Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Good morning. We start the week with news that companies are rushing to meet their financing needs before the US election, in a bid to get ahead of potential market volatility in the final stages of the presidential race.

Corporate borrowers have issued $606bn worth of dollar bonds this year, according to data from LSEG, up by two-fifths compared with the same period in 2023 and the highest total since at least 1990.

Bankers and investors said companies were motivated to borrow by the lowest spreads in years — referring to the difference between US corporate debt yields and those of equivalent government bonds.

But they added that the prospect of a close election had pushed companies to bring forward their plans, rather than risk running into potentially more expensive markets later in the year. Here are more details on what companies from Morgan Stanley to Ford are doing.

And here’s what else I’m keeping tabs on today:

-

Economic data: S&P Global publishes its manufacturing purchasing managers’ indices for the US, Russia, Canada and Greece.

-

Israel: Demonstrations against Benjamin Netanyahu are set to continue until Wednesday after tens of thousands of Israelis rallied in Jerusalem last night in the biggest protest against the prime minister’s rightwing government since the start of the war against Hamas.

-

Easter Monday: Financial markets are closed in the UK, France, Germany and Italy.

-

UK policies: Today marks the start of a phased rollout of free childcare for children below the age of three, a cut to the energy watchdog’s price cap and an increase in the minimum wage.

Five more top stories

1. Exclusive: Regulators in two US states are pushing insurers to cut exposure to 777 Partners, according to an official memo seen by the Financial Times. Their demands are the latest fallout from a dealmaking spree in which the Miami investment firm bought sports teams around the world, and comes as it is bidding for English Premier League club Everton. Here’s why the states believe their move would protect retirees, widows and orphans relying on annuities and other insurance products.

2. Thames Water’s owners will start urgent restructuring talks in the coming days as parent company Kemble risks entering insolvency within weeks unless lenders agree to a debt-for-equity deal, according to people familiar with the matter. Alvarez & Marsal, the restructuring experts, will discuss all options with creditors, which include bank lenders and bondholders, as the government tries to avoid a temporary renationalisation of the UK’s largest water utility. Read the full story.

-

The FT View: Thames Water is a cautionary tale about England’s failed experiment with privatising natural monopolies, writes the FT’s editorial board.

3. Russian disinformation to undermine support for Ukraine in Europe has grown significantly in scale, skill and stealth, one of Germany’s most senior diplomats has warned. “It is absolutely a threat we have to take seriously,” Ralf Beste, head of the department for culture and communication at Germany’s Federal Foreign Office, told the FT. Here’s why Moscow’s campaigns have become harder to combat.

-

EU defence: The chief of Germany’s largest military contractor Rheinmetall told the FT that European countries should ditch their preference for national champions and build bigger, more specialised defence groups to compete with US rivals.

4. Recep Tayyip Erdoğan’s ruling party suffered a resounding defeat in Turkey’s local polls, leaving the president facing his most severe electoral setback since his rise to power two decades ago. The opposition was on course to score decisive mayoral victories in Istanbul, Ankara, Izmir, Bursa and Antalya, according to initial results. Here’s more on what the outcome means for the strongman and his party.

5. Exclusive: Labour plans to abolish all hereditary peers in the UK House of Lords in its first term in power but will allow the ousted legislators to retain access to the Palace of Westminster as a sweetener, according to party insiders. Sir Keir Starmer has previously branded the unelected chamber, where 92 seats are reserved for British aristocrats, “undemocratic” and “indefensible”. Lucy Fisher has more details.

-

More on Labour: Deputy party leader Angela Rayner has likened Labour peer Lord Peter Mandelson’s criticism of her employment reforms to “squealing” by business when the minimum wage was introduced.

-

Tories and Christianity: As the Conservative party shifts rightward, a clutch of vocal Tories have placed religion at the heart of a number of policy debates in Westminster.

For more on UK politics, sign up for our Inside Politics newsletter by Stephen Bush

The Big Read

Saudi Arabia wants mining to contribute $75bn to its economy by 2035, up from $17bn. Oman has started building what could be the world’s largest green steel plant that plans to use iron ore from Cameroon. Qatar’s sovereign wealth fund is now Glencore’s second-biggest shareholder. Hungry to diversify their economies beyond fossil fuels, Gulf nations are redirecting petrodollars to secure minerals used in the green transition — and becoming a new force in the global mining sector.

We’re also reading . . .

-

Conflicts of interest: Kim Kardashian’s run-in with regulators as a “finfluencer” provides lessons on an age-old problem in finance, writes Patrick Jenkins.

-

AI hype: DeepMind co-founder Sir Demis Hassabis tells the FT that money flooding into artificial intelligence has resulted in some crypto-like hype and “grifting” that clouds the field’s “phenomenal” scientific progress.

-

Israel: Oxford professor Avi Shlaim, the eminent and controversial Israeli historian, speaks to Henry Mance about the Jewish state’s war in Gaza.

-

Labour’s challenge: It will be hard for the UK economy to get any worse, but the bad news facing the next government is that it will also be hard to make it much better, writes Martin Wolf.

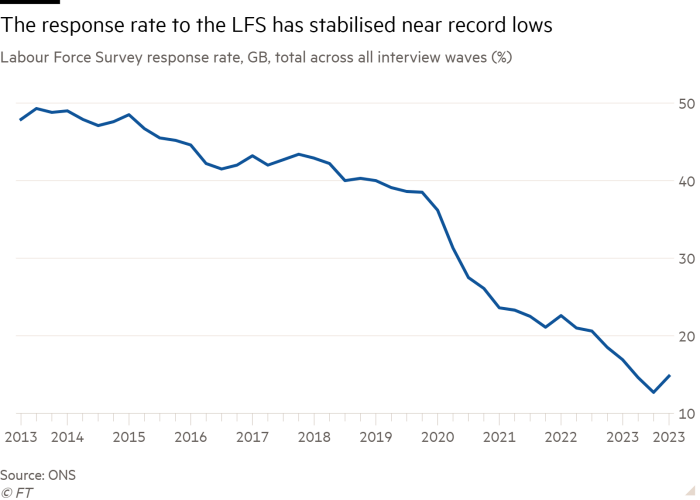

Chart of the day

In the UK, fewer people are willing to participate in door-to-door surveys, creating “a problem with the quality of the statistics”, said the Treasury’s chief economic adviser. There are similar problems in the rest of Europe and across the Atlantic, where issues with jobs data are raising doubts about their use in interest rate decisions.

Take a break from the news

What is the point of private members’ clubs? From restrictive membership policies to elitism and overexpansion, London clubland is under fire. Joy Lo Dico explains why people are still queueing to get in.

Additional contributions from Benjamin Wilhelm

Read More: World News | Entertainment News | Celeb News

FT