The following content is sponsored by Allegiance Gold.

From Traditional Investment to Diversification and Everything in Between

Governments, banks, and wealth generators: everyone wants it, but very few have been willing to educate you about it? Why is that?

At some point in time, we all heard the saying “diversification is key to a better portfolio.”

While financial advisors provide guidance on diversifying investments across various paper assets and ETFs, the true meaning of diversification extends beyond conventional wisdom to include embracing a broader spectrum of opportunities in different asset classes beyond paper and ETFs to mitigate risks in the market while preserving and growing your wealth over time.

So, why aren’t financial advisors always recommending physical gold to you?

Well, to start with, financial advisors can be compensated through various methods, each with its own set of incentives and potential conflicts of interest:

- Commission-Based: Advisors earn a commission for selling specific financial products, such as mutual funds, insurance policies, or annuities. This model may lead to recommendations that prioritize products with higher commissions rather than the client’s best interests.

- Fee-Based: Advisors charge a fee based on a percentage of the client’s assets under management (AUM).

- Hourly or Flat-Fee: Advisors charge clients based on the time spent on financial planning or a flat fee for specific services.

- Hybrid Models: Advisors may combine various compensation structures to offer a mix of services and products tailored to individual client needs.

Although financial advisors’ level of expertise in the paper asset world is supreme, their deficiency of recommendations of physical assets like gold often stems from two factors:

- Lack of Understanding: Many advisors may not fully understand the benefits and risks associated with investing in physical gold. As a result, they may default to recommending traditional asset classes they are more familiar with.

- Limited Compensation Opportunities: Unlike financial products like stocks, bonds, or mutual funds, physical gold doesn’t generate ongoing commissions or fees for advisors. This may disincentivize them from promoting gold as an investment option.

Now one might say, shouldn’t investors take it upon themselves to protect their hard-earned money by including gold in their portfolio regardless of whether it was recommended to them or not?

Well, simply put: No one wants additional tasks added to their busy schedule. We all have better things to worry about, right? So, they end up compromising by seeking the help of their financial advisor.

But not today, not anymore!

If you are tired of hearing promises about traditional investments and forecasts about where the market could be heading, you are not alone and probably you are looking for ways to protect and diversify your portfolio without the hassle of a financial expert.

If this is the case with you, then this educational piece is for you.

