Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

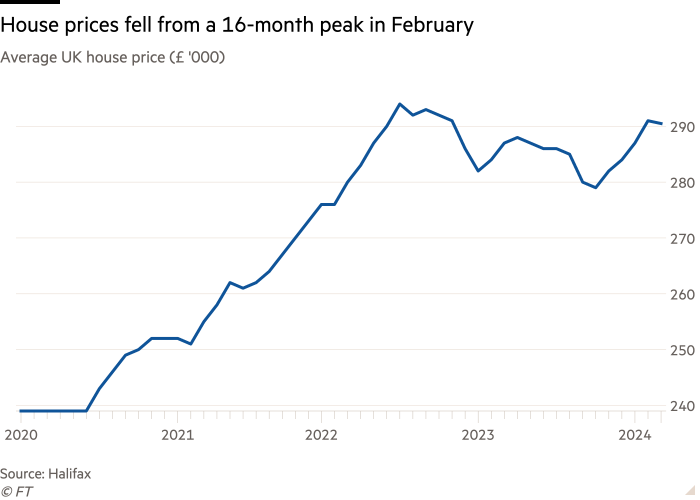

UK house prices fell for the first time in six months in March, according to the lender Halifax, surprising economists and adding to signs of inconsistency in the property market recovery.

The average house price fell 1 per cent month on month in March, down to £288,430 from February, when UK house prices hit a 16-month high of £291,338. The drop ended five consecutive months of increases.

The Halifax data also showed that prices in March were 0.3 per cent higher than a year earlier, a much smaller annual rise than the 1.45 per cent forecast by economists in a Reuters poll.

“Affordability constraints continue to be a challenge for prospective buyers,” said Kim Kinnaird, director of Halifax mortgages. “House prices have shown surprising resilience in the face of significantly higher borrowing costs.”

The figures align with data from mortgage provider Nationwide this week, which also showed an unexpected drop in house prices in March. Meanwhile, mortgage approvals rose in February to a 17-month high, according to separate figures released by the Bank of England this week.

Despite the monthly fall, Kinnaird said she remained optimistic about the market, with the data reflecting improvements in the UK’s cost of living crisis.

“The broader picture is that house prices are up year on year, reflecting the opposing forces of an easing cost of living squeeze — now that pay growth is outpacing general inflation — and relatively high interest rates,” Kinnaird said.

Some analysts said the fall in house prices registered by the Nationwide and Halifax indices was a reflection of rising mortgage rates in March, up from what BoE data this week showed was a six-month low in “effective” interest rate — the actual interest rate paid — in February.

“I think what we are seeing in the house price data out this week is that mortgage rates ticked up in March, probably back up to 5 per cent from 4.5 [per cent] in February, and those higher rates are weighing on price,” said Andrew Wishart, senior economist at research company Capital Economics.

Economists said continued changes in house prices would depend upon the future path of interest rates, which stand at a 16-year high of 5.25 per cent and influence how lenders set mortgage rates.

Jonathan Haskel, a BoE policymaker, told the Financial Times last month that he thought cuts to the cost of borrowing were “a long way off” because of underlying inflation.

“Mortgage rates will fall only gradually from here, with markets expecting the Bank of England to ease restrictions on policy slowly,” said Rob Wood, chief UK economist at consultancy Pantheon Macroeconomics. “This means affordability will be stretched, and that should limit house price rises.”

Still, there are signs that relief for homebuyers may come sooner. A recent BoE poll of UK businesses showed that wage growth expectations hit a two-year low in March, supporting the view that the central bank will start to cut rates from this summer.

Wishart said that if the BoE’s benchmark fell more quickly towards the end of 2024, “we will see mortgage rates come down below 4 per cent, and a near-term flatlining in house prices”.

Read More: World News | Entertainment News | Celeb News

FT