Andrew Bailey struck an upbeat note at this week’s gathering of economic policymakers in Washington: after three years of surging prices, UK inflation is finally on the way down.

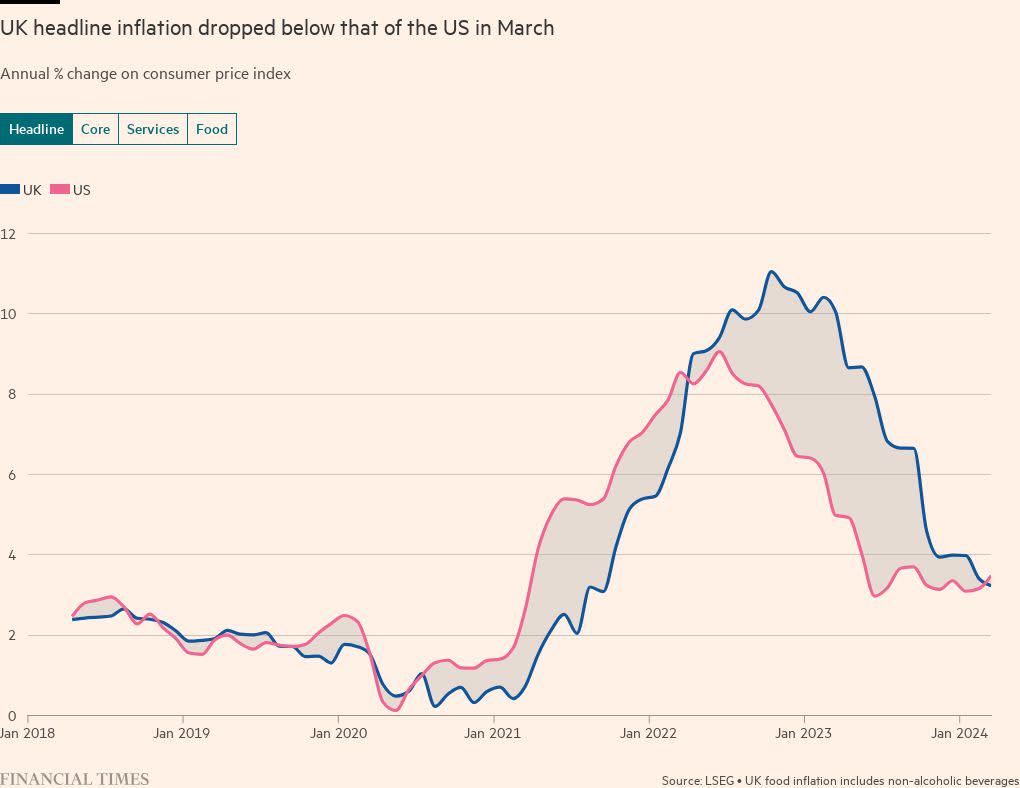

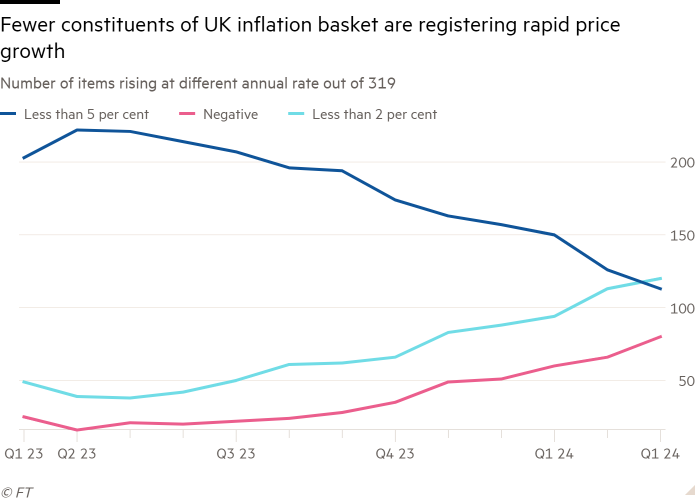

In contrast with the US, where the Federal Reserve now looks likely to delay interest rate cuts as both economic growth and inflation are stronger than expected, the Bank of England governor said there was “strong evidence” that the process of disinflation was “working its way through”.

