Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is chief strategist global gas at S&P Global Commodity Insights

Will Europe go back to Russian gas? The EU has vowed to give up once and for all its “addiction” to Russian gas, but will it? Some argue that Europe will be forced to turn back to Russia because it needs “cheap” Russian gas to revitalise its economy and stave off deindustrialisation. But that is a myth, both seductive and dangerous. It is based on a fundamental misunderstanding of how the European gas market worked. Put simply, Russian gas was never cheap.

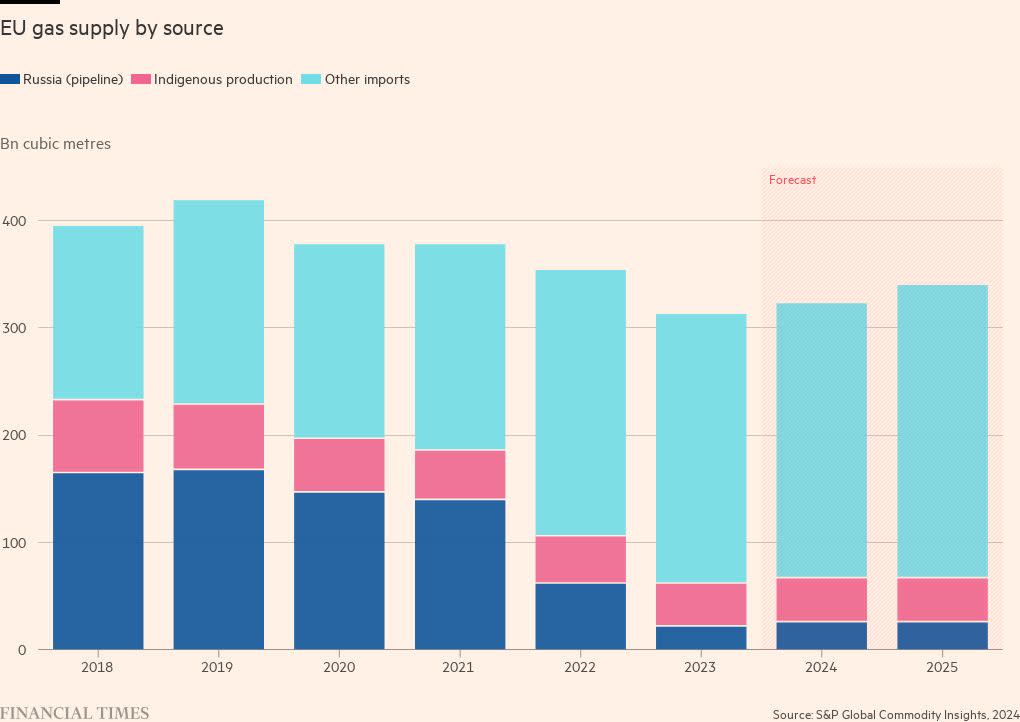

Sales of Russian gas to Europe today are down but not quite out. Pipeline imports to the EU in 2023 were 84 per cent down from the pre-invasion year of 2021, more than many thought bearable. Europe is exiting its second winter of the gas crisis with storage at seasonally high levels. Benchmark prices are back down to familiar ranges. Italy, still buying Russian pipeline gas in 2023, has declared it will finally “kick the habit” in 2024 as more Algerian piped gas and global liquefied natural gas become available.

Two years on from Russia’s full-scale invasion of Ukraine and the European Commission remains committed to its initial adamant response: to reach zero Russian gas by 2027. That means eliminating the remaining pipeline flows into central Europe and stopping LNG imports.

But it is not the commission that decides; it is each individual country. Outside Europe there is much scepticism. The constant refrain is: surely Europe will be enticed to return to cheap Russian gas? “Europe’s industrial powerhouse Germany is dependent on it,” some say. “Europe can’t be competitive without it.” And a “temporary pause” to the authorisation of new US LNG exports announced in January only bolsters the idea that Europe cannot abandon a relationship with Russia — however troubled the marriage — for a possibly “unreliable” US.

These views fail to appreciate the prevailing strength of feeling in much of Europe against the Russian regime. And given the idea of cheap Russian gas in Europe was always a myth, to base policy on it would be a serious mistake.

For certain, Russia enjoys abundant low-cost gas that can theoretically be delivered cheaply to Europe. But it never sold its gas at cost — any more than Mideast oil is sold at cost. Russia sold its gas competitively but not cheaply.

From the 1970s until the 2000s, the Soviet Union and then Russia priced natural gas to displace the competitor — fuel oil in industry and heating oil in domestic heating. So the price was set as a percentage of these oil product prices. If their prices were high, the gas price moved up and Moscow would reap a windfall. If oil prices were low, prices would fall to keep gas in the mix, but sales could still be made well above cost. The other supplies selling within Europe — whether Algeria, the Netherlands or Norway — all used the same mechanism.

Hardly a giveaway, but nor was this a bad deal for Europe. By pricing just below the competitive fuel, Europeans had the confidence to invest in gas infrastructure; and natural gas was able to penetrate deeply, taking over most residential heating and much of industry’s energy supply. Oil (but not cheaper coal) was also marginalised in power generation.

In the late 1990s, things started to change. Europe wanted a marketplace for gas. That meant moving from the artificial linkage with oil and instead setting a market price for gas at hubs and exchanges. The hope was that this would delink prices from oil and result in lower prices. At first, the Russians were staunchly opposed. But under pressure from European competition rules, the contracts were gradually adjusted to include reported price benchmarks. This did not mean Russian gas was sold cheaply; it was sold on a similar basis as all other gas.

China provides an alternative model. Russia’s response to the loss of its traditional markets in the west is to look to expand pipeline sales to the east. Bilateral negotiations are under way between Russia and China on a giant pipeline that would link the low-cost Russian gasfields of western Siberia through to the demand centres around Beijing.

The catch is price. It is a big catch. The Chinese are holding out for a lower price. And given that China has several alternative options and Russia has no alternatives of a similar scale, Beijing appears to hold the upper hand in the negotiations. As a result, Russia will end up paying a cost for the loss of the European market. For when we talk of cheap Russian gas, it will be China in the future that will benefit. It was not Europe in the past.

Read More: World News | Entertainment News | Celeb News

FT