Hello from Washington where I am making my brief return to write Trade Secrets while Alan is away. It’s the calm before the storm here, as various ministers and bigwigs will descend on the US capital today for the annual IMF and World Bank Spring meetings. Today’s newsletter harks back to the time when all climate types hated the World Bank, and looks briefly at what new leader Ajay Banga has done that might persuade them otherwise. (Spoiler: it won’t persuade them otherwise.)

What is Banga’s World Bank doing for us?

It has been almost a year since Wall Street veteran Ajay Banga first stepped into his new life as the head of the World Bank, following the early resignation of his Trump-appointed predecessor, David Malpass, who became something of a hate figure for climate types.

Fans of the World Bank will remember that Banga was himself a surprise appointment. Although he was beloved by his former Wall Street colleagues, development officials — who move in a different world — were puzzled why Banga, the former chief executive of Mastercard, was to be the US government’s choice to revamp the bank.

But here we are.

A year ago the World Bank was under heavy fire for not being fit for purpose — it was slow, clunky and not doing enough on the big global issues of the day, especially climate. Wealthier countries, led by the US and Germany, were pushing it to offer more concessional finance and cheap loans for climate projects, to take on more risk to free up more of its existing cash (but without losing the triple A rating) and do better at mobilising private money.

Banga has got to work. The World Bank, which has traditionally tackled the twin goals of eradicating poverty and boosting shared prosperity, has now expanded its mission to ending poverty “on a liveable planet”. It also talks more about “global public goods” — basically things that are good for the whole world, not just one particular country.

According to a G20-commissioned report published in late 2022 multilateral lenders such as the World Bank have plenty of room to take on more risk while maintaining the triple A credit rating that gives them low-cost access to the bond markets.

The World Bank has pushed through some of these suggestions. It has lowered its equity-to-loan ratio from 20 per cent to 19 per cent, allowing it to take on more risk and freeing up about $4bn a year. It has launched a portfolio guarantee programme, with shareholders able to step in and repay loans, and hybrid capital, which it can leverage. It hopes to combine these two things into a single “platform” — basically a pot of money devoted to global public goods.

There are still some big-ticket items outstanding from the G20’s report. One is to deal with the way so-called callable capital — money that can be summoned by the World Bank from shareholders in the case of an emergency — is treated by the rating agencies. Part of this involves knocking heads together at the three major rating agencies (no small task) and part involves scrutinising the terms and conditions under which the capital can actually be called.

But none of this, and Banga himself is the first to admit it, comes close to generating the trillions of dollars that people estimate are needed to pay for the energy transition in the so-called global south.

World Bank officials feel they are pushing things along as quickly as such an unwieldy bureaucracy can allow. But anyone paying attention to the pace of global warming — and this includes the senior officials of the UN’s climate change branch — wants more money, better deployed, and faster.

Lurking behind these changes at the World Bank is a cloud of resentment from many borrowing countries, who don’t want to be told what to borrow money for and see rich-world lecturing on climate change as hypocritical. Wealthy countries, including the World Bank’s biggest shareholders, have collectively pumped far more carbon into the atmosphere than the so-called global south.

In this sense, the World Bank and the debates and negotiations that happen there are a microcosm of the much broader conversations happening among climate diplomats as part of the UN’s long-running COP process.

Some smaller countries, notably the island nations, argue that high levels of debt and high borrowing costs leave them unable to cope with extreme weather events fuelled by global warming. They’re pushing for more favourable lending terms and pauses in repayment when natural disasters strike, among other things. Mia Mottley, the eloquent prime minister of Barbados, is one of their greatest assets and champions.

Other borrowing governments, notably in Africa and Latin America, argue that they need to develop their oil and gas industries to boost their economic growth. It’s difficult to ask them not to do this when US oil and gas production is currently at record highs.

What these two broad groupings of countries have in common is an argument that climate ambitions — or even dealing with the effects of rising temperatures — cost money that they do not have.

These conversations will be happening on the sidelines of the World Bank and IMF gatherings this week. Looking ahead to COP29 in Azerbaijan this November, countries will be asked to agree on a new finance goal to help low- and middle-income countries become greener. With that looming over these Spring meetings, it’s hard to imagine that pressure on the World Bank would abate any time soon.

Charted waters

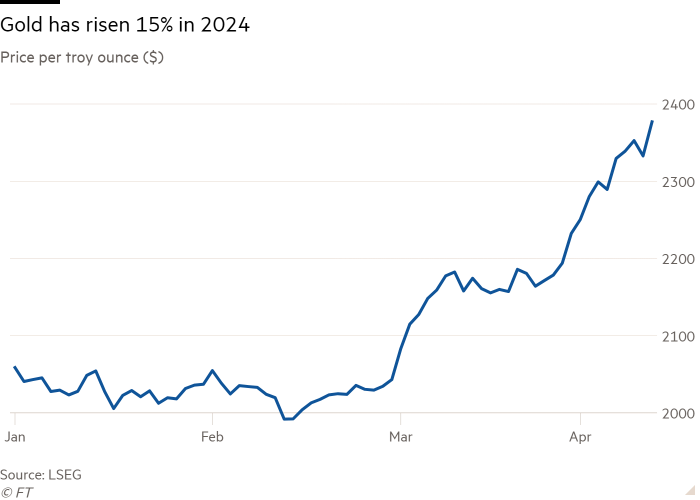

The gold price has risen 15 per cent this year. Quite a few people in the markets reckon this is a response to global inflation falling less quickly than hoped. But the cost of bullion largely flatlined during the big surge in inflation in 2021 and 2022 and historically it’s not a good inflation hedge.

Trade links

Despite surging shipments, lower prices for Chinese goods have driven down the dollar value of China’s exports, even as the country’s return to an export-led growth model raises the hackles of trading partners worldwide.

Apple’s shift in iPhone manufacturing from China to India is happening faster than many sceptics (Trade Secrets included) thought.

A new report from the Carnegie Endowment t for International Peace think-tank argues that the US has limited ability to influence the geopolitical trajectories of emerging powers including India, Brazil, Indonesia, South Africa and Turkey.

Seven years after the first edition, the EU has published a monster 700-page update on state-induced distortions in the Chinese economy (dubbed a “grievance handbook” by Trade Secrets in 2017) to help European companies bring trade complaints.

A Labour government in the UK would seek to move closer to alignment with the EU while maintaining its post-Brexit red lines of not actually rejoining the customs union or single market.

Trade Secrets is edited by Jonathan Moules

Read More: World News | Entertainment News | Celeb News

FT