Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

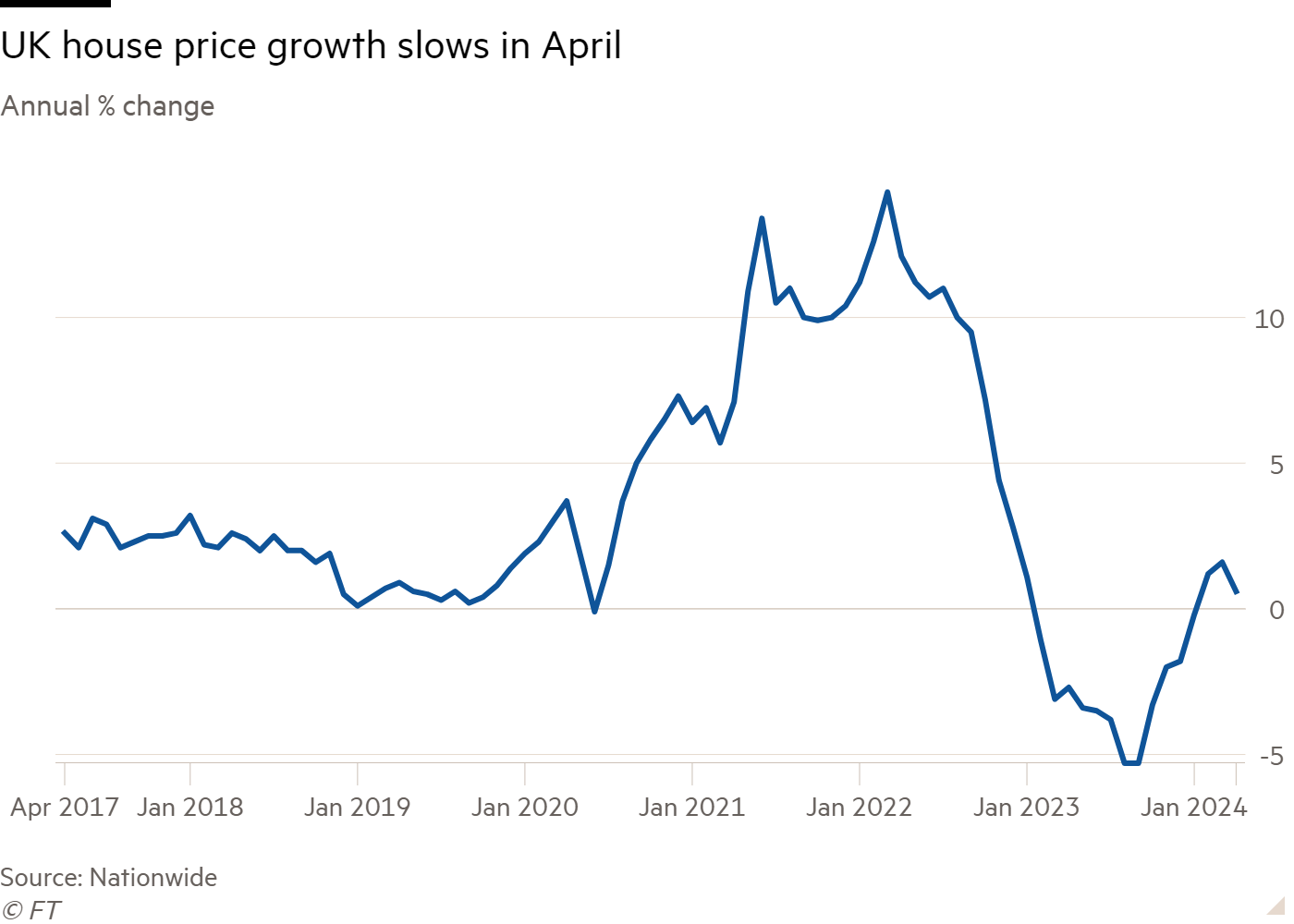

UK house prices fell unexpectedly for the second month in a row in April, according to data from lender Nationwide, reflecting the recent rise in mortgage rates.

House prices fell 0.4 per cent between March and April following a 0.2 per cent drop in March, missing the 0.2 per cent expansion forecast by economists. This was the largest month-on-month contraction since August 2023, when mortgage rates reached their peak.

“The slowdown likely reflects ongoing affordability pressures, with longer term interest rates rising in recent months, reversing the steep fall seen around the turn of the year,” said Robert Gardner, Nationwide’s chief economist.

Swap rates, on which mortgage pricing is based, have risen in recent months in response to markets reassessing how soon they expect the Bank of England to start cutting interest rates from a 16-year high of 5.25 per cent. That reverses the fall in mortgage rates from their peak last summer.

Ranald Mitchell, director at broker Charwin Private Clients said: “The ebullience at the start of the year has been slowly eroded as mortgage rates have edged up.”

“Supply has improved, but the dwindling confidence in the market will only be resolved by a base rate cut,” he added.

Imogen Pattison, economist at Capital Economics, said she expected mortgage rates to hover around their April level, “keeping demand subdued” and preventing “renewed gains in house prices in the near term”.

However, as she forecast the BoE’s benchmark rate to fall more than most this year, “the drop in mortgage rates further ahead will mean house prices are likely to start rising again,” she added.

Data published by the BoE on Tuesday showed that the average two-year quoted mortgage with a 60 per cent loan to value increased to 4.81 per cent in March from 4.62 per cent in February, but remained well below its recent peak of 6.22 per cent in July 2023.

This helped support the recovery of mortgage approvals to an 18-month high in March, the BoE data showed. However, Nationwide data suggests it is hitting house prices.

The lender said house prices rose 0.6 per cent year on year in April, down from 1.6 per cent in March and the lowest growth rate since January, when they were still falling. House prices fell year on year for most of 2023 reflecting rising borrowing costs.

The average house price was £262,000 in April, Nationwide said, down from a peak of £274,000 in August 2022. That was still about £50,000 above the level in February 2020, before the pandemic, reflecting the fast price growth when interest rates were at record lows.

The housing market is suffering a “subdued period at the moment”, said Karen Noye, mortgage expert at wealth manager Quilter. However, the prospect of a rate cut and lower mortgage rates could make purchasing a property “more attractive to prospective buyers who have been stuck in ‘wait and see’ mode”, she added.

Read More: World News | Entertainment News | Celeb News

FT