“The dynamics for inflation are rather different now, between Europe . . . and the US. I think there’s more demand-led inflation in the US than we’re seeing,” he said on Tuesday.

But official data released just hours after Bailey spoke will give at least some members of the BoE’s Monetary Policy Committee pause for thought.

It showed that UK inflation eased by less than expected in March, falling from 3.4 per cent to 3.2 per cent rather than the 3.1 per cent analysts had forecast.

Annual growth in the price of services, which BoE policymakers view as a better measure of underlying inflationary pressures in the economy, also slowed by less than expected, from 6.1 per cent to 6 per cent.

Labour market data released earlier in the week also pointed to lingering wage pressures that could continue to fuel prices in the coming months.

An uptick in oil prices, while not yet a source of serious alarm, could also become a bigger headwind if tensions in the Middle East worsen.

All this has fuelled doubts over the prospect of early UK rate cuts. Market pricing now suggests the BoE will not start to cut its benchmark rate from its current 16 year high of 5.25 per cent until September or November — similar to expectations for the first move from the Fed. Little more than a week ago, traders were betting the MPC would cut as early as June.

Elizabeth Martins, senior UK economist at HSBC, said that if the aim of Bailey’s comments was to convince investors that the UK did not face the same risks as the US of inflation reaccelerating, “this morning’s figures did not help”.

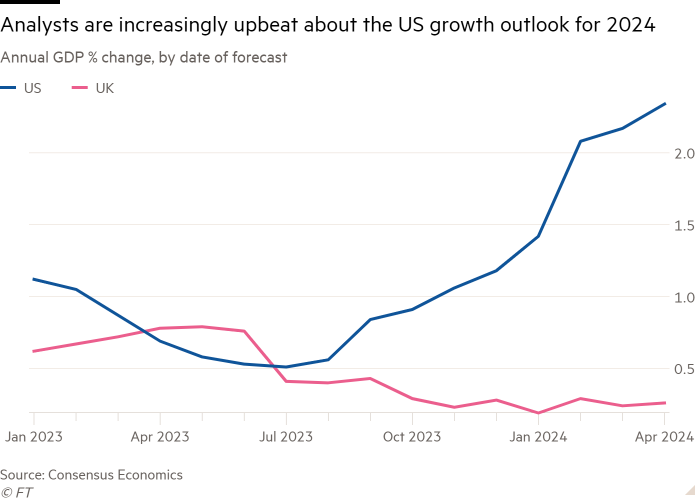

Yet she and other economists said that even if price pressures took longer than expected to subside, the BoE’s position was very different from that of the Fed, with UK inflation still on a downward trajectory, albeit a slower one.

“All in all, we think a healthy dose of perspective is required . . . the big picture remains one of disinflation,” said Gabriella Willis, economist at Santander.

At 3.2 per cent, UK headline inflation is now lower than the latest US reading of 3.5 per cent for the first time in three years, helping Britain shake off its position as an international outlier, even if the measures are not strictly comparable.

The reasons for inflation remaining sticky also differ.

In the UK, policymakers think lingering price pressures largely reflect supply side constraints — in particular, rising ill health in the workforce — that has kept the labour market tight and wage growth strong. In the US, prices are fuelled by the strength of consumer demand.

