Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A stronger than forecast US inflation figure caused a stir as European Central Bank rate-setters sat down for dinner in Frankfurt on Wednesday — but several attendees said it only toughened their resolve to disregard what the Federal Reserve might do.

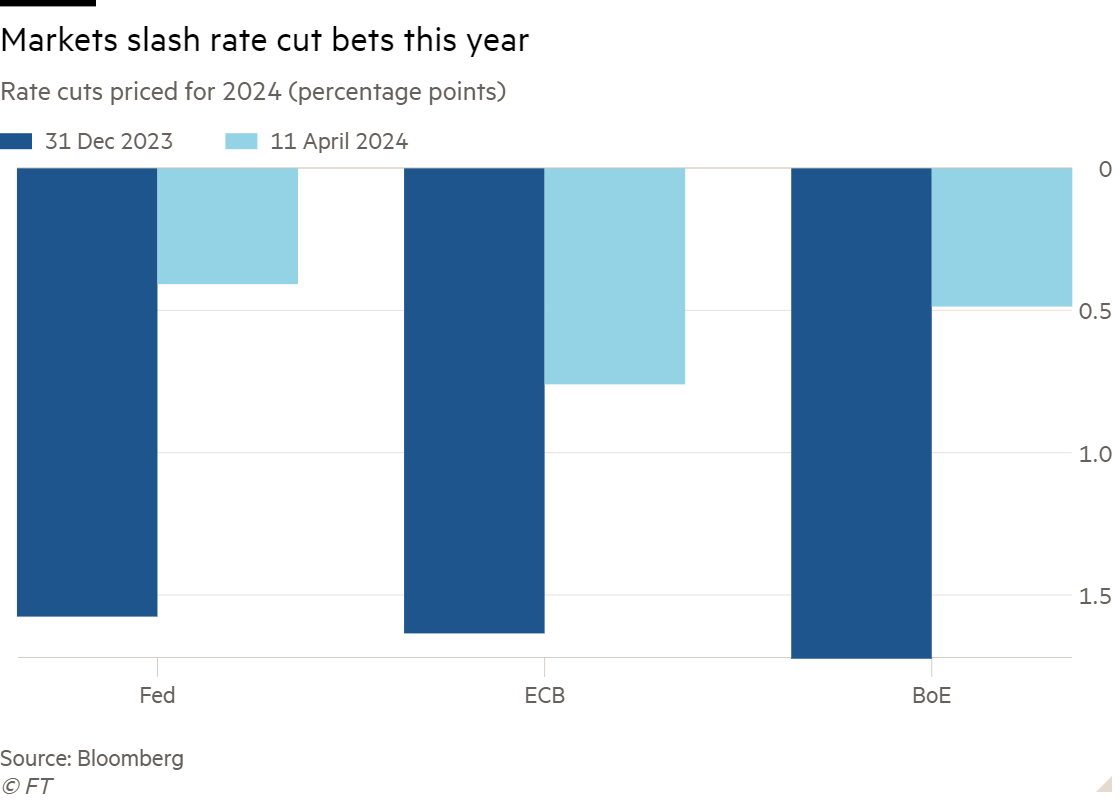

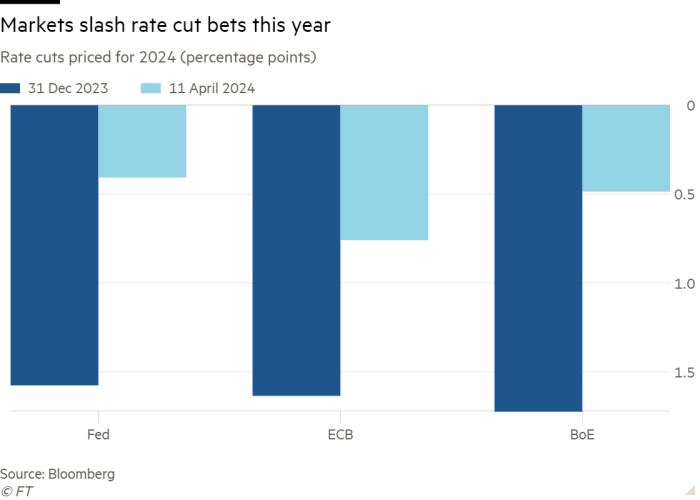

The ECB, which on Thursday decided to keep its benchmark deposit rate at an all-time high of 4 per cent while signalling a cut was likely in June, is grappling with intensifying questions about how much it would cut borrowing costs if the Fed took a different path.

US data a day earlier showed a 3.5 per cent rise in consumer prices for the year to March, compared with expectations of 3.4 per cent. The third successive month of above-forecast inflation prompted traders to bet US rate cuts might undershoot expectations and not begin until November.

