Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Good morning. We start today with the latest Big Tech results as earnings season continues.

Alphabet’s first-quarter revenue jumped 15 per cent, buoyed by a rise in earnings across its main business lines, and the company announced its first-ever dividend of 20 cents a share alongside a $70bn stock buyback.

Revenue at Google’s parent company rose to $80.5bn, beating analysts’ expectations for $79bn, according to a filing yesterday. Earnings per share reached $1.89, up from $1.17 last year and exceeding the average $1.53 estimate.

Shares rose as much as 13 per cent in after-hours trading, positioning Alphabet to add more than $250bn to its market capitalisation and push above $2tn, where it would join “Magnificent Seven” peers Microsoft, Apple and Nvidia. Microsoft also reported better than expected earnings on Thursday.

Alphabet chief executive Sundar Pichai said the quarter represented a “strong performance from Search, YouTube and Cloud” and that Google was “well under way with our Gemini era”, referring to its generative artificial intelligence large language model. Here’s more from the tech giant’s results yesterday.

-

Microsoft: AI helped boost the company’s cloud sales past analysts’ forecasts, with shares up 4.4 per cent in after-hours trading.

-

Elon Musk’s xAI: Sequoia Capital, Silicon Valley’s best-known venture capital firm, has committed to investing in the billionaire’s AI start-up.

-

Meta: The midweek whiplash for the company’s shareholders on its AI spending speaks volumes about how fast the focus of competition has shifted in the tech world, writes Richard Waters.

Here’s what else I’m keeping tabs on today and over the weekend:

-

Economic data: Consumer confidence data is released today in France and the UK, which also publishes insolvency statistics for England and Wales.

-

Companies: Chevron, ExxonMobil, TotalEnergies and NatWest are among the companies reporting results today, while Pearson has a trading update.

-

South Africa: The country marks the anniversary of the first multiracial elections after apartheid in 1994 with Freedom Day tomorrow.

-

G7: Ministers in the grouping meet in Turin on Sunday to discuss action on the ongoing climate, energy and environment crisis.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. Emmanuel Macron has warned that the EU is facing a “mortal” threat from economic decline, rising illiberalism and the return of war caused by Russia’s full-scale invasion of Ukraine. The French president sketched an at times dark portrait of the challenges facing Europe and made the case for radical changes in the bloc’s defence, monetary and investment policies. Here’s more from his speech at Sorbonne University yesterday.

2. Investors have scaled back bets on US rate cuts before the presidential election, dealing a blow to President Joe Biden’s hopes of lower borrowing costs before he is set to face Donald Trump. According to futures contracts, investors are no longer fully confident that the Federal Reserve will deliver its first quarter-point reduction by September and instead expect such a move immediately after the November 5 election. Here’s why.

-

European rates: The European Central Bank is likely to need extra rate cuts if global borrowing costs are pushed up by the Fed maintaining its restrictive monetary policy stance, the head of Italy’s central bank has said.

3. The private sector will continue to play an important role in Labour’s promised state-owned UK railways after it decided against nationalising the companies that own the thousands of trains that run on the network. Rolling stock companies, or roscos, operate out of sight of passengers but are the financial backbone of the rail industry, and have spent the past 30 years buying passenger trains and leasing them to privatised train operators. Read the full story.

-

Teesside: Levelling up secretary Michael Gove should order the UK’s public spending watchdog to investigate the finances of the controversial Teesworks regeneration project, a cross-party group of MPs said today.

-

Labour’s outlook: Most agree Sir Keir Starmer’s party will inherit an economically and financially challenging Britain, writes Chris Giles, but here’s what could go right.

4. A US ban on non-compete agreements has left Wall Street businesses rushing to restructure contracts and find new ways to tie down the high-priced personnel that their business models rely on. The Federal Trade Commission voted on Tuesday to invalidate existing contracts for most employees and for all new contracts starting in August. Here’s how employers and industry groups have reacted.

5. South Korea has warned that the US subsidy scheme for electric vehicles is at risk of “collapse” due to its aim of eliminating “foreign entities of concern” — include Beijing-linked companies — from the supply chain. China’s control over graphite, a crucial battery material, will make it nearly impossible for any EV makers to qualify for the scheme at the heart of President Joe Biden’s flagship green legislation, South Korea’s trade minister said in an interview with the Financial Times.

-

More US-China rivalry: Washington is pushing allies in Europe and Asia to tighten restrictions on chip-related exports to China amid rising concerns about Huawei’s development of advanced semiconductors.

