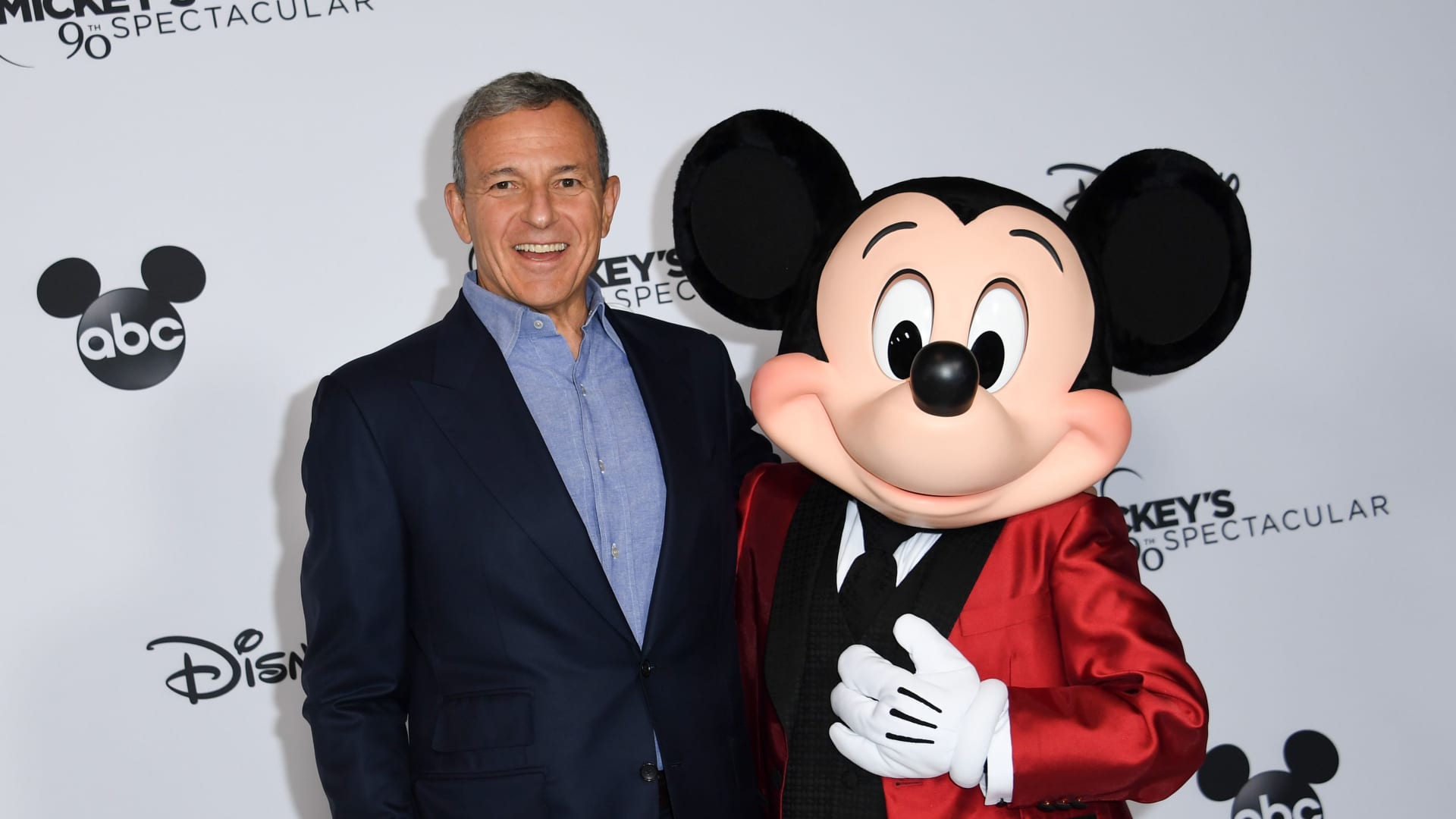

Bob Iger poses with Mickey Mouse attends Mickey’s 90th Spectacular at The Shrine Auditorium on October 6, 2018 in Los Angeles.

Valerie Macon | AFP | Getty Images

Disney shareholders on Wednesday reelected the media conglomerate’s full board, preliminary results show, handing a stinging defeat to activist Nelson Peltz and former Marvel CEO Ike Perlmutter, both of whom agitated for change at one of America’s most storied companies.

