Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For the first demonstration flight of its C919 passenger jet outside China, state-backed aircraft maker Comac headed to Singapore — a clear sign that the would-be rival to Boeing and Airbus saw south-east Asia as its best opportunity for overseas sales.

“It can lay out a foundation for [our] up-and-coming south-east Asian market,” Comac said in a statement on Chinese social media. After Singapore, the company headed to Vietnam, Laos, Cambodia, Malaysia and Indonesia.

With up to an estimated $72bn of state-related support over the past 15 years, the development of the single-aisle aircraft is seen as a big step forward for President Xi Jinping’s vision of moving China up the value chain in technology and providing more of a challenge to its western rivals — particularly at a moment when Boeing’s safety record is under scrutiny after a door panel blew out on a plane in January.

“The C919 has a strong opportunity to gain market share, particularly in its domestic market,” said Mike Yeomans, director of valuations and consulting at aviation consultancy IBA, noting that rival aircraft from Airbus and Boeing are sold out for most of this decade. But he added: “The immediate challenges for Comac are around production, to meet local demand and certification to penetrate international markets.”

Since the C919’s inaugural commercial flight in May last year, only five aircraft have come into service domestically, all of them delivered to majority state-owned China Eastern Airlines. The Chinese market is the biggest near-term opportunity for the C919, Yeomans said.

While the C919 is yet to be certified by aviation authorities in Europe and the US and is only able to operate commercially in China, aviation analysts said regulators in some south-east Asian, African and Latin American countries might approve it more quickly. Indonesia’s TransNusa, partly owned by China Aircraft Leasing Group, is already operating two of Comac’s smaller ARJ21 aircraft.

“If an airline deploys a Comac jet to fly to countries whose regulators have certified the aircraft, there’s no reason for potential buyers to bother about what the US or EU says,” said Shukor Yusof, founder of aviation consultancy Endau Analytics.

The timeline for European and US certification is still unclear. This means that despite the scrutiny of Boeing, Airbus is much more likely than Comac to take advantage, said Xiaowen Fu, a professor at Hong Kong Polytechnic University who specialises in transport economics.

Fu also noted that the C919’s production rate was still growing slowly. While Comac said it had received 1,061 orders as of last year from domestic Chinese airlines and leasing companies, it is still only likely to deliver nine aircraft this year, according to IBA.

IBA said the rate could rise to 70 a year by the end of the decade, but even that would still equate to less than one month of Airbus’s narrow-body production.

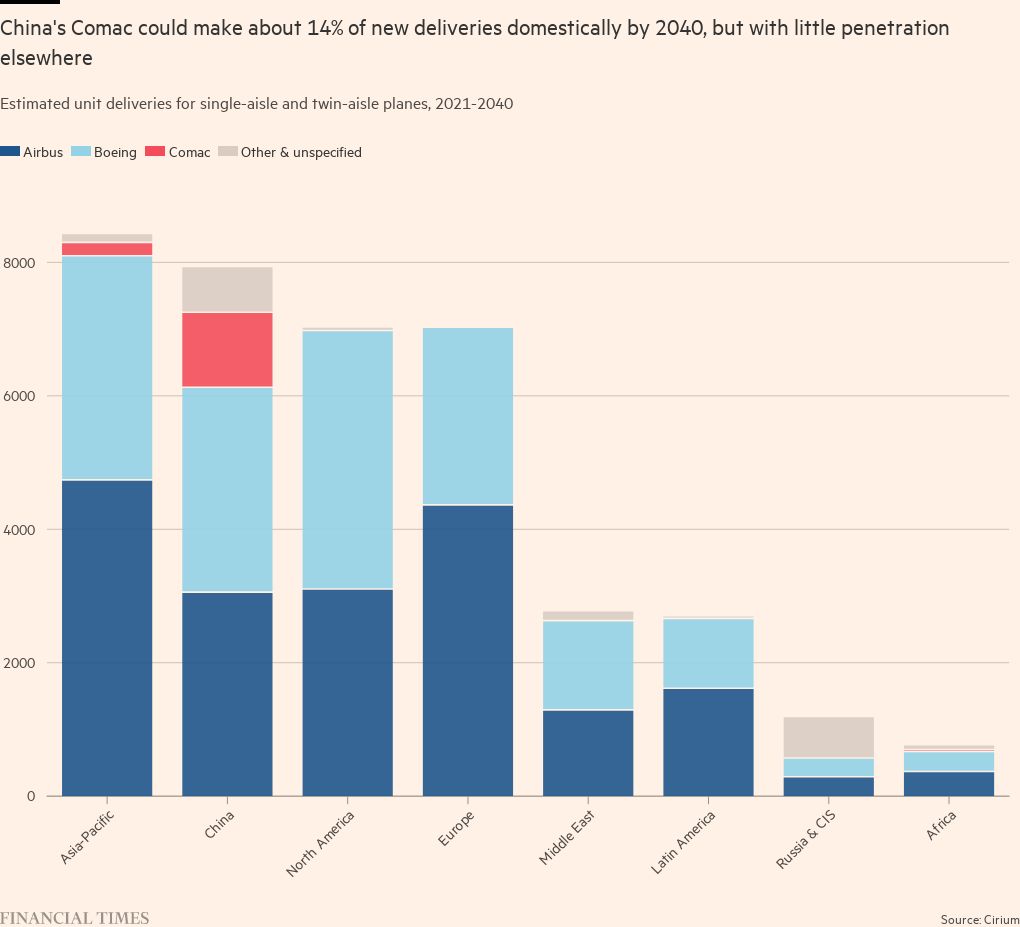

The jet could take an approximate 8 per cent share of the Chinese narrow-body jet market and just a 1.2 per cent share globally by 2030 if Comac is able to “ramp up production successfully”, IBA added.

For Comac to compete with Airbus or Boeing on a global scale, “it’s probably going to take 20 years”, said Willie Walsh, head of the International Air Transport Association. “They will be a significant player in the market, but it will . . . take time for there to be a genuine international interest.”

Two Asia-based aircraft leasing companies told the Financial Times that they were hesitant to buy the C919 in bulk because of the lack of international certification and uncertain client demand.

Comac — which did not respond to requests for comment — appears to be taking a cautious approach in increasing production as “any major safety issue would be a massive setback”, said Max Zenglein, chief economist at the Mercator Institute for China Studies.

Still, others said Comac, with its massive state backing, would be able to expand its output in time.

“Never underestimate China’s ability to ramp up production,” said Yusof of Endau Analytics. “It has no labour shortage unlike Airbus and Boeing, and more importantly, it has the cash.”

But for Comac to produce aeroplanes “consistently and safely . . . [it] won’t be as easy as making EVs or mobile phones”, especially when the C919 is still heavily dependent on foreign suppliers, he added.

Comac is highly reliant on western suppliers for key components including engines supplied by the Franco-American venture CFM International and auxiliary power units supplied by US-based Honeywell, making it vulnerable to geopolitical tensions, analysts said.

While Chinese manufacturers want to replace some western components with domestically made alternatives, analysts said it would take years for them do so in a way that met international commercial aviation safety standards.

The US and UK still dominate commercial jet engine production, said Richard Aboulafia, managing director of AeroDynamic Advisory.

“Realistically, Comac is in no position to threaten Airbus and Boeing,” said Yusof. “But time is on its side.”

Additional reporting by Wenjie Ding in Beijing and Arjun Neil Alim in Berlin

Read More: World News | Entertainment News | Celeb News

FT