Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Good morning. Unhedged is very happy to be back after a week and a half away. Most of last week I was in Switzerland, at a Bank for International Settlements conference. (Unhedged is now just me, until I find a replacement for the irreplaceable Ethan.) There, I learned a lot about how the Basel global banking standards are negotiated. The short version: it’s hard going, but it gets done because everyone involved has a pressing interest in a banking system that doesn’t break all the time. On Friday, I’ll publish an interview with Agustín Carstens, head of the BIS and the central bankers’ central banker. Meanwhile, email me: robert.armstrong@ft.com.

The Fed is stuck, and so are stocks

I won’t flatter myself with the notion that Unhedged is its readers only source of financial news. All the same, it is worth summing up what has happened over the last 10 days or so, while the letter was on hold. Over that time, the overall picture has not so much changed direction as consolidated significantly, in a way that will inform what we hear from the Federal Reserve’s meeting today.

There is now even stronger evidence that the US real economy is growing at an above-trend pace, and inflation is stuck above target. So expectations for lower interest rates have receded still further, causing stock markets to lose their giddiness.

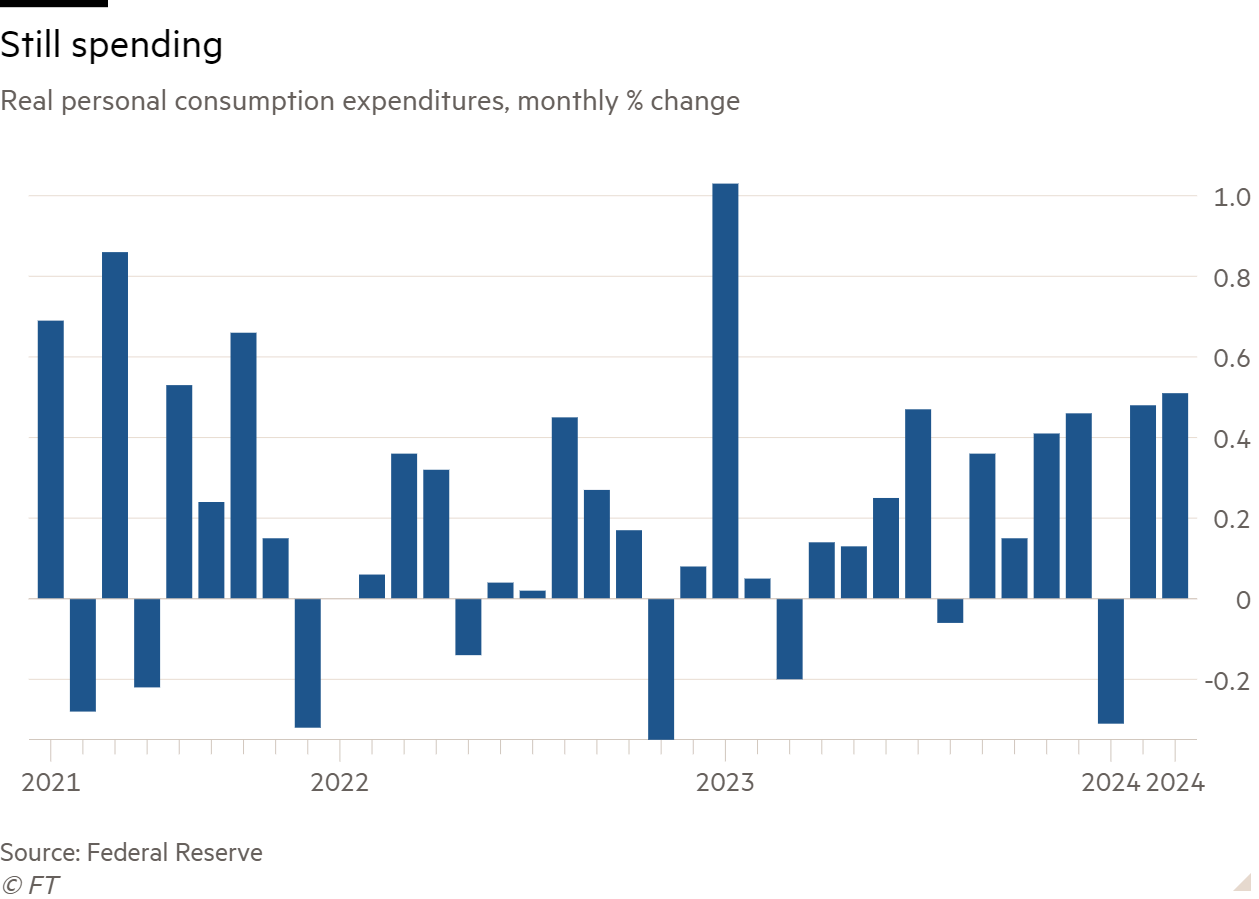

Last Thursday’s first-quarter gross domestic product report showed growth of 1.6 per cent, suggesting a slowdown. This was deceptive. Both the trade deficit and inventories were a drag, but demand is undiminished. Final sales to domestic purchasers grew at an annual rate just a shade under 3 per cent, only a bit slower than the previous quarter. Real personal consumption expenditures (last Friday) confirmed the signal.

Investment is adding to demand, too. Real private investment, both residential and non-residential, are rising nicely. The manufacturing sector, as we have noted before, is finally expanding, if slowly. This is all great, except that the Fed’s preferred measure of inflation is just plain old going in the wrong direction:

A measure of wage inflation the Fed cares about, the employment cost index, came out yesterday, and it ticked up sequentially, too.

The markets saw the outlines of this picture before the recent data filled it in. The furious stock rally that began last October ended as April began, and except for a short sharp bounce driven by tech stocks, it’s been sideways-to-down since:

It has been suggested that the market malaise is down to worries about growth, or even stagflation. I do not think the data support this reading. Andrew Brenner of NatAlliance suggested a bad consumer confidence reading from the Conference Board and a poor Dallas Fed Services Survey, both released yesterday, are evidence of creeping softness. But the majority of the data points the other way. Yes, companies that cater to lower-income households continue to report weakening demand, as the FT reported yesterday. But as Unhedged has pointed out before, distress among low-income, high-debt consumers is consistent with a US economy that is strong in aggregate.