The Big Read

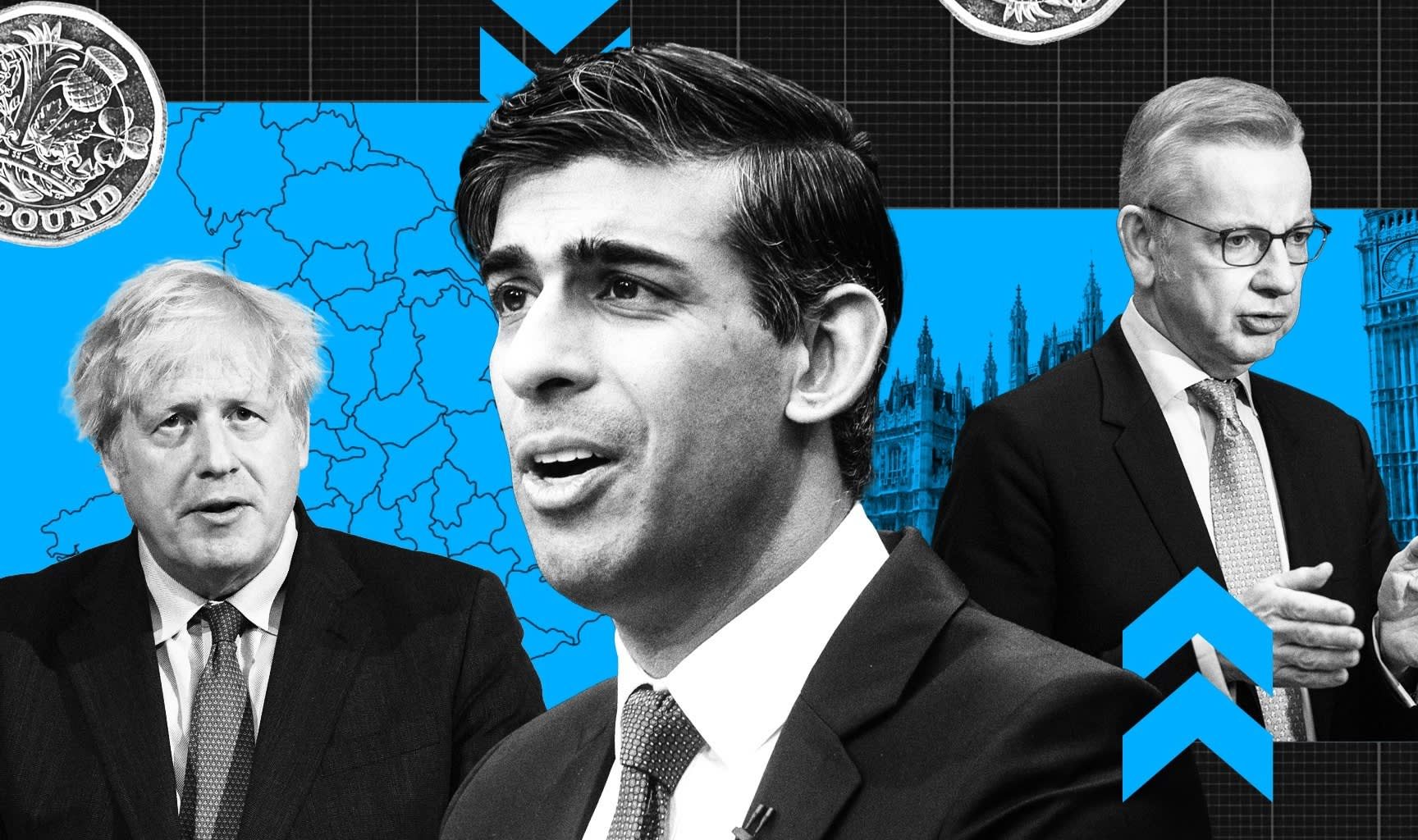

“Levelling up”, an amorphous phrase that helped Boris Johnson win over disillusioned Labour voters in 2019, was intended to ensure visible regeneration projects across the UK were delivered within the space of a few years. Despite the more than £10bn set aside for this effort over the past few years, local authorities have been complaining of delays, opacity and unfairness in how cash was allocated, with Tory MPs frustrated at the lack of progress. A parliamentary committee has found that the initiative’s three main funds have seen “no compelling examples” of delivery to date.

We’re also reading . . .

-

War in Ukraine: With US aid finally on the way, Kyiv could expose flaws inherent in Moscow’s strategy to overwhelm it with numbers, according to western officials and analysts.

-

BHP’s Anglo bid: The world’s biggest miner may find the South African government a thorn in its side as it seeks to take over Anglo American.

-

Reform UK: While Nigel Farage insists he is not a politician, within the rightwing populist party’s unusual structure the arch-Brexiter is the ultimate kingmaker.

-

Wright’s Law: Had we paid more attention to this rule of technological progress instead of Moore’s Law, we could be living with an abundance of clean energy by now, writes Tim Harford.

Chart of the day

When it comes to immigration, almost everything looks better in anglophone countries. Immigrants and their offspring in the UK, US and so on tend to be more skilled, have better jobs and often out-earn the native-born, while those in continental Europe fare worse, writes our chief data reporter John Burn-Murdoch.

Take a break from the news

Here are our six films to watch this week — including Challengers, a lusty new date movie that’s “such fun you suspect it must be illegal”, our film critic Danny Leigh writes.

Additional contributions from Benjamin Wilhelm and Gordon Smith

Read More: World News | Entertainment News | Celeb News

FT