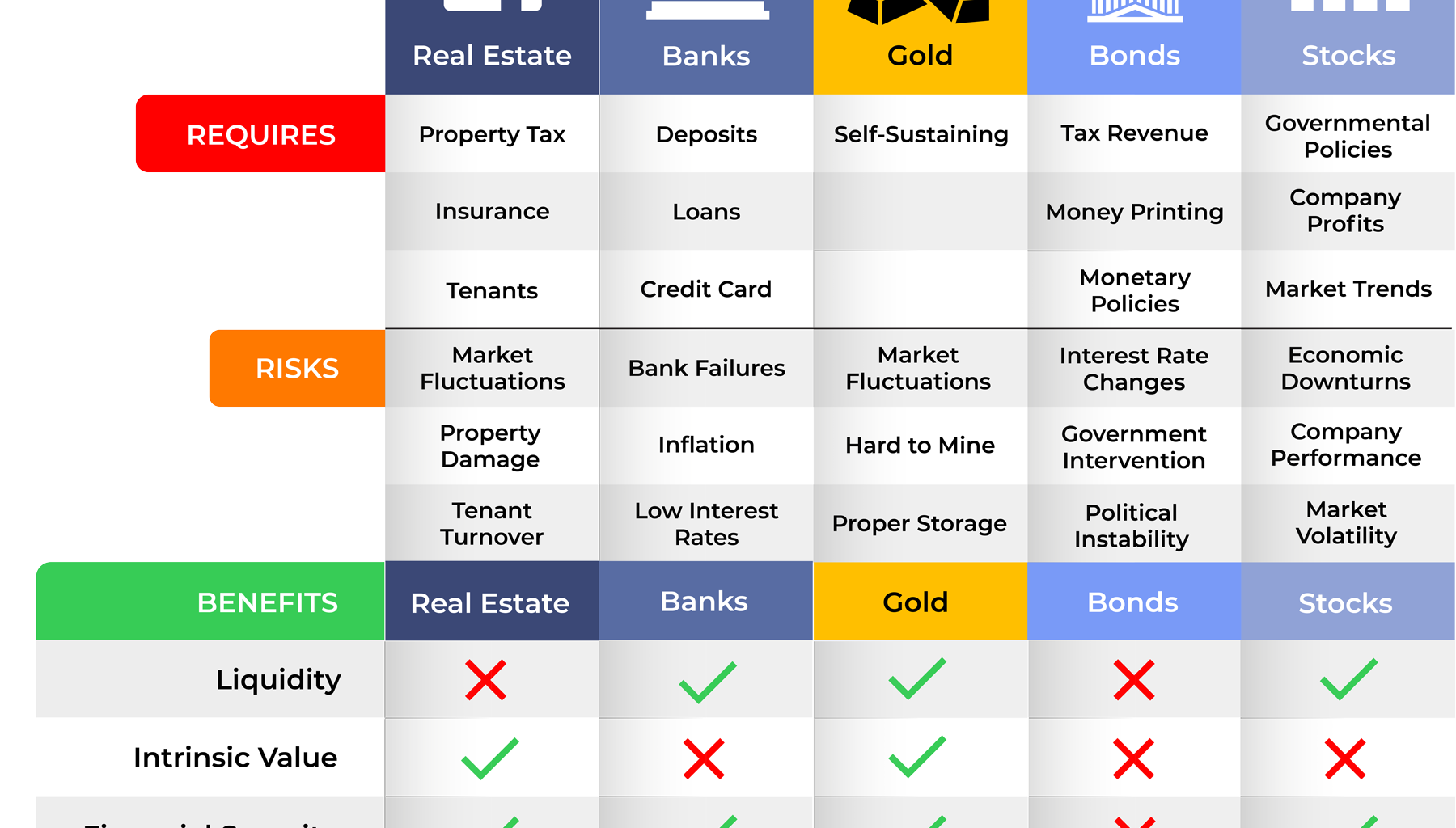

In today’s volatile economic landscape, finding a secure and reliable investment is more crucial than ever. While traditional investments like real estate, stocks, government bonds, and bank certified deposits have their merits, they also come with their own set of challenges and dependencies.

Real Estate

- Dependencies: Tenants, repairs and maintenance, property tax payment, insurance, utilities

- Risks: Market fluctuations, property damage, tenant turnover

Stocks

- Dependencies: Companies’ revenue, consumer purchasing index, market trends, government policies

- Risks: Economic downturns, company performance, market volatility, trend obsoleteness.

Government Bonds

- Dependencies: Government policies, tax revenues, printing money

- Risks: Interest rate changes, inflation, political instability

Bank Certified Deposits

- Dependencies: Consumer deposits, loans lending, credit card usage

- Risks: Bank failures, inflation, low-interest rates

Now what about Gold?

The Intrinsic Value of Gold: A Self-Sustaining Asset

- Dependencies: Unlike traditional investments, gold stands apart as a self-sustaining asset that doesn’t rely on external factors or dependencies to build its intrinsic value

- Risks: Hard to mine, market fluctuations

Key Benefits of Investing in Gold

- Intrinsic Value: Gold possesses inherent value and is not tied to the performance of any company, government, or economic indicator.

- Financial Security: Gold acts as a hedge against inflation, currency devaluation, and economic uncertainty, preserving your wealth and purchasing power.

- Portfolio Diversification: Gold adds stability and balance to your investment portfolio, reducing overall risk and enhancing long-term returns.

- Liquidity: Gold is easily convertible to cash without losing its value, providing liquidity when needed.

To help educate you on how simple it is to start your gold investment without the hassle of financial experts, Allegiance Gold is offering you this complimentary FREE comprehensive educational E-Book: “The Power of Gold: A Guide to investing in precious metals” to learn more about how gold can transform your investment strategy and diversify your financial future.

Read More: World News | Entertainment News | Celeb News

Breitbart