Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Good morning. We start the week with a scoop on the growing clamour for a 24/7 New York bourse.

The issue has become a hot topic in recent years, prompted in part by the 24/7 operation of cryptocurrency trading and the rise in retail investor activity first spurred by coronavirus pandemic lockdowns.

US Treasuries, major currencies and leading stock index futures are already traded around the clock from Monday to Friday and several retail brokers, including Robinhood and Interactive Brokers, offer 24-hour access to US stock trading.

An overnight exchange, however, would be a step change. Read more on the NYSE’s soundings.

And here’s what else I’m keeping tabs on today:

-

‘Hush money’ case: Opening arguments begin in the criminal trial of Donald Trump. The former US president has spent more than a quarter of his campaign donations — or about $76mn — on his legal fees since last January.

-

Ukraine: Greece and Spain are coming under intense pressure from EU and Nato allies to provide Ukraine with air defence systems ahead of a meeting of EU foreign and defence ministers today.

-

Companies: Verizon is expected to show strong subscriber growth, driven by 5G adoption, when it releases first-quarter results.

-

Christine Lagarde: The European Central Bank president will speak at Yale University on the importance of ideas in driving economic growth.

-

Passover: The Jewish festival commemorating the Israelites’ liberation from slavery in Egypt begins this evening.

The Financial Times is preparing to host its third annual Brazil Summit in New York. Speakers include Carlos Fávaro, the minister of state for agriculture and livestock and Cláudio Castro, governor of the State of Rio de Janeiro. Register now to receive a discount.

Five more top stories

1. The head of Israel’s military intelligence has announced that he will resign. Major General Aharon Haliva said in his resignation letter that he took responsibility for the military intelligence failings that preceded Hamas’s attack on October 7, widely regarded as the worst security failure in the Jewish state’s 76-year history. Read more on the resignation, the first by a senior official since the Hamas attack.

2. The US Federal Deposit Insurance Corporation is working on proposals aimed at ensuring asset managers do not seek too much influence over the banks in which they hold large stakes. Republican board member Jonathan McKernan and the Democratic chair Martin Gruenberg are each crafting measures that would demand new requirements of funds that hold more than 10 per cent of a bank’s shares to ensure they remain “passive” investors. Here’s more on the proposal that has spooked the asset management industry.

-

More on the asset management industry: BlackRock more than tripled its spending on home security for Larry Fink last year, after the asset manager’s chair and chief executive became a target for “anti-woke” activists and conspiracy theorists.

3. The Philippines and the US have kicked off three weeks of military exercises that are set to further strain the countries’ relations with China. This year’s staging of Balikatan, the allies’ largest annual military drill, will include a joint sail in the disputed South China Sea outside the Philippines’ territorial waters. Read more on the manoeuvres, which will include French and Australian naval vessels for the first time.

4. The global banking regulator is sounding out investors on the suitability of additional tier 1 bonds, a form of debt that was wiped out when Credit Suisse collapsed last year. The Basel Committee on Banking Supervision held a series of high-level meetings with bank executives, investors and credit rating agencies at the European Banking Authority in recent weeks, according to people with knowledge of the talks. Read the full story.

5. Tesla shareholders are bracing themselves for its worst performance in seven years in its quarterly results tomorrow, as the carmaker faces slowing demand and a brutal price war. Investors will also be looking for changes in focus at Elon Musk’s company after reports it was slowing plans for a cheaper electric car in favour of self-driving “robotaxis”. Here’s what to know ahead of Tesla’s earnings.

Today’s big read

Two years on from the Great Resignation, when a roaring jobs market and the effects of the pandemic encouraged swaths of the workforce to switch employers, attrition in the professional services industry has swung to historic lows. Tech groups, investment banks and other former destinations for departing consultants have gone from hiring mode to firing mode. Now firms such as McKinsey are looking at forcing large-scale departures to rebalance the books.

We’re also reading . . .

-

Overstimulated US: One overlooked reason for America’s economic resilience is stimulus still coursing through the economy, but it cannot sustain such aggressive spending indefinitely, writes Ruchir Sharma.

-

Gideon Rachman: Ukraine is the frontline of a much larger conflict, with the US vote to provide extra money to Kyiv and others showing how America now sees the world.

-

Succession planning: Companies are choosing, or being forced to, think about the next in line earlier than they once would as shareholders demand greater insight, writes Anjli Raval.

Chart of the day

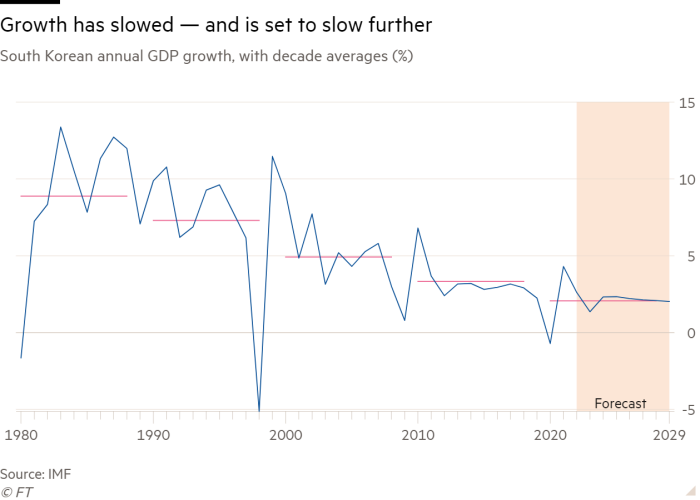

Between 1970 and 2022 South Korea’s economy grew at an average of 6.4 per cent. But last year the Bank of Korea warned that annual growth was on course to slow to an average of 2.1 per cent this decade, 0.6 per cent in the 2030s and will start to shrink by the 2040s. Pillars of the old model, such as cheap energy and labour, are creaking and the concerns about future economic growth are being compounded by an impending demographic crisis. Is South Korea’s economic miracle over?

Take a break from the news

To celebrate the 20th edition of the Financial Times and Schroders Business Book of the Year, past winners pick their favourite business books of all time. We also asked what the authors would add to their own winning title if given the chance to update it to reflect events since publication.

Additional reporting from Tee Zhuo and Benjamin Wilhelm

Read More: World News | Entertainment News | Celeb News

FT