Most importantly, if markets were responding to a rising risk of a slowdown, we would expect to see that reflected in corporate bonds’ yield spreads over Treasuries, which respond to even slight changes in the probability of recession. But junk spreads remained pinned at lows not seen since 2007:

What we are seeing is the stock market move from pricing in a strong economy and falling rates, to pricing in a strong economy and high and stable rates, at least in the near term (For a measured argument in favour of falling inflation and rates in the medium-term, look at Chris Giles’s latest central banking newsletter; his core argument, as I see it, is the US labour market continues to loosen up).

The Fed has no choice to await an improvement in the data before cutting rates, and stocks could be stuck in a sideways pattern until that happens. Making predictions about the short-term behaviour of equities is folly, of course. But it’s not just the receding chances of a rate cut that is applying downward pressure. Stocks remain expensive, and earnings have not been great, despite the strong economy. As of Friday, S&P 500 stocks that have reported first quarter results have managed 3.5 per cent growth in earnings and 4 per cent revenue growth, on average, according to FactSet. Margin expansion has been hard to come by as inflation has lingered. As of now, stocks are sailing into some fundamental headwinds.

What might break the impasse the Fed finds itself in? The obvious candidate, given where the current robust growth is coming from, is softening demand from consumers. There is some reason to think this might happen because — as almost everyone agrees — US households’ excess pandemic savings are exhausted. Below, for example, is a chart from Nancy Vanden Houten of Oxford Economics. Excess savings are hard to measure. She follows the more or less standard methodology, calculating excess savings as the actual level of savings (accumulated income less expenditure) less what savings would have been, had pre-pandemic trends persisted.

Vanden Houten notes “consumers are continuing to spend at a healthy clip” despite the diminishing stock of savings. That is to say, the savings rate is low, a sign of confidence. I asked her if that might make consumer spending vulnerable to a confidence shock. She replied:

You have to ask how long consumers will maintain such a low savings rate. We think for now that a healthy labour market and gains in wealth from equities and real estate will bolster spending, but see a risk households start to boost savings. I think that there is a risk that lower income households will cut back on spending — perhaps they already have. They are most likely to have depleted any savings and also haven’t enjoyed the same increases in wealth as other households.

In other words, there is a risk that the stress and parsimony we see among a small minority of poorer households will spread upwards. That will help solve the Fed’s inflation problem, but not in a way shareholders will enjoy.

One good read

“Biden is to Obama what Johnson was to Kennedy.”

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Read More: World News | Entertainment News | Celeb News

FT