The widely expected victory caps a combative months-long process and affirms the board’s decisions, from the move to bring back CEO Bob Iger to his efforts to re-invigorate the $223 billion media company. Peltz and Trian wanted to oust two directors — Maria Elena Lagomasino and Michael Froman — citing sustained share underperformance, a failed succession process, and billions in misdirected investments.

A second activist, Blackwells, also failed to win board seats in its own long-shot bid.

“I want to thank our shareholders for their trust and confidence in our Board and management. With the distracting proxy contest now behind us, we’re eager to focus 100% of our attention on our most important priorities: growth and value creation for our shareholders and creative excellence for our consumers,” Iger said in a release.

Disney deployed significant resources in the proxy fight. The company called in support from its founding family, Star Wars creator George Lucas, JP Morgan CEO Jamie Dimon and Laurene Powell Jobs, the widow of Pixar and Apple CEO Steve Jobs.

“While we are disappointed with the outcome of this proxy contest, Trian greatly appreciates all of the support and dialogue we have had with Disney stakeholders. We are proud of the impact we have had in refocusing this Company on value creation and good governance,” Trian said in a statement.

The company also spent an estimated $40 million fighting off Peltz. The full-court press worked. Disney’s two largest shareholders, Vanguard and Blackrock, reportedly decided to back management in the final days before Wednesday’s meeting.

Ultimately, the activist failed to convince enough retail or institutional shareholders that he had a meaningful plan to fix the House of Mouse. While Peltz’s candidacy picked up meaningful support from proxy advisors and smaller institutional investors, shareholders were less compelled by former Disney CFO Jay Rasulo, whom Trian also nominated to the board.

Jay Rasulo and Nelson Peltz.

Patrick T. Fallon | Bloomberg | Getty Images | Adam Jeffery | CNBC

Peltz, who dislikes being called an activist but has orchestrated successful campaigns at iconic companies like PepsiCo, P&G and Wendy’s, controls a $3.98 billion stake in Disney, or about 2% of total shares outstanding. Most of those shares are owned by Perlmutter.

With Disney shares up nearly 50% since Peltz’s campaign first began, Trian and Perlmutter gained a lot despite their board defeat. Peltz is partially on the hook for an estimated $25 million spent on the fight, a small amount compared to the paper gains in the stake he controls.

As it moves past the battle with Peltz, Disney still faces down unprecedented challenges. ESPN has shed subscribers for years, raising questions about whether it is prepared to go toe-to-toe with streaming upstarts. Disney’s streaming business has spent billions to win subscribers and is losing money as it tries to catch up to market leader Netflix.

Perhaps most significantly, the company is searching for a successor to Iger for the second time in five years. Disney’s botched succession, where Iger’s hand-picked replacement Bob Chapek was ousted just two years into his tenure, was a key point Trian used against the company.

Nelson Peltz, founding partner and CEO of Trian Fund Management, speaks with CNBC’s Andrew Ross Sorkin on July 17, 2013 in New York.

Heidi Gutman | CNBC, NBCU Photo Bank, NBCUniversal via Getty Images

There is evidence that major proxy advisors agreed with Peltz’s argument that the board was ill-equipped to take on a second search process.

Shareholder advisory firms Glass Lewis and ISS both noted the succession issues in their recommendations to investors. Glass Lewis sided with Disney and asserted Iger’s return, paired with this year’s nominations of Morgan Stanley Chairman James Gorman and former Sky CEO Jeremy Darroch to the board, have given the company “adequate opportunity to launch a more credible succession program and develop, communicate and execute on several key initiatives which appear to reasonably target acknowledged operational and financial weaknesses at Disney.”

Investors rallied around Disney in February after the company made a series of major announcements durings its earnings call, including that it had obtained the exclusive streaming rights to Taylor Swift’s Eras Tour concert film, a $1.5 billion strategic investment in Epic Games as well as a flagship ESPN streaming service.

Peltz called the slew of announcements a “spaghetti-against-the-wall” plan that was meant to “distract shareholders.”

Shares of Disney have jumped 23% since Disney’s fiscal first quarter earnings report in early February.

Disclosure: Sky News is owned by Comcast, CNBC’s parent company.

Read More: World News | Entertainment News | Celeb News

CNBC