Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Good morning. We bring you an exclusive story today on a plan that would mark the biggest ever shake-up to Google’s search business.

The company is considering charging for new “premium” features powered by generative artificial intelligence, people with knowledge of Google’s plans have told the FT.

This would represent the first time that Google, which for many years has offered free consumer services funded entirely by advertising, has made people pay for enhancements to its core search product.

Google is looking at options including adding AI-powered search features to its premium subscription services, which already offer access to its new Gemini AI assistant in Gmail and Docs. Engineers are developing the technology needed to deploy the service but executives have not yet made a final decision on whether or when to launch it, one of the people said.

The FT’s AI editor Madhumita Murgia and West Coast editor Richard Waters have more details on the potential revamp.

And here’s what else I’m keeping tabs on today:

-

Economic data: S&P Global has its services purchasing managers’ indices for UK, France, Germany and Italy, and composite PMI for the EU. The Bank of England publishes data on the UK’s international reserves.

-

Nato: The alliance marks its 75th anniversary with a ceremony in Brussels and remarks from secretary-general Jens Stoltenberg. The FT reported yesterday that he has proposed a $100bn military aid package for Ukraine for discussion at Nato’s meeting of foreign ministers.

-

Goldman Sachs: The Wall Street bank is set to reveal in a report today that the gender pay gap in its UK operations widened last year, hitting a six-year high.

-

Joe Lewis: The British billionaire, whose family owns Tottenham Hotspur football club, is due to be sentenced after he pleaded guilty to criminal counts in a US insider trading case in January.

-

Kuwait: The oil-rich Gulf state holds parliamentary elections today.

Five more top stories

1. Exclusive: Switzerland’s financial regulator has tried to block the release of key files to Credit Suisse investors who are suing it after $17bn of bonds were wiped out in the bank’s rescue. Finma has written to the Swiss court hearing the case, claiming that releasing the documents would undermine confidence in the regulator and strengthen potential legal claims against the Swiss state. Here’s more from the letter seen by the FT.

2. US institutional investors are selling more of their private equity holdings at a discount as they cut exposure to the illiquid asset class. Led by pension funds and endowments, big investors sold 99 per cent of their private equity holdings at or below their net asset value on the secondary market last year, according to Jefferies, the most since the investment bank began tracking the figure in 2017. This compares to 95 per cent in 2022 and 73 per cent in 2021. Read the full story.

3. Exclusive: Abrdn’s shareholders have been urged to vote against a pay report on its new chief financial officer’s salary. The report by influential adviser Glass Lewis noted that Jason Windsor’s “significant” base salary of £675,000 was 25 per cent more than his predecessor’s and appeared to be above the norm for such a position. Emma Dunkley has more details.

4. Israeli war cabinet member Benny Gantz has called for early elections, piling pressure on Prime Minister Benjamin Netanyahu and his increasingly unpopular right-wing coalition. Gantz said polls should be held in September, approaching the first anniversary of the start of the war against Hamas in Gaza. The election should take place in 2026 under current rules. Here’s why he is calling for it to be brought forward.

5. The UK has again pushed back a deadline for airports to install new security scanners that allow passengers to leave liquids inside hand luggage. The Department for Transport had given all large British airports until June to install the advanced scanners, but it extended the deadline by up to 12 months today. Here’s more on the delayed rollout.

