Republican presidential candidate and former U.S. President Donald Trump gestures as he takes the stage at his caucus night watch party in Des Moines, Iowa, U.S., January 15, 2024.

Evelyn Hockstein | Reuters

DAVOS, Switzerland — Global business leaders may be in the snowy hills of Switzerland, but their conversations keep returning to Washington, D.C.

The topic of Donald Trump has dominated dinners and parties at Davos, with many in attendance at the World Economic Forum mulling the former president’s potential return to the White House after his resounding Iowa caucus victory.

Several business executives have noted a theme in their private discussions during the summit: U.S. industry leaders seem overwhelmingly nonplussed with a second Trump term, while foreign chief executives are terrified — particularly of restrictions on immigration and potential global conflicts.

One prominent U.S. business executive, who asked not to be named because his discussions with foreign leaders were private, said some of the fear may be due to a lack of understanding of the checks and balances built into the U.S. government.

“I’m not sure Europeans understand how weak executive orders are,” that person said. “We have a justice system. Congress will probably be divided. It’s right to be cautious, but it won’t be the end of the world.”

Another U.S. bank CEO privately expressed annoyance with media exaggeration of the threat of a Trump presidency, stressing he’s “all bark and no bite.” The bank chief also dismissed Trump’s refusal to accept the results of the 2020 election as bloviation.

“He’s going to win the presidency,” the CEO predicted. “Many of his policies were right.”

2024 predictions

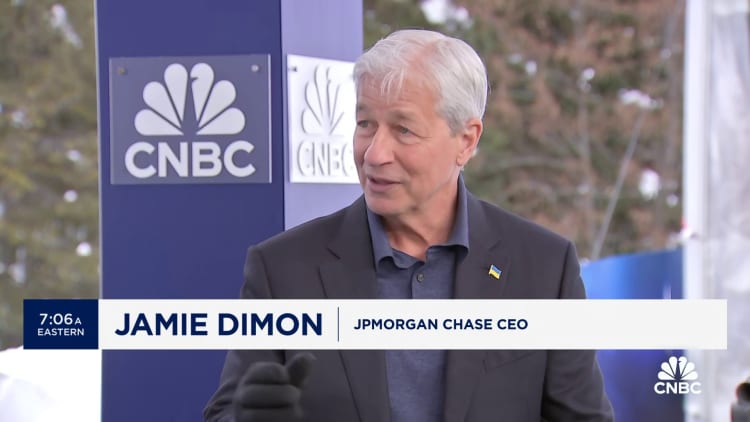

Jamie Dimon, President & CEO,Chairman & CEO JPMorgan Chase, speaking on CNBC’s Squawk Box at the World Economic Forum Annual Meeting in Davos, Switzerland on Jan. 17th, 2024.

Adam Galici | CNBC

While JPMorgan Chase CEO Jamie Dimon wouldn’t predict a Trump victory, he echoed his fellow bank CEO’s comments in an interview Wednesday on CNBC’s “Squawk Box.”

“Just take a step back, and be honest. He was kind of right about NATO. He was kind of right about immigration, he grew the economy quite well. Trade. Tax reform worked. He was right about some of China,” said Dimon. “I don’t like how he said things about Mexico, but he wasn’t wrong about some of these critical issues. And that’s why they’re voting for him.”

Still, while Dimon also echoed the sentiment that an apocalypse is unlikely, he did note he hopes “the country survives” with either the reelection of President Joe Biden or the return of Trump to the White House, even as some fear American democracy would be threatened by his return.

“I will be prepared for both, we will deal with both, my company will survive and thrive in both,” Dimon said.

One partner at a large global private equity firm said privately he’s been surprised by the lack of concern among U.S. executives given Trump’s refusal to accept his election defeat in 2020 and the subsequent U.S. Capitol riot of January 6, 2021.

Another former Trump administration official said there’s more reason for concern this time around because many of the people that kept Trump’s damaging urges in check won’t be working with him if he returns to office.

Steve Schwarzman, Chairman, CEO & Co-Founder Blackstone Group, speaking on CNBC’s Squawk Box at the World Economic Forum Annual Meeting in Davos, Switzerland on Jan. 17th, 2024.

Adam Galici | CNBC

Blackstone CEO Stephen Schwarzman expressed another common theme among executives — that both Trump and Biden are flawed choices.

“I think we have an interesting presidential election now, where there are very high negatives, as you know, for both candidates,” Schwarzman said, adding he’s waiting to see how things play out. “I’m not into the hypothetical world yet as much as you’d like me to be. And we’ll see what happens. There are always surprises in these elections.”

Ben Smith, co-founder of business news outlet Semafor, told CNBC on Thursday he’s heard from many at Davos that Trump is likely to win — but given the poor track record of Davos predictions in years past, that may actually be an indicator for Biden.

Smith and several other Davos attendees noted that predictions made at the World Economic Forum have historically turned out false, including past comments about recession outlooks and the likelihood of Trump winning the presidency in 2016.

“This year it is an absolute item of faith that Donald Trump will be elected president of the United States, which I think is great news for Joe Biden,” Smith said in an interview on “Squawk Box.”

Cross-country

While Wall Street executives were open and preparing for a Trump victory in 2024, various technology leaders either refused to comment on Trump or downplayed what others viewed as a potential threat to the U.S. government.

“Obviously the U.S. government is a large customer of Salesforce, and depending on who’s in office creates a whole stir with a different part of our employee base,” said Marc Benioff, Salesforce‘s CEO, in an interview on Tuesday with Bloomberg’s Brad Stone. “But the reality is, hey, we are the same company, regardless of when that election is going to occur. And regardless of who that president will be.”

Marc Benioff, co-founder, chairman and CEO Salesforce, speaking with CNBC’s Sara Eisen at the World Economic Forum Annual Meeting in Davos, Switzerland on Jan. 17th, 2024.

Adam Galici | CNBC

OpenAI CEO Sam Altman, who also spoke with Stone, expressed similar sentiments.

“I think elections are, you know, huge deals. I believe that America is gonna be fine,” Altman said. “No matter what happens in this election.”

Nasdaq CEO Adena Friedman said it’s simply too early to focus on what Trump may or may not mean for the country this time around.

“Honestly, I think they need to see how the primaries shake out,” Friedman said.

WATCH: Jamie Dimon’s full interview with CNBC’s Squawk Box

Read More: World News | Entertainment News | Celeb News

CNBC