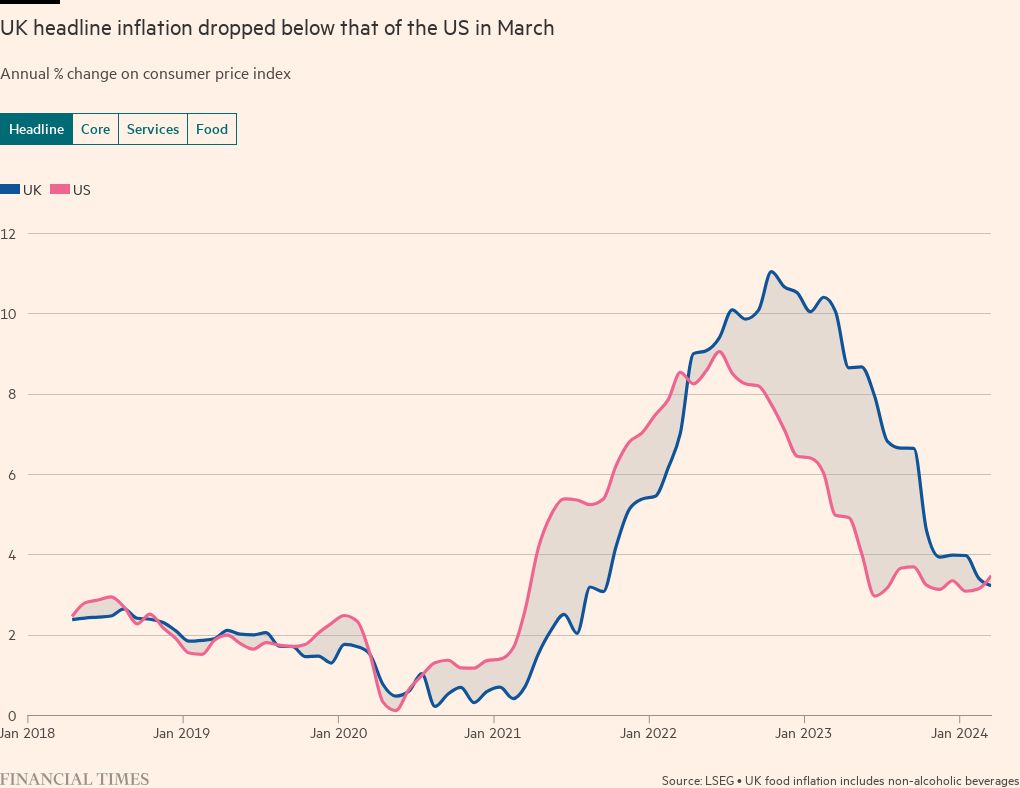

The IMF said on Tuesday that the US economy will grow by 2.7 per cent this year, in contrast with a small expansion of 0.5 per cent in the UK.

Claire Lombardelli, chief economist at the OECD, told the House of Commons Treasury select committee on Tuesday that the divergence between a strong US economy and weaker European ones was the biggest recent change in the global outlook.

“The outlook for US interest rates and US inflation and growth is quite markedly changed now,” said Lombardelli, who will join the BoE’s MPC in July.

“I’m not going to put a date on when I expect the UK to start the process of loosening monetary policy, but it is clearly the case that will be the direction of travel,” she added.

While economists differ on when the first UK rate cut will come, most said Wednesday’s inflation data would not be a barrier to the BoE making a first move as soon as June, or in August or the early autumn.

Even if an economic upswing gains momentum, “we still think that the recovery won’t be strong enough to prevent inflation from falling”, said Ruth Gregory, deputy chief UK economist at consultancy Capital Economics. “The big difference is that the UK economy is not as strong as the US and activity is picking up from a weaker starting point,” she added.

The big question, however, is whether the BoE will feel comfortable pressing ahead if the Fed remains on hold, even if the outlook for domestic inflation justifies it.

Bailey, like Christine Lagarde at the European Central Bank, has been keen to signal that the BoE will set its own course.

But Simon French, head of research at investment bank Panmure Gordon, said it would be “uncomfortable” for the BoE if divergence from US monetary policy led sterling to weaken against the dollar to a degree that could “invite more inflation, rather than less”.

“It is all very well setting policy based on domestic inflationary dynamics,” he said, referring to recent comments by Bailey and Lagarde. He added: “I don’t think markets really believe them. That is the problem.”

Read More: World News | Entertainment News | Celeb News

FT