The Big Read

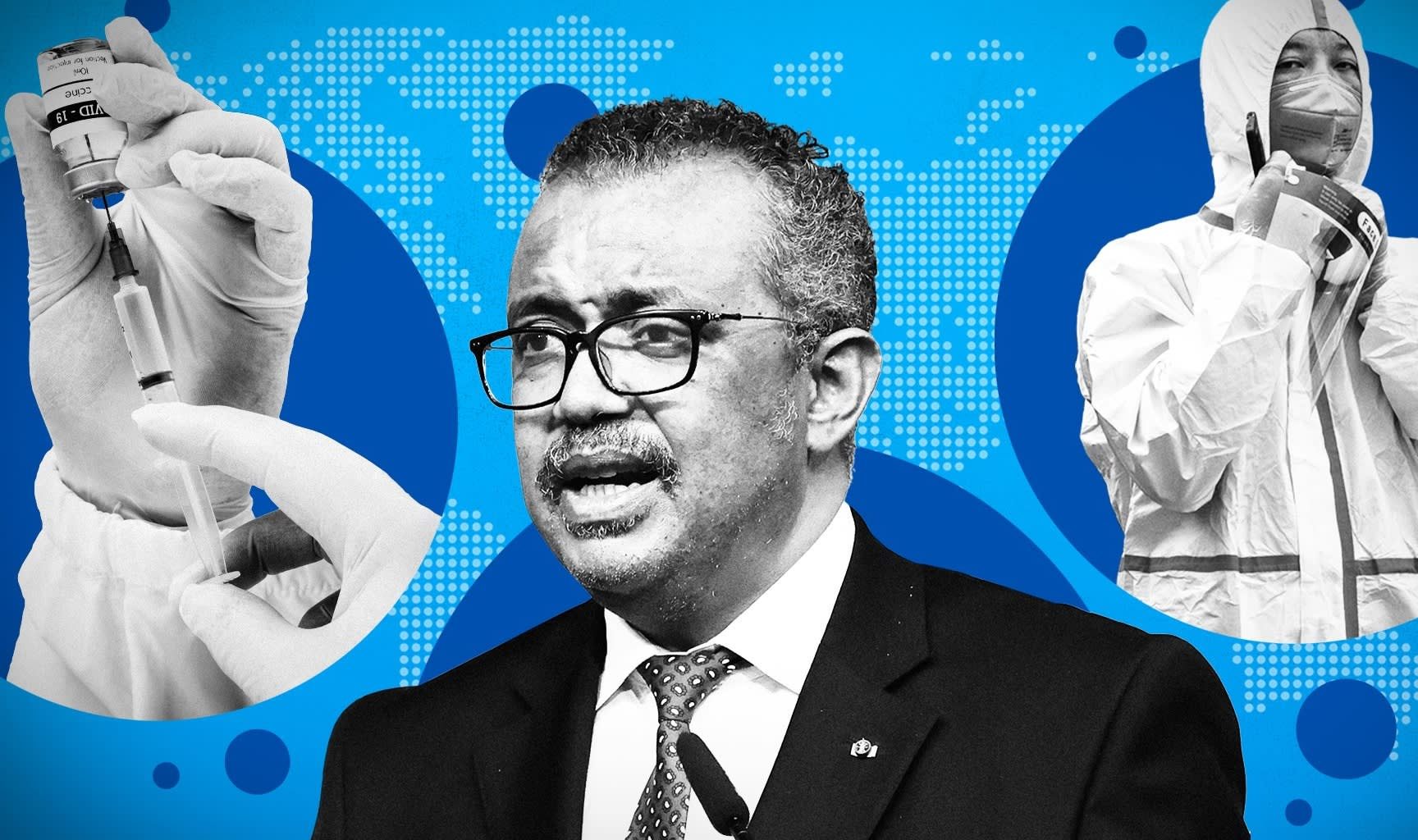

Fear of “Disease X” has already sparked several rounds of painstaking international negotiations over the world’s first pandemic treaty. The ominous code name refers to the as yet unknown illness expected to one day ravage the world in a repeat of Covid-19 — or perhaps inflict even worse damage. But ahead of the World Health Organization’s May deadline, domestic politics over “sovereignty” and geopolitical tensions are threatening to derail a plan crucial to avoiding the deadly mistakes of the last pandemic.

We’re also reading . . .

-

Moscow attack: Why did Russian intelligence dismiss US warnings of a terror threat before the March 22 attack on Crocus City Hall?

-

Middle East tensions: Iran is weighing how to retaliate for the death of a Revolutionary Guard commander in a suspected Israeli air strike without igniting a wider conflagration.

-

UK transport: After years of quiet renationalisation, politicians and industry bosses agree a wholesale rethink of Britain’s railways is desperately needed.

-

Interest rates: Diverging inflation figures are prompting predictions that the European Central Bank could cut rates earlier than the Federal Reserve.

For more on rate-setters’ battle with inflation, sign up for our Central Banks newsletter by Chris Giles. Or, upgrade your subscription here.

Chart of the day

Gold prices surged to an all-time high yesterday as traders responded to signals that the US Federal Reserve was preparing to cut interest rates later this year, even as inflation remained stubbornly above the central bank’s target. The haven asset, also boosted by concerns over the potential for an escalating conflict in the Middle East, has rallied 15 per cent since mid-February.

Take a break from the news

There are about 4,000 snake species, living in oceans, lakes, deserts, forests and even underground. A new study shows the twisting back-story of an animal touted as a new superfood, writes science commentator Anjana Ahuja.

Additional contributions from Benjamin Wilhelm and Gordon Smith

Read More: World News | Entertainment News | Celeb News

FT