“We are not Switzerland, we are the euro area and can operate independently without worrying about the exchange rate,” one ECB governing council member told the Financial Times, referring to the Swiss central bank’s costly interventions to support the franc in recent years.

Another said: “It would actually be illegal for the ECB to decide policy based on what the Fed was doing.”

A few dissenters even pushed for the ECB to cut rates this week. But several of those present said no more than three out of 26 council members forcefully argued for an immediate rate cut. However, one who pushed for a cut said six others had done the same.

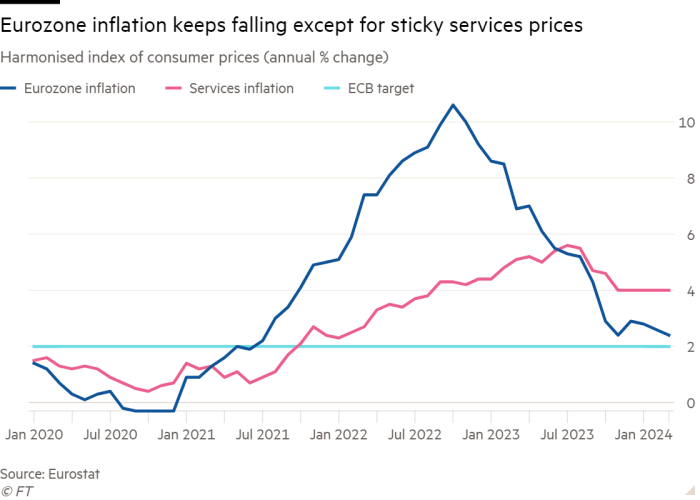

The ECB has clearly signalled that with the eurozone economy predicted to grow only tepidly this year and inflation falling towards its 2 per cent target — after dropping to 2.4 per cent in March — it expects to start cutting rates in June.

This position was reinforced by several ECB council members on Friday, including the heads of the Greek, Latvian and Estonian central banks, who all expressed confidence it was on track to start easing policy at their next meeting on June 6.

Their stance was supported by the findings of two ECB surveys. One showed companies expect wage growth to slow, profit margins to shrink and the economy to make a “gradual but modest” recovery this year. Another found analysts still expect eurozone inflation to settle at the ECB’s 2 per cent target next year.

The dovish message seemed to sink in with investors on Friday, as the euro fell 0.8 per cent against the dollar to a five-month low of $1.067. Eurozone government bond prices rallied, sending yields on Germany’s benchmark 10-year bond down 14 basis points at 2.33 per cent.

Traders in swaps markets upgraded the likelihood of the ECB starting to cut rates in June to about 90 per cent, up from 75 per cent a day earlier.

All officials contacted by the FT after Thursday’s meeting brushed off concerns about transatlantic divergence on monetary policy and expressed confidence there would be a broad consensus to start cutting rates in June even if the Fed waits longer.

“We would need some kind of geopolitical shock or two very bad inflation readings not to cut rates in June,” said one council member. A second said: “All colleagues agree we should diverge from the Fed — everything here is pointing to a reduction of inflation.”

A third said: “We discussed this quite a bit over dinner when the US inflation numbers came out and basically we’ve got to focus on our mandate and not get distracted by what the Fed might do.”

The ECB declined to comment on the council discussions. Its president Christine Lagarde dismissed reporters’ questions on Thursday about whether its decisions would be swayed by the Fed. “We are data-dependent, not Fed-dependent,” she said, pointing out that inflation in the US was “not the same” as in Europe.

Council members agreed with Lagarde’s assessment, pointing out US inflation was being kept higher by relatively strong economic growth and the expansionary fiscal policy of President Joe Biden’s administration. “We are confident of hitting our inflation target and the US data didn’t shatter that confidence,” said one.

But some economists reckon the ECB will try to avoid cutting rates much more aggressively than the Fed, partly out of fear of weakening the euro and so further stoking inflation. There are also concerns eurozone inflation could soon mirror the recent resurgence seen in the US.

“We disagree with what Lagarde said regarding US inflation and the full decoupling of eurozone inflation developments from those in the US,” said Carsten Brzeski, global head of macro at ING, pointing out that US price growth had “nicely led eurozone developments with a lag of around half a year”.

He added that the eurozone was likely to experience similar “structural constraints to the supply side” as the US, such as “the lack of skilled workers, capacity constraints due to under-investment, or energy and commodity dependencies”.

Greg Fuzesi, an economist at JPMorgan, said “US inflation developments have some relevance” for the ECB. He cited the recent stickiness of eurozone services prices — which have risen at an annual rate of 4 per cent for five months — as an example of how “incoming data are providing some challenge to the ECB”.

Read More: World News | Entertainment News | Celeb News

FT