Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

There are cracks showing in the most important market for global luxury. Gucci’s slump in sales, with parent Kering’s warning this week of a slowdown in Asia, prompted investor concerns about demand for the wares of Europe’s luxury groups.

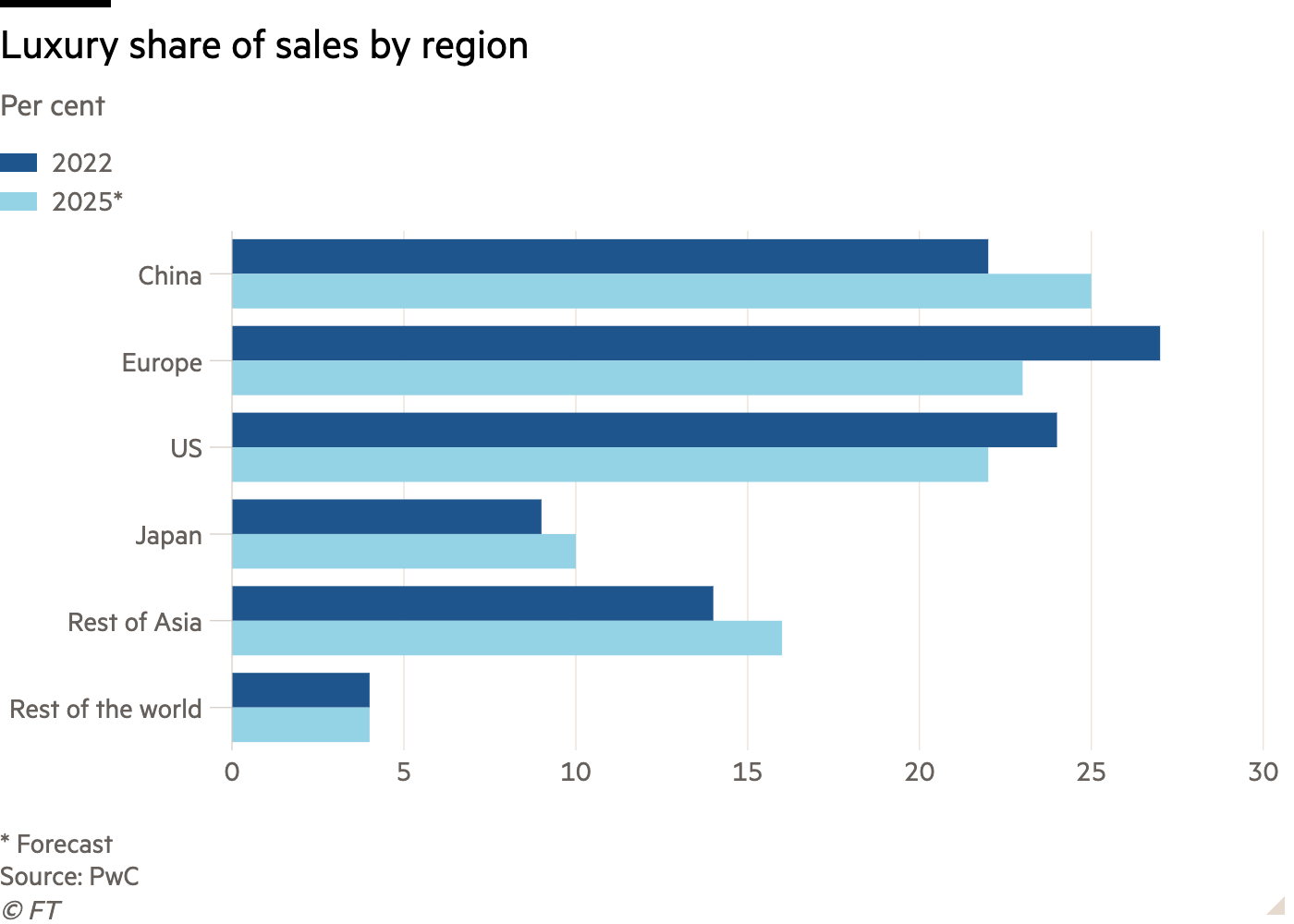

Tastes in Asia — and its largest market China — are certainly changing. But a closer look at those trends suggests they won’t hit luxury groups equally. There will be winners, both among Europe’s high-end houses and a growing crop of local rivals.

China’s second-hand luxury market is booming. Rapid growth in this market, estimated to be worth over $8bn in China, is starting to be replicated in other parts of the region, notably in south-east Asia.

That means resale values are becoming increasingly important to shoppers, with consumers showing a preference for brands whose products retain their value. Hermès, Louis Vuitton and Chanel tend to top that list, not just thanks to high demand but also because of regular price increases.

Shopper preferences are shifting away from affordable, mass market luxury to less frequent but higher-end purchases. With that comes a tendency to favour classic products, meaning a smaller number of brands are getting more demand. As share prices of European luxury companies fell this week after Kering’s warning, LVMH and Hermès fared best.

Another challenge to European brands is the rise of homegrown luxury alternatives. Rising geopolitical tensions in recent years have created a more patriotic group of Chinese shoppers. The tendency to turn to local producers has been evident in everything from electronics to electric cars, with millennials leading the shift. The luxury segment is no exception.

Chinese fashion and luxury brands have been growing rapidly in recent years, with premium brands such as Shang Xia — a Chinese luxury fashion brand backed by Hermès — gaining popularity among locals. Peer Icicle has grown to over 270 stores in China. Others, like Chinese outerwear brand Bosideng, have made progress in shifting upmarket to a more premium customer. Shares of Bosideng are up a fifth this year, reflecting improving operating margins of 17 per cent on sales of $2.3bn in the year to March

Even as luxury spending from the ultra-wealthy segment remains resilient, middle-class Chinese shoppers have been the real force behind the growth of the past decade. As long as the economic slowdown in China persists, consumers will get more choosy and more focused on resale values. Investors need to get more picky too.

Read More: World News | Entertainment News | Celeb News

FT