this year”.

Urban unemployment rose to 5.3 per cent, from 5.1 per cent in December.

Read More: World News | Entertainment News | Celeb News

FT