Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

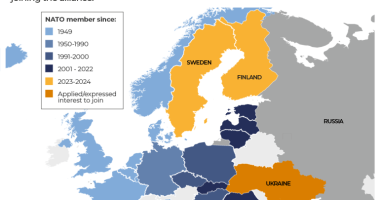

Good morning. Finland’s President Alexander Stubb has called on European leaders to be “more Finnish” in an interview with the FT, urging them to stop warning about a possible Russian attack and instead make sure they are ready for it.

Below, I have more from Stubb on why Europe needs less talk and more action. And our Frankfurt bureau chief previews why the ECB is expected to do nothing at its latest rate-setting decision today.

Who has your vote in June’s EU elections? Listen to economic experts from major parties debate their visions for Europe’s future at a debate co-hosted by Bruegel and the Financial Times next Monday, live in Brussels or online.

Trust me, I’m Finnish

Alexander Stubb wants everyone to calm down. Amid increasing talk of a potential Russian attack on a European Nato member, Finland’s president has a message: “I would say remain cool, calm and collected.”

Context: Russia has shifted to a war economy to fuel its invasion of Ukraine. That, combined with bellicose rhetoric from the Kremlin, and fears that the US might not defend all European allies, has led to some voicing fears of a potential wider conflict on the continent.

“In Finnish we have a saying: ‘a pessimist is never disappointed’. I don’t like that saying,” Stubb said. “It’s very easy to throw out these sort of simple terms of, you know, Russia is going to attack Europe next.”

“I don’t think it’s going to do that. But we have to be prepared for it,” he added.

Finland has learned to always be ready for Russian attack: the two countries have fought 30 wars and skirmishes since the 1300s.

But other EU and Nato allies are talking too much and not doing enough, Stubb reckons.

“When it comes to procurement of defence materiel, we need to start pooling. When it comes to financing, we need to start pooling. When it comes to planning and operations, we need to start pooling,” he said. “In Nato, we’re already doing that. But in Europe, I think we’re lagging a little bit behind.”

But that, he stresses, does not necessarily mean pooling debt to fund defence investment, as has been proposed by some EU capitals.

“I am not making here a call for defence bonds,” he said. He added that the issue in Europe was that public money and mutual debt were too often seen as the only solution. “That is not the case.”

“This is an issue of really strict administrative planning and the private sector. If at the end of the day there is some mutualisation, so be it. But I’m not advocating that at the moment,” Stubb said.

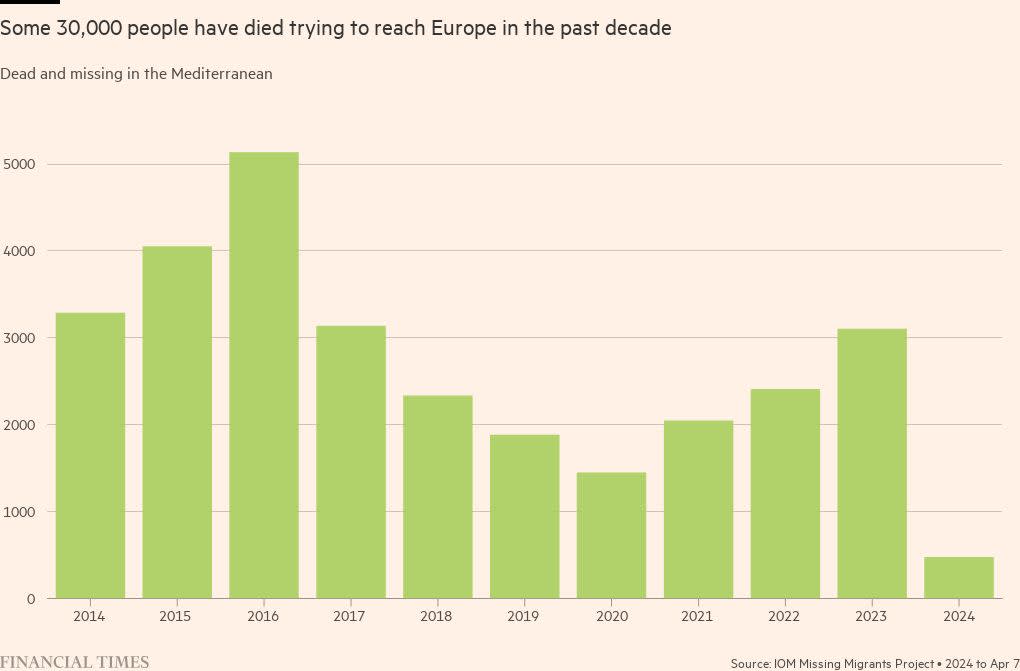

Chart du jour: Outsourcing

The EU is funding authoritarian countries on its periphery to curb arrivals to the bloc, although irregular migration figures are well below 2016’s peak. Read our deep dive into the human cost of Europe’s increasingly draconian migration policies.

Hold it

Eurozone inflation has fallen to within a fraction of the European Central Bank’s 2 per cent target, and the economy has ground to almost a complete standstill.

So why, asks Martin Arnold, is the ECB expected to leave interest rates at a record high when its governing council meets today?

Context: The ECB has kept its benchmark deposit rate at an all-time high of 4 per cent since last September. Senior policymakers have said they are likely to start cutting rates as early as their next meeting on June 6 if price pressures keep cooling as expected.

ECB president Christine Lagarde said last month she expected it to “make policy less restrictive” as long as the data coming in the next eight weeks show inflation still falling towards its target.

There are three factors that make ECB rate-setters nervous to act sooner.

The first is that while annual headline inflation fell to 2.4 per cent in March, this mainly reflects falling energy and fresh food costs and weak growth in goods prices. Services inflation, however, has been stuck at an uncomfortably high 4 per cent for five months.

The second worry is wage growth, which eased in the fourth quarter. The ECB wants this to continue in 2024, but early signs from Germany are troubling: its annual 9.7 per cent rise in negotiated wage growth including bonuses in March was almost the highest since 2011.

The final fly in the ointment is the US Federal Reserve.

Inflation has overshot forecasts in the US for three months, prompting investors to bet the Fed may not start cutting rates until November. This is unlikely to stop the ECB from lowering borrowing costs, but it will make it more uneasy about going first.

What to watch today

-

Eurogroup meets in Luxembourg.

-

Central European leaders meet for the Three Seas Summit in Vilnius.

Now read these

Recommended newsletters for you

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: europe.express@ft.com. Keep up with the latest European stories @FT Europe

Read More: World News | Entertainment News | Celeb News

FT